France Used Car Market Ecosystem

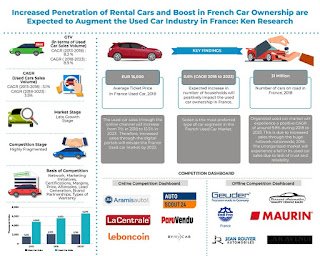

The France Used Car Auctions market is moderately fragmented with multiple dealers (both organized and unorganized) operating in the industry. Majority of the used cars are sourced from car-rental/ leasing companies & auctions.

Direct buying from consumers or individual sellers is another major source.

Key Findings

- France used car market is at a late growth stage along with a single-digit CAGR in terms of sales volume.

- Amid the COVID-19 pandemic-associated lockdown, the demand for used cars witnessed a halt in sales for the first half of the year 2020. However, since the second half of the year 2020, the demand for used vehicles started to pick the pace and continued until 2021

- In 2021, more than six million cars have changed hands in a single year.

- The prolonged waiting period for new vehicles encourages a large number of customers across the country to opt for used vehicles, which is likely to drive market growth during the forecast period.

To Know More about this report, download a Free Sample Report

The surge in Demand of Used Cars in France: The surge in the adoption of car financing and insurance options at the used car dealerships in France will lead to significant growth in the used car market. The used car industry is anticipated to grow in the next few years owing to the fall in new car sales due to the ban on diesel and petrol cars. The French people will take time to shift from fuel cars to electric cars, which will contribute to the growth of the used car market. The country would be witnessing a growth in used car dealerships, leading to the increased availability of used cars for customers.

Government Initiatives to Regulate France Used Car Market: The implementation of government policies for low-emission zones and other regulations may have a slight negative impact on the used car market. However, the simplification of the procedure for purchasing a used car would also contribute to the growth of the used car market in the next few years.

Challenges Faced By The Industry: Some of the unorganized players do not provide warranties on pre-owned vehicles. Furthermore, some sellers commit fraud by re-painting and removing dents from accident vehicles to conceal their damage and obtain a falsely inflated value, which causes buyers to be hesitant in purchasing used cars. As a result, the higher rate of malpractice and unorganized dealers' larger market share pose a threat to the growth of the used car market.

Analysts at Ken Research in their latest publication “France Used Car Market Outlook to 2023 – Surge in Demand for Rental Cars Backed by Increased Online Used Car Sales” by Ken Research observed that used car market is an emerging automotive market in France at rebounding stage from the economic crisis after pandemic. The rising government policies and demand for used car industry, increase in disposable income along with rising online platforms for used cars is expected to contribute to the market growth over the forecast period. The market is expected to grow at ~% CAGR during 2021-2026F owing to increase in prices of new cars, rise in demand for used cars and government initiatives.

Key Segments Covered in the report: -

France Used Car Market

By Type of Market Structure

- Organized Channel

- Unorganized Channel

- OEM Certified Franchise Dealers

- Multi Brand Dealers

- DDSA

- C2C Transaction

- Local Dealership

- Auction Companies

To more about industry trends, Request a free Expert call

By Type of Car

- Sedan

- Hatchback

- SUV

- Van

- Crossover

- Others

By Age of Vehicle

- 0-2 years

- 2-4 years

- 4-6 years

- 6-8 years

- 8-10 years

- More than 10 years

By Kms Driven and Type of Fuel Engine

- Less than 5,000 km

- 5,000-20,000 km

- 20,000-50,000 km

- 50,000-80,000 km

- 80,000-120,000 km

- Above 120,000 km

Key Target Audience

- Offline Dealers

- Online Portal

- Organized Multi Brands Dealers

- OEM Certified Dealerships

- Online Portal

- Private Equity and Venture Capitalist

- Industry Associations

- OEM Manufacturers

- Automotive Manufacturers

- Car Auction Companies

- Car manufacturing Companies

- Tourism Agencies

- Government Bodies & Regulating Authorities

Time Period Captured in the Report:

- Historical Period: 2017-2021

- Base Period: 2022

- Forecast Period: 2023-2027F

Visit this Link Request for a custom report

Companies Covered:

Online Companies Covered:

- Aramisauto

- Autoscout24

- La Centrale

- Paru Vendu

- Leboncoin

- BYmyCAR

- Auto-selection

Offline Companies Covered:

- Emil Frey France

- Geudet

- BYmyCAR

- Bernard Automobiles

- Car Avenue

- Maurin

- Jean Rouyer Automobiles

Key Topics Covered in the Report

- Introduction to France Used Car Market

- France Used Car Market Size, 2017-2022

- France Used Car Market Segmentation

- Trends and Developments in France Used Car Market

- Issues and Challenges in France Used Car Market

- Used Car Market Supply Chain

- France Used Car Auction Market

- Online Comparative Landscape in France Used Car Market

- Offline Comparative Landscape in France Used Car Market

- Government Regulations in France Used Car Market

- Business Model in Online Used Car /Market

- Working Model in France Used Car Market

- Case Study- Dutch Renault Dealer Group- How To Sell Off The Old Stock In The Inventory?

- France Used Car Market Future Outlook and Projections, 2023-2027F

- Analyst Recommendation for France Used Car Market

To Know More about this report, download a Free Sample Report: -

Future Outlook of France Used Cars Market

Related Reports by Ken Research: -