- Eastern European countries like Poland, Romania, and Hungary are expected to grow in the future due to increasing manufacturing base in the countries and increasing foreign trade. Eastern Europe is also the gateway to land trade with Central Asia and China. All these factors will allow them to emerge as growing freight forwarding markets in the future.

- There is a growing dearth of professional truck drivers in Europe because of high retirement rates and it facing an image crisis due to which young people are reluctant to join the industry. According to the International Road Transport Union (IRU), there was a gap of 21% in the demand and supply of truck drivers in Europe in 2018. The dearth is also driving up the cost of road freight.

- Tech Disruptions in the freight forwarding industry are key for its future growth. Major companies are investing in technologies such as IoT, blockchain and autonomous transportation to help them gain an edge over the competition and future proof them in the industry.

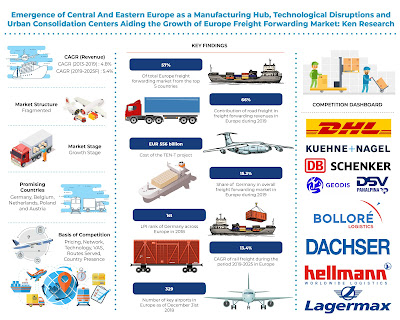

TEN-T Policy: The TEN-T policy aims at connecting the major hubs in Europe through multiple infrastructure projects in the EU as well as non-EU countries. The completion of all of the projects in the TEN-T policy is expected by 2030, and by 2025 a majority of the projects are expected to be completed or near completion by 2025, which will help boost intra-Europe trade. The overall cost of all projects is around EUR 556 billion according to 2005 prices.

A shift of Freight Volumes from Road to Rail: Europe is committed to achieving the goals laid out in the Paris Agreement to curb down emissions. Since heavy goods vehicles are one of the largest pollutants on the road, European nations are making an effort to induce a modal shift of freight volumes from road to rail by investing in infrastructure and improve cross-border connections with other countries. Rail is an eco-friendlier an alternative to road and a single train has the capacity to remove around 300 trucks from the roads.

The Belt and Road Initiative of China places Europe as the destination for Chinese trains. The initiative will improve connectivity between Europe, Central Asia, and China and offers an alternative to the ocean and air freight. It opens an important trade lane for European manufacturers to ship their goods to China. This will help to boost trade with Asia for European countries.

Analysts at Ken Research in their the latest publication “Europe Freight Forwarding Market Outlook to 2025 – By Country (Austria, Belgium, Germany, Netherlands, Poland, Sweden, and Others) and By Mode of Transportation (Road, Sea, Air, Rail, and Inland Waterways)” believe that the freight The forwarding industry in Europe is at a growing stage. Keeping the commitment towards the environment in mind, countries should focus on the modal shift from road to rail and inland waterway which would facilitate both intra-Europe and extra-Europe trade and thus contribute to the growth of the freight forwarding market.

Key Segments Covered: -

By Mode of Transportation

Road

Rail

Sea

Air

Inland Waterways

By Country (Revenues and Freight Volume)

Germany

Spain

France

UK

Italy

Netherlands

Poland

Romania

Belgium

Norway

Greece

Austria

Sweden

Czech Republic

Hungary

Bulgaria

Denmark

Finland

Portugal

Slovenia

Slovakia

Lithuania

Ireland

Estonia

Latvia

Luxembourg

Croatia

Cyprus

Malta

Country Profile

By Mode of Transportation

Road

Rail

Sea

Air

Inland Waterways

By Road

International

Domestic Transportation

By Rail

International

Domestic Transportation

By Sea

International

Domestic Transportation

By Air

International

Domestic Transportation

By Inland Waterways

International

Domestic Transportation

Companies Covered

Europe

DHL

Kuehne + Nagel

DB Schenker

DACHSER

GEODIS

CEVA Logistics

DSV

Hellmann Logistics

Rhenus Logistics

CEVA Logistics

Austria

JCL Logistics

DACHSER

CEVA Logistics

Augustin Quehenberger

Lagermax

DSV

Belgium

Ziegler

Manuport

DHL

CEVA Logistics

Yusen Logistics

DACHSER

Hamann International

UPS

Essers

Kuehne + Nagel

GEFCO

Cargo-partner

Germany

Kuehne + Nagel

DACHSER

GEODIS

Koch International

Netherlands

CEVA Logistics

DACHSER

GEODIS

Broekman Logistics

Poland

Gruba Rupen

DB Schenker

Lotos Kolej

Rohlig SUUS

JASFBG

DSV

Sweden

DACHSER

DSV

Country Profiles

Austria

Belgium

Germany

Netherlands

Poland

Sweden

Key Target Audience

Freight Forwarding Companies

Freight Forwarding Consultancy Companies

Contract Logistics Companies

Venture Capitalists

Freight Tech Companies

Consulting Companies

Investment Banks

Time Period Captured in the Report

Historical Period – 2013-2019P

Forecast Period – 2019P-2025F

Key Topics Covered in the Report: -

Transport Infrastructure in Europe

Europe Freight Forwarding Market Overview

Europe Freight Forwarding Market Size

Country Profiles (Austria, Belgium, Germany, Netherlands, Poland, Sweden)

Competitive Scenario in Europe Freight Forwarding Market

Technological Disruptions in Europe Freight Forwarding Market

Trends and Developments in Europe Freight Forwarding Market

Issues and Challenges in Europe Freight Forwarding Market

Company Profiles of Major Players in Europe Freight Forwarding Market

Europe Freight Forwarding Market Future Outlook and Projections

Europe Freight Forwarding Future Market Size

Europe Freight Forwarding Market Future Segmentation

Analyst Recommendations

For More Information On The Research Report, Refer To Below Link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249