The pre-2010 trading industry of India was restricted to informed investors; undertaking trading activities via their relationship managers, thereby losing out large chunks of profits to intermediaries through high brokerage charges.

Post-2010, recognizing the opportunity of increasing Internet penetration, mobile phone subscribers, and retail investment participation, Zerodha introduced DIY internet-based trading platforms at low per trade charges (lower of 0.01% or flat INR 20 per trade). The emergence of discount brokerages compelled Full-service brokerages such as ICICI Securities, Motilal Oswal to slash their prices but was not at par with discount brokers.

But one must think about how these discount brokers are able to offer such low pricing in comparison to highly experienced traditional brokerages. Such discounted brokerages levy high technological capabilities such as eKYC, biometric authentications, Order Management Systems; analytical tools, etc; focusing on economies of scales by generating high trading volumes & account openings. This is further supplemented with online-based operations without deploying resources for research or advisory services. Moreover, DB firms usually rely on “word of mouth” marketing thereby saving up a major proportion of their client acquisition cost. All of these minimized expenses cumulate to a very low operating cost in comparison to traditional brokers, thereby, enabling them to provide services at such cheap pricing.

Following Zerodha’s no-frills model approach, new players including 5Paisa, Upstox entered the market with similar pricing strategies. Within a span of 8 years (in FY’18) Zerodha became a leading player in the brokerage industry by catering to ~1 Million retail customers. According to a study by Ken Research, what sets out Zerodha from its peers is its unique product offerings like Kite, Coin, Small case; easy to use interface; technologically advanced and fast customer acquisition process; comparable low account opening charges and high-quality macro-level research & advisory services.

Providing only trade execution services has limited discount brokerage’s reach to only DIY retail customers, therefore are losing out on high revenue from HNIs & institutional clients. Another major challenge faced by them is to retain their existing client base and preventing client switching at times of additional financial services requirements. In order to solve these problems, it becomes pertinent to analyze if DBs should expand their services portfolio?

It is important for discount brokers to diversify their offerings catering to institutional requirements and we can already see some major players moving in this direction. Capitalizing on the growing preference for Mutual Fund investing & catering to both traders & investors, Zerodha recently applied for an AMC license.

Similarly, supplementing its digital platform 5Paisa expanded its business to digital lending via its P2P Lending Subsidiary. Other dimensions could be to deal with insurance aggregation services, loan aggregations, pension scheme planning services, etc. allowing investment in short term saving schemes through their platform and partnering with the retail crowdfunding platforms; thereby allowing investors to exploit the asset-based diversification opportunities.

Adding to potential routes that can be followed, discount brokerages can invest in collaborations or developing in-house advisory services. However, in becoming a one-stop solution via any of the routes mentioned above, a major challenge for players would be maintaining its low operating cost and delivering superior quality DIY services.

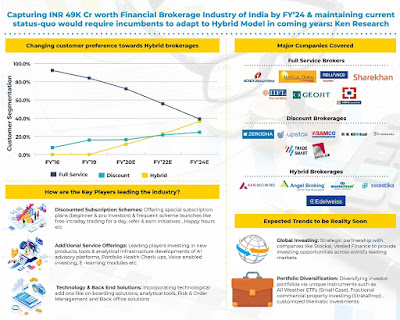

Companies Covered: -

Full-Service Brokerages

ICICI Securities

HDFC Securities

ShareKhan

Kotak Securities

Motilal Oswal

Nirmal Bang

Geojit Financial Services

IIFL Securities

SMC Global Securities

Reliance Securities

Discount Brokerage

Zerodha

5Paisa

Upstox

SAMCO

Prostocks

R K Global

Wisdom Capital

Interactive Brokers

Hybrid brokerage

Angel Broking

Edelweiss

Axis Direct

Swastika Investment (TradingBells)

MasterTrust

Key Topics Covered in the Report: -

Overview of India Financial Brokerage Industry

Understanding customer’s requirements

Decision-making criteria for selecting brokers by retail & Institutional Clients

Evolution in Role of Brokers, 2005-2022

Full-Service Brokerage in India:

Overview with Business Model followed

Competitive Landscape including Cross comparison among major players on financial, operational, Pricing, Strengths & Weakness Analysis

Company Profile of major Full-Service Brokers

Future Outlook & Potential of Full-Service Brokers in India

Discount Brokerage in India:

Overview with Industry Ecosystem & Business Model followed

Competitive Landscape including Cross comparison among major players on Financial, Operational, Technological, Pricing, Strengths & Weakness Analysis

Company Profile of major Discount Brokers

Technological Landscape including Technologies available, Profiling of major Technology Providers

Overview of Back Office Operations with Profiling of major Back Office Operators

EKYC Providers & costing

Future Outlook of Discount Brokerage

Case Study of Stock

Hybrid Brokerage in India:

Overview with Business Model followed

Industry Landscape including Cross comparison among major players on financial, operational, Pricing, Strengths & Weakness Analysis

Company Profile of major Hybrid Brokers

Future Outlook for Hybrid Brokerage with expected Industry Trends

Regulatory Landscape Governing Brokerage Industry in India

For More Information on the research report, refer to below link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249