What is the Scenario of Furniture Market in Philippines?

Philippines are the second largest archipelago on earth, comprised by over 7,000 islands. Furniture craftsmanship started off in the 16th century when cabinet makers from Spain were brought in by colonial merchants who saw distinct possibilities for good furniture products in the country which had hardwood in abundance. Filipino craftsmen were quick to learn not only the art of masonry but also intricate carvings and adornments on doors and other church furnishing.

The ban on the export of rattan poles in 1977 led to the establishment of rattan factories in Manila and Cebu. Particularly in Cebu, traders who used to export rattan poles to the US and Taiwan, upgraded their production to unfinished rattan parts such as chair backs, legs and seats which were then subsequently exported to furniture assemblers. Over 4,000 furniture manufacturers directly or indirectly employed over 800,000 workers.

Single proprietorships and family-owned corporations are common in the industry. While majority of the firms are wholly owned and managed by Filipinos, a number of companies are partly owned by foreign investors. The industry is said to employ highly-skilled workers who are products of both formal and informal training. The furniture sector uses a wide variety of materials including wood, rattan, metal, bamboo, plastic, buri and stone. There are three major furniture production hubs in the country namely Cebu, Metro Manila and Pampanga.

Major raw materials used for production include rattan poles and splits, lumber, metal bars or rods and fossilized stone and horn. Some other inputs include fittings and finishing materials. The furniture market of Philippines was valued at USD ~ million in 2012 and inclined to USD ~ million by 2016. The industry witnessed growth at a CAGR of ~% during the period 2012-2016.

Which Segments is doing Well in Furniture Market in Philippines?

Retailers existing in the space catered to the varied requirements across all categories of end users. The growing middle class population in Philippines coupled with increasing GDP of the country boosted the demand for residential property. Growing demand for housing structures was the major reason behind the augmented demand for furniture in the country.

Home furniture dominated the overall Philippines furniture market, contributing ~% to the revenues in 2016. Office furniture contributed ~% to the overall revenues generated by Philippines furniture market in 2016. High office occupancy rate of over 80% led to an increased demand for furniture by this segment.

Growth in establishments of luxurious hotels in the country resulted in increased demand for hotel furniture products which added ~% to the overall revenues generated by the country’s furniture market in 2016. Industrial furniture contributed the least share of ~% to the overall market revenues in 2016.

There has been a rapid growth in real estate sector due to the demand for residential property in the country. Bedroom furniture was the highest selling product category in home furniture segment and accounted for ~% market share in overall home furniture market as of 2016 in Philippines. This was followed by living room furniture (~%), kitchen furniture (~%), dining room furniture (~%) and all other home furniture (~%).

The number of households witnessed a phenomenal rise from 21.3 million in 2012 to 23.5 million by 2016, at a CAGR of 2.5% during the same period. The shift and migration of people to urban cities in Philippines due to lucrative employment opportunities offered in the metro regions has resulted in heightened demand for residential units in the country. The improved living standards resulted in incline in consumer expenditure on furniture to be installed at homes. The increased urban population of Philippines from 43.3 million in 2012 to 45.8 million by 2016 has been among the primary reasons, positively impacting the growth of modern furniture demanded by households.

What are the Key Trends in Philippines Furniture Market?

Growing Exports:

Philippine furniture is one of the priority export products given assistance and supported by the government. Export has grown at a CAGR of 17.4% in the last five years. In fact, it has made significant inroads in the global furniture market for its rattan based furniture products. Developments in the industry have also seen the increase in the number of production infrastructures and highly skilled craftsmen and manpower, supporting the surging growth of the industry.

Shift from Production of Low-End Furniture to Medium and High End Lines:

The Philippines ranks as one of the world’s best producers of fine furniture, from the traditional to the casual contemporary to highly experimental. The furniture industry manufactures affordable products of exquisite craftsmanship which is the successful result of modern technology combined with human creativity and eye for beauty. The diversification of furniture is also marked by the shift from the production of low-end furniture to the medium and high-end lines. This means emphasis on quality, design and material rather than on mass production of pieces. This is attributed primarily to growing competition globally.

Increasing Competition amongst Manufacturers and Retailers:

The furniture market is Philippines is highly competitive due to the growing domestic demand and the emergence of multiple players catering to the same target audience in the space. Manufacturers operating in country compete on almost same grounds, including price of the product and the quality of wood used to manufacture furniture.

It is difficult for a new entrant to distinguish themselves from existing players, having the same resources and manufacturing and similar or related products at competitive prices. On the other hand, it becomes a tedious task for the retailers to offer a plethora of products to the customers. Fluctuating demand for various types of furniture often makes them limit their prices so as to have an edge over competitors.

High Demand for Customized Furniture:

Philippines furniture market is dominated by the unorganized players, who cater to the furniture requirements of customers across all sectors in the country. Organized players entering the market have not been able to serve the growing demand for customized furniture, which includes offering both traditional and modern products as per the demand of the clients. Since, organized players followed a ready to install product strategy; they haven’t been able to manufacture different types of products for diversified classes of customers existing in Philippines.

