India Herbal Extracts Market Overview and Size

India herbal extracts market has recorded phenomenal growth over the years, owing to the rising awareness among the people about the health benefits of consuming herbal products. The traditional beliefs to depend on plant products for various purposes have also been the major factor which has surged the revenues for the market. Herbal extract market in India increased to INR ~ crore in FY’2017 from INR ~ crore in FY’2012, at a robust CAGR of ~% during the same period.

The review period witnessed an upsurge in use of herbal medicines that has led to a sudden increase in herbal manufacturing units. The preference of people for ayurveda and natural herbs as an alternative to conventional medicines prescribed by the doctors, has boosted the revenues of Indian herbal extracts manufacturers offering products to pharmaceutical companies in India and abroad.

The market has majorly been driven by the exports of high quality herbal extracts which are demanded by the US, Canada, Ukraine, South Korea, Czech Republic, Israel, France, Taiwan, Nepal, and other nations. The inclination of foreign customers towards Indian products due to health benefits of various herbs has led to a boost in the overall sales.

Segmentation of India Herbal Extracts Market by End Users (Pharmaceuticals And Nutraceuticals, Cosmetics, And Food & Beverages Industries)

The use of herbal extracts in the pharmaceutical and nutraceutical industry in India and abroad contributed a dominant share of ~% in the overall sales of the players operating in the space during FY’2017. The growing demand of ayurveda medicines due to limited or no side effects has boosted the use of herbal extracts by the players operating in pharmaceutical industry in India. Dietary supplements which are used to provide health benefits also involve a major component of herbal extract to be consumed by the people.

Indian consumers are more inclined towards natural and herbal cosmetic products, especially those used for hair and skin care. The rising demand for natural cosmetics has resulted in augmented use of herbal extracts in preparing beauty products. The sale of herbal extracts to Indian and foreign cosmetics companies contributed ~% to the overall revenues of the market during FY’2017. Face creams or lotions, hair oils, shampoos, soaps, face washes, lipsticks and lip glosses were the key products where herbal extracts were used.

Segmentation of India Herbal Extracts Market by Exports and Domestic Sales

Market players generated the maximum revenues from selling herbal extracts to customers outside India. Export sales dominated the market and contributed ~% to the overall sales of herbal extracts by all the players operating in the space. The dominant share of export sales in the overall revenues is due to the continuous rise in demand for natural Indian products by the ultimate consumers abroad. Foreign customers have adopted herbal products as an alternative to various foods and medicines used on daily basis. The major herbal extracts which boosted the exports of Indian manufacturers were Curcumin, paprika, black pepper, carotenoids, and other extracts used in weight management products.

India Pharmaceuticals and Nutraceuticals Herbal Extracts Market

Segmentation by Major Herbal Extracts: The sales of carotenoids by Indian manufacturers to pharmaceutical and nutraceutical companies dominated the market, by contributing ~ to the overall revenues during FY’2017. The total sales of aloe vera and ginger extract to pharmaceutical and nutraceutical sector contributed ~ and ~ respectively to the overall sales during FY'2017. The sales of extract derived from capsicum plant added ~ to the overall sales of pharmaceutical herbal extracts during FY’2017. Curcumin and Shilajit accounted for ~ and ~ in the sales of overall herbal extracts by manufacturers to players in pharmaceutical and nutraceutical industry during FY’2017. The sales of marigold and shatavari extract to pharmaceutical and nutraceutical companies contributed the least share of ~ and ~ to the overall sales during FY’2017.

Segmentation by Application: Drugs for general wellness accounted for the maximum consumption during FY’2017, wherein herbal extract manufacturers generated ~ of the total revenue from sales of extracts used in such medicines and supplements. Herbal extracts for improving the conditions of digestive system and liver accounted for ~ of the overall sales during FY’2017. The overall consumption of herbal extracts for curing cardio vascular diseases resulted in ~ of the overall sales to pharmaceutical companies during FY’2017. The sales of herbal extracts for treating respiratory problems, and hypnotics and sedatives added ~ and ~ to the overall revenues generated by the market players during FY’2017.

India Cosmetics Herbal Extracts Market

Segmentation by Major Herbs: Curcumin is the main active ingredient in turmeric and is preferred by companies in the cosmetics industry. The sales of turmeric in India cosmetics herbal extracts market contributed a dominant share of ~ during FY’2017. The total sales of aloe vera extract to the cosmetics industry in FY’2017 contributed a share of ~ to the market revenues. The extracts from amla and brahmi are widely used in manufacturing hair care products. The overall sales of brahmi and amla extracts to the companies in cosmetics industries constituted a share of ~ in the overall market revenues during FY’2017. The rising demand for bathing bars, facial bars and face washes with herbal ingredients made kesar and chandan extract account for ~ in the overall market revenues during FY’2017. Coffee extract accounted for the least share in the overall market revenues.

Segmentation by Application: The sales of herbal extracts which were used in creams contributed a dominant share of ~ to the overall market revenues during FY’2017, followed by lotions and moisturizers, accounting for ~ revenues during the same year. Herbal extracts used in shampoos and soaps constituted ~ and ~ respectively of the market revenues during FY’2017. Flower extracts used in talcum powders had a share of ~% in the revenues generated from sales of extracts to cosmetics industry during FY’2017.

