The report titled “UAE Medical Device Market Outlook to 2025 – Driven by technological advancement, increase in the aging population and a rise in the prevalence of chronic diseases in the country” provides a comprehensive analysis on the status of the medical device market in UAE. The report covers various aspects including the current market scenario in UAE, procurement and pricing trends, market potential of each medical device, major growth drivers, tech disruptions and innovations, and competitive benchmarking. The report concludes with market projections for future of the industry including forecasted industry size by revenue and business activity.

UAE Medical Device Market Overview and Size

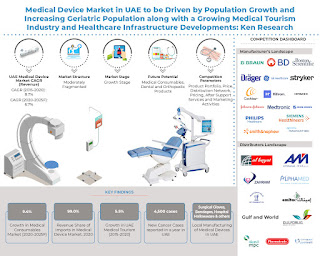

UAE is the fourth largest medical device market in the Middle East and Africa region, growing @8.7% CAGR in 2015-2020. It is a highly price sensitive and import dependent market with advanced medical devices imported from countries such as US, Germany, Japan and China and local production limited to prototype units, spare parts and disposables such as surgical gloves, syringes, and needles. UAE’s increasing budget allocation for the healthcare sector and ongoing healthcare development projects has played a pivotal role in the continued growth.

UAE Medical Device Market Segmentation

By Procurement: Imports have accounted for majority of the revenue share in UAE Medical Device Market in 2020. The imports are largely related to more sophisticated medical and surgical instruments and infrastructure.

By Mode of Sales: Distributor Mediated Sales have accounted for majority of the revenue in UAE Medical Device Market in 2020. Majority of the international companies hire distributors in UAE through which it sells the medical devices to hospitals, diagnostic laboratories and other non-residential customers.

By Type of Medical Device: Medical Consumables have accounted for the largest revenue share in UAE Medical Devices market in 2020, followed by Diagnostic Imaging product and Respiratory Products with Public & private hospitals and diagnostic labs/clinics make up the larger end users for each segment/sub-segment of the industry.

By Type of Medical Consumables: Surgical Gloves and Masks, Syringes, Needles and Catheters and Intravenous IV Administration Sets contributed more than 50.0% revenue in 2020. The COVID-19 outbreak and increasing hospital admissions across the country have significantly increased the demand for medical disposables.

By Type of Diagnostic Imaging Product: CT Scans contributed the highest revenue share in 2020 followed by X Ray Based Products, Ultrasound and MRI. The CT Scan segment witnessed the fastest growth since they are one of the primary diagnostic tools for COVID-19 patients.

By Type of Cardiac Device: Angioplasty Device Angioplasty and CRM have accounted for the major share in the UAE medical device market in 2020. 6.5 mn people have at least one major risk factor for heart diseases driving the for the growth of cardiac device market.

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NDg0NzM1

By Type of Respiratory Product: Oxygen Concentrators contributed highest revenue share in 2020. The UAE population has high risk of exposures to occupational and environmental factors that lead to illnesses such as asthma, chronic bronchitis and emphysema. Prevalence of asthma in UAE is 8.6% in male and 11.8% in female young adults 20-44 years.

By Type of Hospital Furniture: Hospital Beds with Mechanical Fittings and Dentists' Chairs contributed highest revenue share in 2020. Increasing number of hospitals and lifestyle diseases along with operations on morbidly obese patients increasing by more than 5,000 cases a year is driving growth.

By Type of Auxiliary Product: Hearing Aids have accounted for the major share in the UAE medical devices market in 2020. Increase in hearing loss (4% of people in UAE live with impaired hearing) is the main reason for the growth of hearing aids devices in the country.

By Type of Dental and Orthopedic Products: Orthopedic Appliances contributed the highest revenue in 2020. Oral implant surgery, products for sensitive teeth and gum are some of the major areas in dental care which led to demand of these equipment’s.

By End Users Hospitals along with Clinics and Diagnostic Lab Centers contributed highest to the market revenue in UAE Medical Devices Market in 2020. Consumer and provider attitudes toward telehealth have improved since the post-COVID-19 era.

Competitive Landscape in the UAE Medical Market

The competition scenario in UAE medical devices market is highly fragmented due to the presence of large number of international companies and local distributors leading to dilution of market share. The international companies distribute their products through authorized distributors located across the country. GE, Siemens, Philips, Hill-rom, Fresenius, Phonak, Stryker are the major companies operating in the UAE Medical Device market. Pharma trade, Gulf & world traders, Pure Health and Al Zahrawi are few top distributors in UAE. The major competitive parameters include product portfolio, price, and distribution network, pricing, after support services and marketing activities.

