“Rising number of internet users, the introduction of international brands in Singapore, increasing number of social media users and highly advanced digital infrastructure will be the key factors driving growth in Singapore Online Advertising Market”

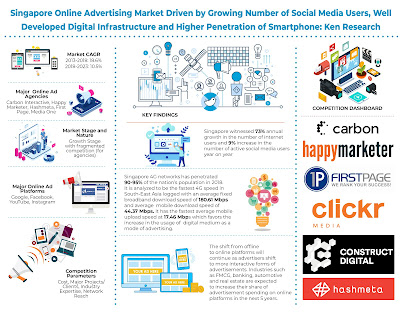

Analysts at Ken Research in their latest publication “Singapore Online Advertising Market Outlook to 2023 - By Medium (Desktop and Mobile), by Type (Search Advertising, Social Media Advertising, Banner Advertising, Video Advertising and Online classifieds and others), by Sectors (FMCG, Entertainment & Media, BFSI, Retail, Healthcare, Automotive and others) and by Model ( Cost per click, Cost per mile and Cost per action)” believes that an increase in the number of smartphone users, well developed digital infrastructure and increasing online spent by FMCG & entertainment would surge the overall online advertising spending in the market. The market has witnessed a positive CAGR of close to 18.6% in terms of online advertising spend in Singapore during the review period 2013-2018.

Digital Presence, a transition from traditional means& Code of Conduct: Developed industries have started transiting towards more sophisticated methods of marketing & promotion. Big brands now invest higher revenue share on online digital marketing especially being conducted through search engines and social media platforms. Platforms such as Google, Yahoo, Facebook, Instagram, and others play a major role due to heavy customer traffic experienced. It has also been observed that desktop advertisement has been more prevalent in 2018. However, Smartphone penetration supporting industry growth is estimated to stand positive by the end of 2023. The steady increase in adaptation of the Internet among the urban and rural population has opened various avenues for marketers to go online and spend on a digital advertisement. Internet speed and the connectivity of a broadband network are highly supportive of industry growth. In 2018, Singaporeans have spent at least 7 hours 9 minutes daily on the internet. This is expected to compel propelling brands and companies to shift away from traditional methods. Consumer time spent on mobile has increased not only for utility purposes but also for the consumption of media and entertainment.

The government of Singapore is quite strict with their norms& code of conduct as per ‘Singapore Code of Advertising Practice‘. The regulation ensures full disclosure of information and prohibits fraudulent activities in advertising. These efforts have helped create a sense of security and trust amongst various entities in the market.

Key Segments Covered:-

By Online Advertising Medium By Online Ad Spend

Desktop

Mobile

By Types of Online Advertising By Online Ad Spend

Search Advertising

Social Media Advertising

Banner Advertising

Video Advertising

Online Classified & Others

By Different Sector/Industries By Online Ad Spend

FMCG

Entertainment & Media

BFSI

Retail

Health care

Automotive

Others

By Pricing Models By Online Ad Spend

Cost per Click (CPC)

Cost per Mile (CPM)

Cost per Action (CPA)

Time Period Captured in the Report:-

Historical Period: 2013-2018

Forecast Period: 2019-2023

Key Target Audience

Advertising Agencies

Social Networking Platforms

End User Industries Investing in Online Advertising

Investors

Advertising Agencies Covered:-

Carbon Interactive

Active Media

Happy Marketer

Hashmeta Pte. Ltd.

Clickr Media

Media One

One9 Ninety

Advertising Platforms Covered:-

Google

Facebook

Instagram

YouTube

LinkedIn

Twitter

Snapchat

Keywords:-

Digital Advertising Market Share Singapore

Singapore Ad Spending Market Metrics

Online Video Advertising Spend Singapore

Singapore Online Ad Spending Market

Singapore Digital Ad Spending Market

Singapore Digital Advertising Stats Market

Singapore Digital Display Ad Spend Market

Singapore Online Advertising Market Trends

Singapore Online Advertising Market Challenges

Singapore Online Advertising Market Issues

Singapore Online Advertising Consumer Profile

Singapore Digital Consumer Landscape

Singapore Mobile Advertising Market

Singapore Desktop Advertising Market

Singapore Search Advertising Market

Singapore Banner Advertising Market

Singapore Online Video Advertising Market

For More Information, Refer To Below Link:-

Related Reports:-

Contact Us:-Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249