Global Seed Treatment Market By Function

The Global Seed Treatment market is segmented by Function into Seed Protection and Seed Enhancement.

The seed protection segment occupies the largest share of the seed treatment market when seen from the prism of functions. The seed enhancement segment mostly takes care of plant nutrition needs.

Seed protection procedures can be chemical or non-chemical/biological. Seed enhancement procedures involve the application of biologicals, such as bio-fertilizers, bio-stimulants, plant growth regulators, seed priming, and seed disinfection procedures.

Global Seed Treatment Market By Geography

The Global Seed Treatment Market is segmented by geography into North America, Europe, Asia- pacific and LAMEA.

North America is expected to dominate the global Seed Treatment market during the forecasted period owing to the presence of major companies such as Nvidia Corporation, Microsoft, Meta Platforms, and Unity Games.

North America is estimated to continue with its dominance over the seed treatment market even in the forecasting period, majorly due to the large-scale adoption of biotech crops in countries like the United States and Canada.

The United States has been one of the earliest adopters of Biotech crops. Biotech crops were introduced in 1996. Within the next seventeen years, by 2013, more than ninety percent of all cotton, soybeans, and corn planted in the United States was Biotech. More than 173 million acres were planted with biotech seeds in the United States by 2013.

Competition Scenario In Global Seed Treatment Market

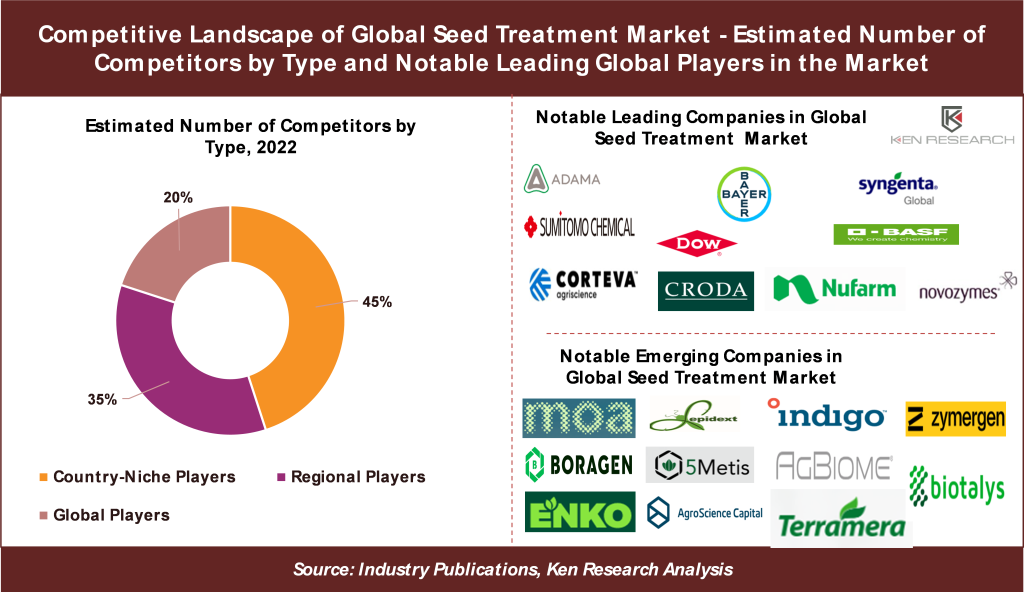

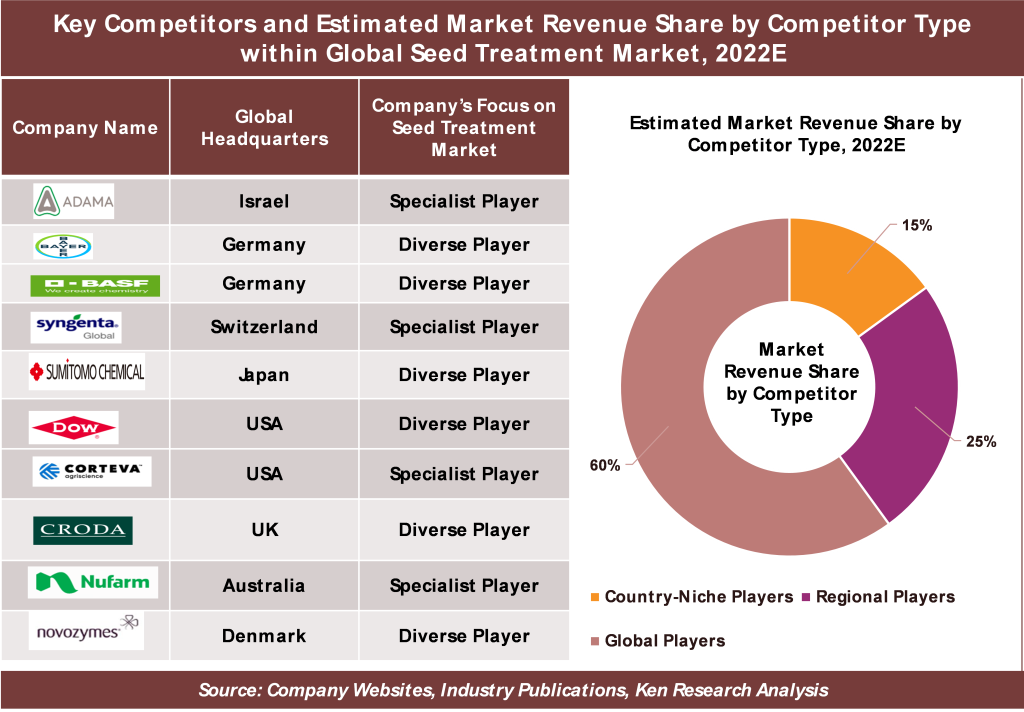

The Global Seed Treatment market has nearly 150 players, including globally diversified players, regional players, and country-niche players having their expertise in addressing region-specific needs to treat seeds in a way that is conducive to the local climate conditions.

Large global players constitute ~20% of the market in terms of the number of competitors, while regional players hold the second largest share. Some of the major players in the market include Adama Agricultural Solutions, Bayer AG, BASF, Syngenta AG, Sumitomo Chemical Co., Ltd., Dow, Corteva, Inc., Croda International Plc., Nufarm, Novozymes, and more, among others.

Request for Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDEx

What is the Expected Future Outlook for the Overall Global SEED TREATMENT Market Across the globe?

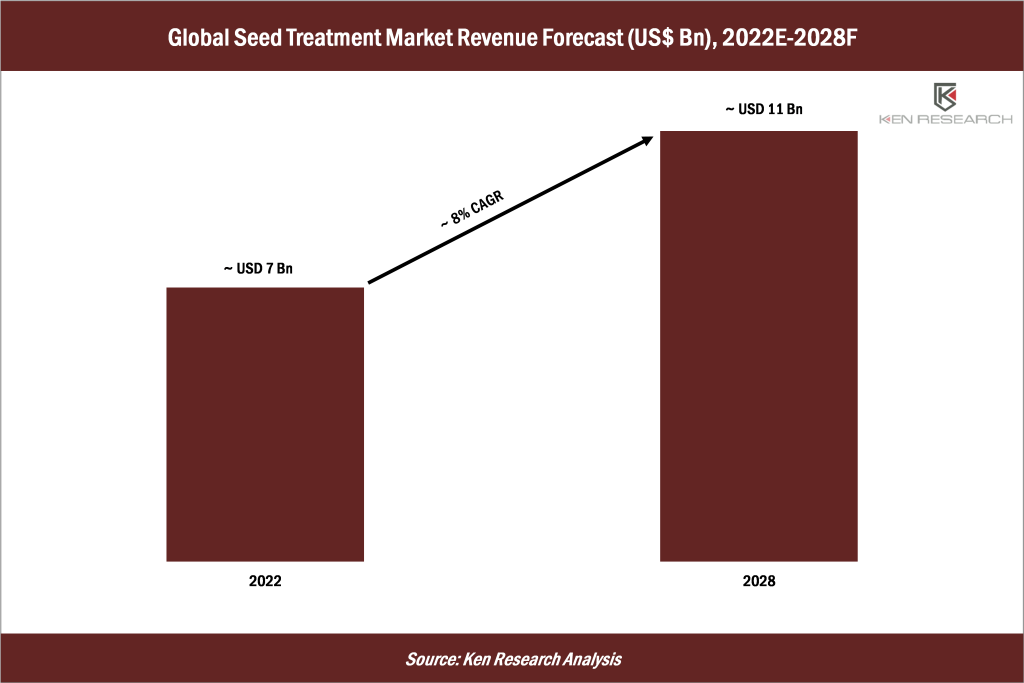

The Global Seed Treatment market was valued at USD ~billion in 2022 and is anticipated to reach USD ~billion by the end of 2028F, witnessing a CAGR of ~% during the forecast period 2022-2028F. The realistic growth scenario represents the most likely scenario as per current market conditions. This scenario assumes that there will be no overall impact on the market due to any potential COVID-19 waves in the future.