UAE Medical Device Market Outlook & Projections

The UAE medical device market is expected to generate ~ revenue in 2025, with imports contributing highest share to the market revenues. The creation of a world-class healthcare sector is a top priority for the UAE and the healthcare sector is expected to advance and expand significantly in the next few years which will support the growth of Medical Device Market in the country. The Healthcare expenditure in UAE is expected to rise from $15.5 Bn in 2019 to $ 29.2 Bn in 2029. Aging population along with increase in number of hospitals and clinics, increase in total healthcare expenditure by the government and increase in medical tourism in the country are going to impact the demand for medical devices in the positive manner.

Key Segments Covered: -

By Type of Business Activity

Import

Local Production

By Mode of Selling

Distributor Mediated

Direct Sales

By Type of Device

Medical Consumables

Diagnostic Imaging Products

Respiratory Products

Dental and Orthopedic Products

Cardiac Device

Hospital Furniture

Auxiliary Devices

Ophthalmic Devices

Dialysis Machine

Others

By Type of Medical Consumable

Indoor surgical Gloves and Masks

Syringes, Needles and Catheters

Intravenous Administration Set

Sutures and catgut

Infusion Pumps

Ostomy

Bandages, Dressings and Others

By Type of Diagnostic Imaging Product

CT Scan

X-ray Based Products

Ultrasound

MRI

Electro diagnostic apparatus (Functional Examination)

ECG

Others

By Type of Cardiac Device

Angioplasty Device

Cardiac Rhythm Management

ICD

Implants

Pacemakers

Heart-Lung Machines

Others

By Type of Respiratory Products

Oxygen Concentrator

Nebulizers

Humidifier

Ventilators

Airway Pressure devices

Others

By Type of Hospital Furniture

Hospital Beds with Mechanical Fittings and Dentists' Chairs

Operating Tables

Examination Tables

Medical, surgical, dental or veterinary furniture

Others

By Type of Auxiliary Product

Hearing Aids

Artificial body parts (excluding artificial teeth and joints)

Others

By Type of Dental and Orthopedic Products

Orthopedic Appliances

Artificial teeth and dental fittings

Dental appliances

Surgical Belts

Trusses

Crutches

Others

By Type of End-Users

Hospitals

Clinics

Labs and Others

By Type of Region

Dubai

Abu Dhabi

Ras Al Khaimah

Sharjah

Others

Companies Covered

- Braun

Becton Dickinson (BD)

Boston Scientific

Canon

Dräger

Fresenius Medical Care

Fujifilm

GE Healthcare

Getinge

Hitachi

Johnson & Johnson

Medtronic

Nihon Kohden

Philips HealthTech

Siemens Healthineers

Smith & Nephew

Stryker

Zimmer Biomet

Cochlear

Oticon

Starkey

Widex

Hill-Rom Holdings Inc.

Invacare Corporation

Paramount Bed Holdings

Key Target Audience

Medical Device Manufacturers

Medical Device Distributors

Medical Device Importers

Research organizations and consulting companies

Government bodies such as regulating authorities and policy makers

Market research and Consulting firms

Time Period Captured in the Report: -

Historical Period – 2015-2020

Forecast Period –2020-2025F

Key Topics Covered in the Report

Executive Summary

Overview of UAE Healthcare System

UAE Medical Device Market Introduction and Overview

Industry Life Cycle and Value Chain of UAE Medical Device Market

Key Market Drivers in the UAE Medical Device Market

Demand & Supply Side Ecosystem, Preferences & Trends across UAE Medical Device Market

UAE Medical Device Market Size by Revenue

UAE Medical Device Market by Type of Devices and Sub Segments

UAE Medical Device Market by End Users

UAE Medical Device Market by Regions (Abu Dhabi, Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain)

Competitive Factors and Assessment in UAE Medical Device Market

Market Trends and Development

Market Issues and Challenges

Government Rules and Regulations

UAE Medical Device Market Future Outlook

Upcoming Technologies in the Medical Device Market

Analyst Recommendations

For More Information on the research report, refer to below link:

UAE Medical Device Market Growth Rate

Related Reports by Ken Research: -

Philippines Medical Devices Outlook To 2025 (Second Edition)- Rising Cases Of Chronic Diseases And Expected Growth In Demand For Cancer Therapy And Dialysis Equipment

Brazil Medical Device Market Outlook To 2025 - By Type Of Device (Reagent For In-Vitro Diagnostics, Materials And Supplies, Laboratory Equipment And Others), Type Of Business Activity (Import And Local Production), Channel Of Sales (Distributor And Direct), Type Of End User (Hospital, Clinics And Diagnostic Lab Centers And Others) And By Region (South-East, South, North-East, Mid-West And North)

India Medical Device Market Outlook To 2023 - By IVD Market (Type Of Device, Sales Channel, Domestic Manufacturing And Import), By Diagnostic Imaging Market (Type Of Device, Domestic Manufacturing And Import) And By Patient Aid Market (Orthopedic Device, Hospital Furniture And Hearing Aid)

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249