Supply Chain Inefficiency:

Inefficiency in making the product available to the customers through an unorganized logistics network in Philippines is another barrier for potential entrants into the market. The logistics system in Philippines has been well known to possess several inefficiencies, which include lack of management systems, improper product handling, unfulfilled delivery times and many more. The delivery systems used by companies in the country either comprise of in-house logistics or third party logistics services for the transport of furniture products.

How Has Major Companies Performed in Recent Times?

The furniture industry in Philippines is highly competitive owing to large number of companies, both domestic and international, offer furniture products at competitive prices with limited variations in design and aesthetics. Furniture products of all price segments, including cheap, mid-segment and luxurious/premium ones are designed by several manufacturers to cater to customers of all classes. Generally, manufacturers and retailers focus on targeting a particular customer segment based on purchasing power of consumers. Despite the presence of international brands, the unorganized players largely cater to the furniture demands of the country. They offer cheaper and customized solutions for furniture needs across the country.

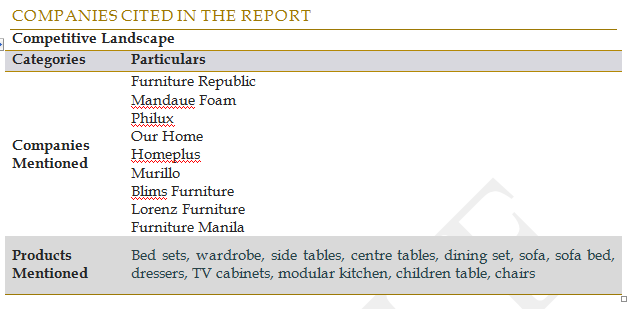

The unorganized sector poses a stiff competition to organized players existing or entering the space due to abundance of raw material and availability of cheap skilled labor. However, organized players have been successful in marketing modern furniture products largely in the metro cities of the country. Some of major players operating in this space included Furniture Republic, Mandaue Foam, Philux, Our Home, Homeplus, Murillo, Blims Furniture and many more.

What is the Growth Prospects of Furniture market in Philippines?

Tourism and Residential sector:

Since tourism based enterprises such as hotels, restaurants, museums and leisure service providers face growing needs to update their amenities; the demand for unique furniture items is expected to rise sharply. A number of hotels, particularly those located in Manila, Pampanga and Cebu underwent refurbishing using locally manufactured furniture products in H1, 2017. Growth in international tourism in the country is expected to augment the number of hotels rooms in Philippines to rise from 57,233 in 2016 to 100,682 by 2021

Apart from the robust hotel sector, construction of more condominiums and residential houses in the country is expected to drive the growth of the industry in the coming years. The property sector’s strong growth and families’ easier access to housing credit will also increase demand for household items and most importantly furniture products. The number of households in Philippines is projected to rise from 23.5 million in 2016 to 26.5 million by 2021, representing growth at a CAGR of 2.5% during the period 2016-2021. The residential sector generated most of the demand for furniture products in the country.

International Players Participation:

World’s largest furniture retailer, IKEA, has announced its plans to set up its first store in Philippines by the end of 2017. French furniture manufacturer Gautier forayed into Philippines last year by opening its first store in Shangri-La in March 2016. The company intends to open several new stores in the country in next 2-3 years. The company is renowned worldwide for its high quality, efficient after-sales service and offers long term warranty on several products.

Government Support:

The Board of Investments (BOI) of Philippines agreed to provide incentives to a PHP 9.13 million furniture export project in Mandaue City, which is expected to boost the country’s positioning as a global hub for furniture. The project, under Maison Galuchat Inc, is expected to manufacture furniture and accessories and export all of them to countries in Asia, Europe and the US. The company intends to initially employ about 50 craftsmen and gradually expand it to 120 by 2022.

The government of Philippines aims to be the global design hub for furniture products using sustainable materials by 2030. Through the efforts of the Chamber of Furniture Industries in the Philippines (CFIP) and the Cebu Furniture Industries Foundation (CFIF), the industry expects to make a global mark through the sustainable production of sophisticated, sturdy and environmentally friendly products.

Overall, the furniture market is expected to grow at an impressive CAGR of ~% during 2016-2021 and register market revenues of USD ~ million by 2021.

Key Factors Considered in the Report

Comprehensive analysis of the furniture market

Industry is presented by end users, organized and unorganized sector, major regions, and product categories in bed room, living room, kitchen and dining room

Home Furniture Sales Manila

Center Table Sales Philippines

Dining Room Furniture Philippines

Mandaue Foam Furniture Philippines

Our Home Furniture Sales Philippines

Philippine Furniture Market Size

Cebu Sales Furniture Philippines

Detailed profiles of major players and their product portfolios

Snapshot on current online furniture market

Case studies on installation of modular kitchen and home furniture

Identified major industry developments in last few years and assess the future growth of the industry

For more information on the market research report please refer to the below link:

Related Report by Ken Research

Contact:

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-124-4230204