The country is projected to continue facing impedance towards economic growth until 2018, post which the investment climate is expected to improve. Due to this, the market for pumps is also expected to witness low revenue growth until 2018.

New and existing players entering the market will look to set up their manufacturing facility within the country in order to provide end customers with competitively priced pumps while meeting the rising domestic demand.

The report titled “Indonesia Pumps Industry Outlook to 2021 - Increasing Government Initiatives towards Irrigation and Wastewater Treatment with Expansion of Industrial Sector to Drive Growth” provides a comprehensive analysis regarding the performance of the Pumps Market in Indonesia. The report covers various aspects including the market size by revenues and segmentation on the basis of market structure. The market has also been segmented on the basis of type of pumps utilized, industries, water pumps and end users. The report also covers the trade scenario and government regulation in Indonesia pumps market. In addition to this, the market share of major players for water and industrial pumps, competitive landscape of Pump Manufacturers and Value Chain Analysis of Indonesia Pumps Market has also been showcased. This report will help Industry consultants, Pump Manufacturers and dealers, Manufacturing Industries, Real Estate Companies, the Indonesian Government, potential entrants and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future

The setting up of new power plants, iron and steel factories and oil and gas fields will aid growth in revenues of this market. In addition to this, the expansion and rise in production by these sectors will increase pump sales as a result of increasing replacement demand.

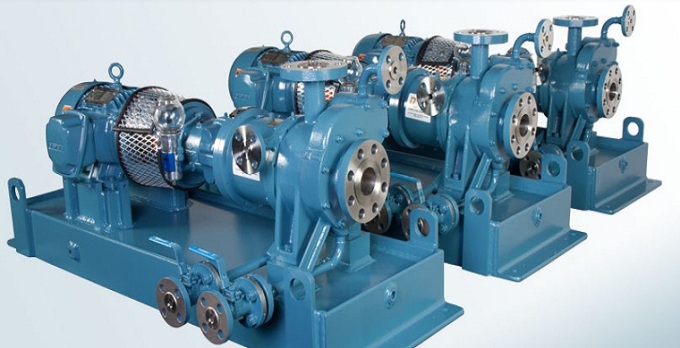

Centrifugal pumps will continue to witness higher sales in the future as a result of its lower price as compared to positive displacement pumps. The increasing investment by the Indonesian government on infrastructure and irrigation will aid the boost in sales of these pumps in the future. Urban development and the increasing number of commercial buildings will compliment the growth in pump sales in the future. Jakarta, Medan and Bandung are projected to witness highest sales of commercial centrifugal pumps in the future. Positive displacement pumps will witness higher demand from those end users that utilize viscous and semi-solid fluids during its operation. The projected increase in prices of crude oil will see an expansion of existing oil refineries and the entry of new refineries, aiding sales of positive displacement pumps in the future.

The rising urbanization and increasing investment on infrastructure by the government and private individuals will result in more commercial buildings and high rise offices engulfing the country. Increased demand for pumps by the government in the future will mainly arise due to wastewater and sewage treatment and irrigation. In addition to this, the increasing number of residential buildings will require the government to increase the water supply penetration, thus resulting in an increased demand for water pumps.

“According to Research Analyst at Ken Research- “Existing Pump manufacturers should look to set up precise sales and service centers close to the industries they target in order to ensure prompt delivery of products and quality service support. New entrants should look to collaborate with foreign companies to set up manufacturing facilities for pumps within the domestic territory. In addition to this, the Indonesian Government should provide subsidies in the form of land, buildings and machinery and encourage a positive business climate in the country through the form of tax breaks.”

Key Topics Covered in the Report:

Indonesia Pumps Market Overview

Submersible Pumps Market Growth

Wilo Pumps Sales

Water Pumps Market

Water Supply Pumps Industry Sales

Ksb Indonesia Pump Sales

Rotary Pumps Market Growth

Value Chain Analysis In Indonesia Pumps Market

Indonesia Pumps Market Size, 2011-2016

Indonesia Pumps Market Segmentation

Solar Pumps Industry

Pumps Sales Indonesia

Grundfos Water Pumps Market Share

Market Share Analysis Pumps Market

Single Stage Submersible Pumps Market

Positive Displacement Pumps Market Overview

Trade Scenario For Pumps in Indonesia

Decision Making Process for Buying Pumps in Indonesia

Trends and Development in Indonesia Pump Market

Issues and Challenges in Indonesia Pumps Market

Government Regulation in Indonesia Pumps Market

Tender Process in Indonesia Pumps Market

Market Share of Major Players in the Water Sector (Clean, Wastewater and Irrigation), 2016

Market Share of Major Players in the Industrial Sector (Food Processing, Iron and Steel, Oil and Gas and Others), 2016

Competitive Landscape of Major Players in Indonesia Pumps Market

Indonesia Pumps Market Future Outlook and Projections, 2021

Companies Covered in the Report

Grundfos Indonesia

Wilo Pumps Indonesia

Ebara Indonesia

Intech Pumps Indonesia

Torishima Guna Engineering Indonesia

KSB Indonesia

PT.Tsurmi Pompa Indonesia

Flowserve Indonesia

Products Mentioned:

Centrifugal Pumps

Positive Displacement Pumps

Submersible Pumps

Non-Submersible Pumps

Single Stage Submersible Pumps

Multi Stage Submersible Pumps

Rotary Pumps

Reciprocating Pumps

For more information about the publication, refer to following link:

Related Reports:

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249