Introduction

The banking industry, a dynamic force shaping global economies, is amid a transformative era. As technological waves crash against traditional shores, and customer expectations surge, the industry is compelled to navigate uncharted waters. In this comprehensive exploration, we embark on a journey through the trends, challenges, and opportunities that define the present and future of banking.

Evolution of the Banking Sector

Historical Perspective

To truly understand the industry's resilience, we embark on a historical odyssey. From humble moneylending origins to the establishment of complex financial institutions, the banking sector's evolution is a testament to adaptability.

Technological Advancements Shaping the Sector

In recent decades, the industry has experienced a seismic shift propelled by technological innovations. The advent of online banking, mobile applications, and fintech disruptions has transformed banking into a realm of efficiency and accessibility.

Current State of the Banking Market

The global online banking market, valued at USD 4235.19 million in 2022, is a testament to the industry's digital metamorphosis. Key players, ranging from traditional giants to nimble fintech entities, contribute to a competitive and vibrant landscape.

Banking Industry Trends: A Comprehensive Analysis

Shift Towards Digitalization

As consumers increasingly favor digital channels, banks are pivoting toward prioritizing online services. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning, amplifies operational efficiency and elevates customer experiences.

Impact of Artificial Intelligence and Machine Learning

Innovations driven by AI and machine learning have revolutionized banking operations. From robust fraud detection mechanisms to personalized financial advice, these technologies empower banks to provide tailored solutions while mitigating risks.

Changing Customer Expectations

Customers today demand more than just basic financial services. The banking industry must respond to evolving expectations, offering seamless and personalized experiences to retain and attract clients.

Challenges Faced by the Banking Industry

Despite advancements, challenges persist, posing threats to stability and growth.

Cybersecurity Threats

As banking operations become increasingly digitized, the risk of cybersecurity threats looms large. Safeguarding sensitive financial data is paramount to maintaining customer trust.

Regulatory Changes

The ever-evolving regulatory landscape presents challenges for banks to stay compliant. Navigating complex regulations requires proactive strategies and a keen understanding of legal frameworks.

Competition from Fintech Companies

The rise of fintech disruptors introduces a new dimension of competition. Traditional banks must innovate and collaborate to stay competitive in a rapidly evolving financial ecosystem.

Opportunities in the Banking Sector

Amid challenges, the banking sector presents numerous opportunities for growth and innovation.

Innovation in Financial Products

Developing innovative financial products and services, such as digital wallets and robo-advisors, opens avenues for attracting a diverse customer base.

Expansion into Emerging Markets

Exploring opportunities in emerging markets allows banks to tap into new customer segments and diversify their portfolios.

Collaborations and Partnerships

Strategic collaborations with fintech companies and other industry players foster innovation and enhance service offerings.

Strategies for Sustainable Growth

Adopting sustainable strategies is imperative for long-term success in the banking industry.

Customer-Centric Approaches

Putting customers at the center of business operations ensures satisfaction and loyalty. Tailoring services to meet customer needs fosters lasting relationships.

Sustainable and Responsible Banking Practices

Embracing sustainability and responsible banking practices not only aligns with global trends but also attracts socially conscious consumers.

Adapting to Market Dynamics

The ability to adapt to changing market dynamics is crucial. Agile strategies enable banks to navigate uncertainties and seize emerging opportunities.

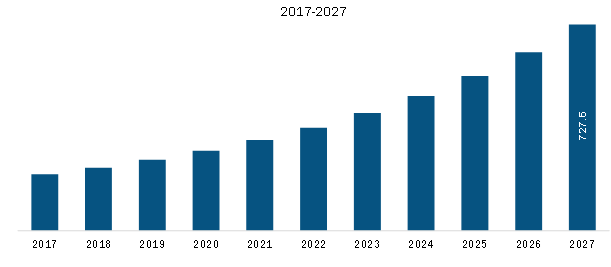

Global Banking Industry Market Size Forecast

The forecast for the online banking market anticipates a CAGR of 5.46%, reaching USD 5824.98 million by 2028. Factors such as technological advancements, changing consumer behaviors, and global economic trends contribute to this growth projection.

Regional Variances in Banking Trends

Banking trends vary across regions due to diverse economic, cultural, and regulatory influences. Understanding these regional nuances is essential for global players seeking to establish a significant presence.

Impact of Economic Factors on the Banking Industry

Economic factors, including inflation rates, interest rates, and overall economic stability, exert a profound influence on the banking sector. Adapting to economic fluctuations is a strategic imperative for sustainable growth.

Customer Experience in the Digital Banking Era

In the digital age, providing a seamless and enjoyable customer experience is paramount for retaining and attracting clients.

Importance of User-Friendly Interfaces

Intuitive and user-friendly interfaces enhance the overall banking experience, making it convenient and accessible for users of all demographics.

Personalization in Banking Services

Tailoring services to individual preferences creates a sense of personalization, fostering stronger connections between banks and their customers.

Innovations Reshaping the Banking Landscape

The rapid evolution of technology introduces innovations that reshape how banks operate and engage with their clientele.

Blockchain Technology

Blockchain technology, known for its security and transparency, has the potential to revolutionize transactions, reducing fraud and streamlining processes.

Biometric Authentication

The integration of biometric authentication enhances security measures, providing a robust defense against unauthorized access.

Contactless Payments

Contactless payment methods, driven by technological advancements, offer convenience and efficiency.

Sustainability in the Banking Sector

The banking industry, recognizing its role in environmental stewardship, has witnessed the emergence of green banking initiatives.

Green Banking Initiatives

Initiatives such as sustainable investments and eco-friendly practices contribute to a positive environmental impact.

Environmental and Social Responsibility

In addition to green initiatives, banks are increasingly adopting policies that align with broader environmental and social responsibility goals.

Adaptation to Regulatory Changes

Navigating the complex regulatory landscape is an ongoing challenge for banks.

Compliance Challenges

The banking sector faces challenges in staying compliant with ever-evolving regulations, necessitating a proactive and adaptable approach.

Strategies for Staying Compliant

Proactive strategies, including robust compliance frameworks and continuous monitoring, are essential to navigate regulatory complexities.

Conclusion

In conclusion, the banking industry stands at the crossroads of unprecedented change and opportunity. The amalgamation of technological advancements, changing customer expectations, and global economic shifts necessitates a proactive and adaptive approach. As the industry charts its course into the future, embracing innovation, sustainability, and customer-centricity will be key to sustained growth and relevance.