India Food and Beverages Herbal Extracts Market

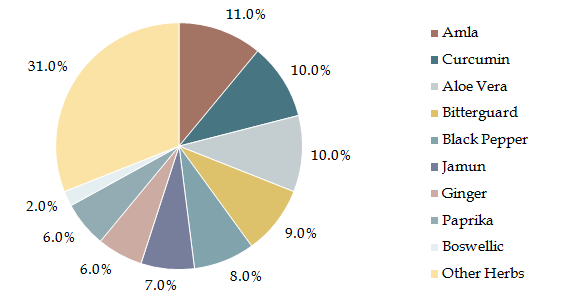

Segmentation by Major Herbs: The revenues generated from sales of extract derived from amla dominated the Food and Beverages herbal extracts market, contributing ~% of the overall revenues during FY’2017. The sales of aloe vera extracts constituted ~% of the overall revenues generated by the market players from selling herbal extracts to companies operating in food and beverages industry in the country during FY’2017. The growing sales of bitter gourd juices have added to the sales of the extracts from the herb, contributing ~% to the overall market revenues during FY’2017. The total sales of extract produced from jamun and ginger constituted ~% and ~% respectively of the overall sales by the market players to F&B sector in the country during FY’2017. The sales of turmeric extract added ~ to the overall sales during FY’2017. The sales of boswellia accounted for ~% of the overall revenues generated by the herbal extracts manufacturers from their sales to food and beverages customers during FY’2017.

Segmentation by Application: Majority of the herbal extracts in the food and beverages industry were used for preparing food products. Rising awareness about diet food and the inclination of people towards the consumption of natural food products, made this segment acquire a dominant position in the market. The overall sales of extracts to prepare food products constituted ~ of the market revenues during FY’2017. The sales of extracts which were used in beverages and other drinks accounted for ~% of the share in the overall market revenues during FY’2017.

India Food and Beverages Herbal Extracts Market Segmentation by Major Herbs on the Basis of Revenues in Percentage (%), FY’2017

India Food and Beverages Herbal Extracts Market Segmentation by Major Herbs on the Basis of Revenues in Percentage (%), FY’2017

Snapshot on India Oleoresins Market

Oleoresins are pure extracts of spices or herbs. Kancor Ingredients was the first market player in India, which was started in 1969 as Bombay Oil Industries, when it began manufacturing oleoresin of black pepper, followed by Synthite Industries Limited and Plant Lipids. Other leading market players include Arjuna Natural Extracts Ltd., and Sami Labs Limited. As per several industry reports, India held over 50-60% in the global oleoresins production in FY’2017.

India Oleoresins Market Size, FY’2012 – FY’2017: India oleoresins market increased from INR ~ crore during FY’2012 to INR ~ crore during FY’2017, at a CAGR of ~% during the same period. The market for oleoresins has been increasing due to rising demand for packaged spices and the use of spice mixes in food applications. The allowance of ~% foreign direct investment (FDI) in five plantation crops, which include cardamom via the automatic route has attracted foreign fund in cardamom plantation, thus having a positive effect on the extraction volumes of oleoresins.

Major Herbs Used in Oleoresins Extraction: The most used herbs for oleoresins extraction are turmeric, black pepper, paprika, capsicum, ginger, garlic, and onion. In terms of volume, oleoresins from paprika had the largest contribution in the market, whereas, in terms of value, oleoresin from turmeric led the overall revenues during FY’2017.

India Oleoresins Market Future Outlook and Projections: The market for oleoresins in India is expected to incline from INR ~ crore during FY’2017 to INR ~ crore during FY’2022, at a CAGR of ~% during the same period. The continuous use of spice extracts across food and beverages industry are anticipated to raise the sales of oleoresins in the market. Asia Pacific is projected to drive the growth of the market owing to the development of food processing industry in the developing nations including India, China and Indonesia. R&D initiatives to introduce new varieties and better quality of oleoresins for aromatherapy applications are anticipated to augment the market growth during the outlook period.

What is the Expected Future Outlook for India Herbal Extracts market?

The revenues generated by herbal extracts market in India are projected to increase to INR ~ crore during FY’2022 from INR ~ crore during FY’2018, at a robust CAGR of ~ during this period.

One of the major reasons which are anticipated to fuel the market revenues during the outlook period is the rising awareness about the health benefits of consuming products with significant proportion of herbal extracts in their ingredients. It is also projected that there will be an increase in domestic sales due to changing customer preferences. Setting up of new manufacturing units and maintaining a proper network of supply chain to cater the domestic demand, is expected to upsurge the revenues and sales of various players operating in the space.

Over a longer outlook period, it is estimated that the market will witness new players tapping the space with varied products to meet the demands of ultimate consumers of herbal products. The market is expected to be driven by the rising number of organized players, which can ensure uniformity in quality of differed herbal extracts.

Companies Cited in the Report

List of Companies Companies Covered in the Report

Arjuna Natural Extracts Ltd.

Synthite Industries Limited

Sami Labs Limited

Vidya Herbs Private Limited

OmniActive Health Technologies Ltd.

Indfrag Limited Major Players

K.Patel Phyto Extractions Pvt. Ltd.

Sydler India

Alpspure Lifesciences Private Limited

Cymbio Pharma Pvt. Ltd.

Sai Phytoceuticals Pvt. Ltd.

Sanat Products Ltd.

Key Topics Covered in the Report:

Oleoresins of Spices Market India

Oleoresins Manufacturers in India

India Oleoresins Market

India Essential Oil Market

Oleoresins Demand in India

Export Herbal Extract from India

Market Share Omni Active Health India

For more information on the research report, refer to below link:

Related Reports by Ken Research

Contact:

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-124-4230204