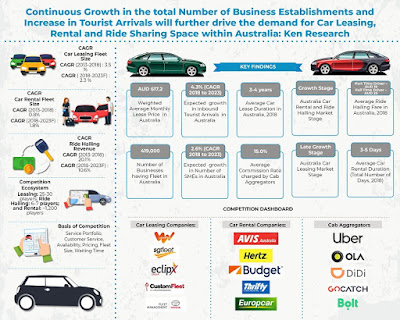

- Total number of small and medium enterprises in Australia is expected to positively grow thus, registering a CAGR of close to 2.8% during the forecast period 2019-2023. The gross value added by the mining industry in Australia is expected to grow at a CAGR of 3.9%, stimulated by the expected continuation of the mining boom during the period. This would be facilitated by a proportionate rise in the corporate demand for car leasing service in the country by the end of 2023.

- The car rental market is also expected to increase due to the rise in number of tourist arrivals in the country with an anticipated CAGR of 4.3% till 2023. The Tourism 2020 plan initiated by the Australian Tourism Industry is estimated to get completed by the year ending 2020.

- Growth in the ride hailing segment of the market is expected to come through with the entry of new players offering ride sharing services and increasing number of millennial populations in the country. The cab aggregator industry of Australia is also estimated to reach around a fleet size of 206,000 units and AUD 2,400.0 Million in terms of revenue by the year ending 2023.

Australia car leasing and rental market growth will be facilitated by the increasing number of small and medium establishments, growing size of mining, construction, & logistics sector, increasing employment, growing number of tourist arrivals in the country and a low exchange rate with the USD. The market is still dominated by the corporate user segment owing to their bulk demand including a variety of cars for employee mobility and further company use. In terms of rental purpose, the business segment is forecasted to grow at CAGR of 6.1% in terms of revenue during 2019-2023. The individual demand is mainly supported by the tourist arrivals with inbound tourists dominating the demand. Demand for rental is highest during the summer months and the Chinese New Year in Australia.

New car rental companies as well as cab aggregators might enter the market in the coming years. Opportunity may also arise for car sharing service providers, due to their growing popularity as a disruptor of the overall mobility industry. Companies will look to focus on differentiating themselves on the basis of value-added services they could provide to their prospective clients, reducing the service cost, enhancing customer service and introducing newer models backed by technology into their fleet to capture a significant share in the independent markets.

In terms of regional demand, it is expected that the states of New South Wales, Victoria and Queensland will have high demand for car rental, leasing and ride hailing space owing to the high population in these states and the high concentration of small and medium enterprises in these states. Darwin, Adelaide and Hobart are cities where the penetration and reach of ride sharing, leasing and car rental is low and hence new players can target these cities for setting up operations in the near future.

Analysts at Ken Research within their latest publication “Australia Car Leasing and Rental Market Outlook to 2023 - By Type of Car, By Region, By End User, By Rental Booking Purpose, By Rental Booking Mode and Ride Hailing Market- By Type of Ride, By Hailing Purpose and By State” believe that the market is expected to register positive growth at CAGR of 1.6% in terms of operating leasing revenue; 1.8% in terms of fleet size in car rental segment, 3.3% in terms of rental revenue; and 10.6% in terms of fleet size in ride hailing segment and lastly, 11.5% in terms of ride hailing revenue during the forecasted period 2019-2023.

Key Segments Covered in Australia Car Rental and Leasing Market

Australia Car Leasing Market

By Type of Car

Ute

Sedan

SUV

Luxury

By Region

New South Wales

Victoria

Queensland

Western Australia

Other States (Tasmania and South Australia)

By End-User

Mining

Construction and Engineering

Government

Telecommunications

Others (Logistics and Utility Industry)

Australia Car Rental Market

By Type of Car

SUV

Ute and LCVs

Sedans

By Rental Purpose

Leisure

Business

By Booking Mode

Online

Offline

Australia Ride-Hailing Market

By Type of Ride

Sedan / Economy / Mini

SUV and Ute

Luxury

By Hailing Purpose

Airport

Leisure

Office

By State

New South Wales

Victoria

Queensland

Western Australia

Other States (Tasmania and South Australia)

Time Period Captured in the Report: -

Historical Period: 2013-2018

Forecast Period: 2019-2023

Key Target Audience

Car Rental Companies

Fleet Management Organizations

Cab Aggregators or Ride-Sharing Companies

Car Sharing Companies

Car Dealers

Consumer Finance Organizations

Automobile and Mobility Organizations

End-User Industries

Companies Covered: -

Car Leasing Companies

LeasePlan Australia

Eclipx Group

SG Fleet

Custom Fleet

Toyota Fleet Management

ORIX

Summit Fleet

Car Rental Companies

Avis Australia

Hertz Australia

Budget Australia

Thrifty Australia

Europcar Australia

Cab Aggregators

Uber

Ola

DiDi

GoCatch

Taxify (Bolt)

Key Topics Covered in the Report: -

Car Sharing Market in Australia

Passenger car rental and hire in Australia

Fleet market size Australia

Ride-Sharing Market Australia

Ridesharing Companies in Australia

Australia Cab Sharing Market

Avis Australia Car Rentals Market Share

Budget Australia Car Rental Market Competitors

Inbound Tourists Market Growth in Australia

InterCity Travel in Australia

Melbourne Car Leasing Market Share

Uber Australia Market Share

Airport car rentals Brisbane

Thrifty car rental Sydney airport

Car Hire Sydney Airport

Sedan Car Rental Industry Sydney

Ola Market Share in Australia

For More Information on the Research Report, Click On The Link Below: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249