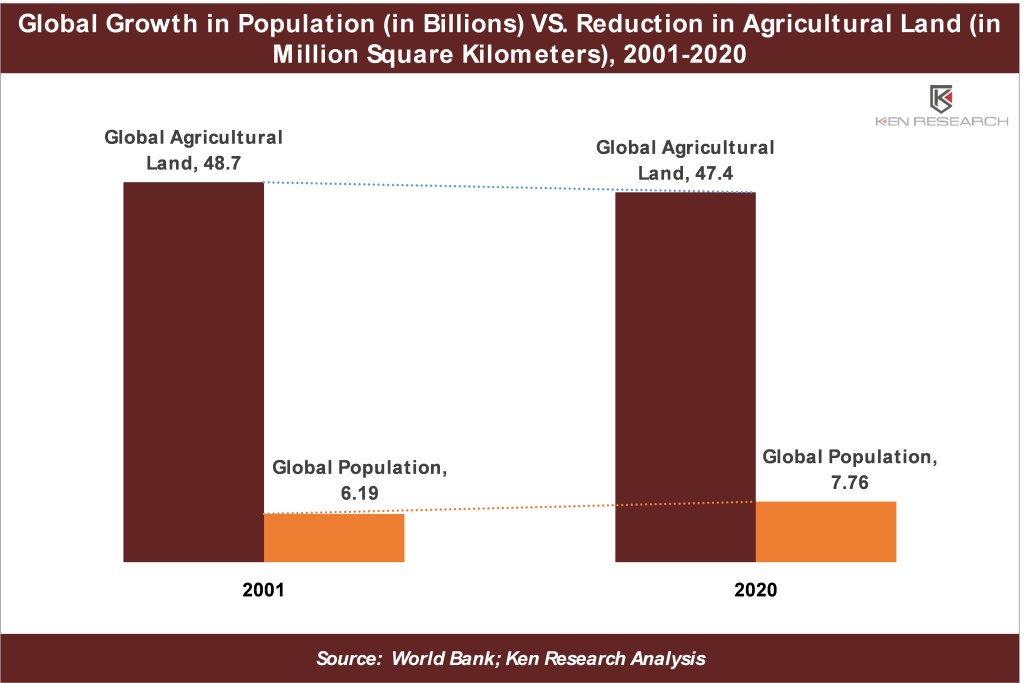

The Global Seed Treatment market is driven by rising demand of the seeds as it offers low-cost protection against diseases and soil-borne organisms and protects weak seeds, resulting in improved germination. However, the market is also constantly being influenced by rapid development in technology, product innovation, and diversification in some countries.

Ask for Free Customization @https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2MDEx

With the increasing acquisition and emergence of new products, the Global Seed Treatment market is changing rapidly. For instance, In July 2022, ADAMA Limited launched Chrome, an innovative broad-spectrum weed control solution. Chrome is a liquid herbicide that is made by combining three active ingredients: Flufenacet, Diflufenican, and Chlorotoluron. As a simple and ready-to-use solution, Chrome is expected to effectively resist issues relating to grass and broadleaf weeds. ADAMA expects Chrome to prove effective in controlling weeds in the long run.

In September 2022, Syngenta became the exclusive worldwide commercialization distributor of Bioceres’s biological seed treatment solutions. The collaboration, which would also involve joint R&D efforts, is expected to bring speed to the market by expediting the global registration of products and the launch of new biological solutions.

Nufarm launched a host of new products, including the Leopard Herbicide in July 2022, and the Longbow EC herbicide. While Leopard is expected to introduce enhanced planting flexibility for soybeans, field corn, and cotton, Longbow EC is expected to control more than 60 species of broadleaf weeds.

The Global Seed Treatment Market is expected to continue growing on a steady and moderately-paced trajectory. The need for efficient farming is increasing worldwide. Farmers and agricultural farm owners are looking for ways to reduce the loss of yield, improve their seed’s germination potential, and protect seeds from the negative impacts of irregular climate, pests, insects, and diverse types of crop diseases. As of 2019, genetically modified crops occupied 190 million hectares of cultivable fields, indicating a growing inclination towards leveraging science and technology for the improvement of agricultural production. This inclination would serve as a tailwind for the Global Seed Treatment Market in the forecasted future.

Market Taxonomy

By Type

Chemical

Non-Chemical

By Treatment / Application Technique

Seed Dressing

Seed Coating

Seed Pelleting

By Crop

Grains and Cereals

Oilseeds and Pulses

Fruits and Vegetables

Other Crop Types (Forages, Alfalfa, Flower seeds, etc.)

By Formulation

Liquid Formulation

Dry Formulation

By Function

Seed Protection

Seed Enhancement

By Region

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy)

Asia Pacific (China, Japan, South Korea, India, Indonesia, Australis)

Latin America, Middle East, and Africa (LAMEA)

Key Companies

Adama Agricultural Solutions

Bayer AG

BASF

Syngenta AG

Sumitomo Chemical Co., Ltd.

Dow

Corteva, Inc.

Croda International Plc.

Nufarm

Novozymes A/S

For more insights on the market intelligence, refer to below link: –

Global Seed Treatment Market Size, Segments, Outlook, and Revenue Forecast 2022-2028: Ken Research