A Warehouse Management system (WMS) is software that aids in the management and intelligent execution of a warehouse's, distribution center, or fulfilment center’s operations. WMS applications provide features like order allocation, order picking, replenishment, packing, shipping, labor management, yard management, and automated materials handling equipment interfaces.

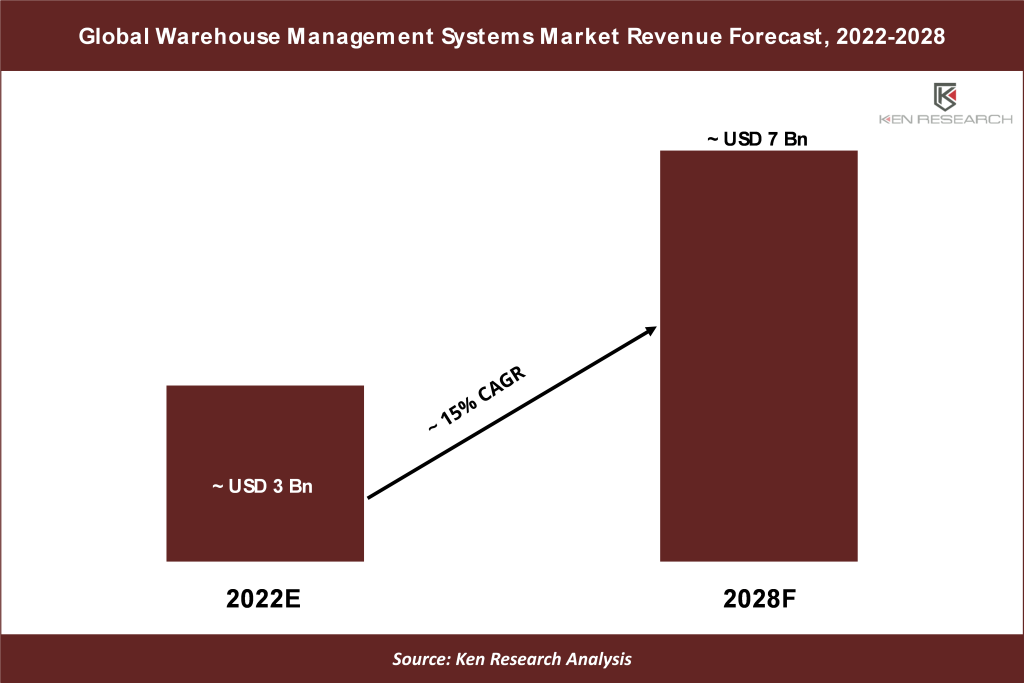

The Global Warehouse Management Systems Market is expected to record a positive CAGR of ~15% during the forecast period (2022-2028) and reach a revenue of US$ 7 Bn by 2028. This growth is owing to the development of digital technology in global logistics, including delivery of key performance indicators (KPIs), enhanced supply chain flexibility, and cost-cutting, which have pushed Third-Party Logistics (3PL) and the supply chain sector to adopt warehouse management systems along with the rising e-commerce and customer online purchasing behaviors are anticipated to enhance demand for the warehouse management system.

For more information, request a free sample @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDE2

- WMS demand is expected to increase significantly as a result of switching supply chain strategies used by product manufacturers and rising consumer demand, especially in the transport & logistics, and retail industries. One of the key factors driving the market expansion is the requirement for manufacturers to automate warehouse management procedures and reduce costs globally. The system's capacity to deliver goods as quickly as possible via the shortest shipping routes could be the cause of the system's skyrocketing demand.

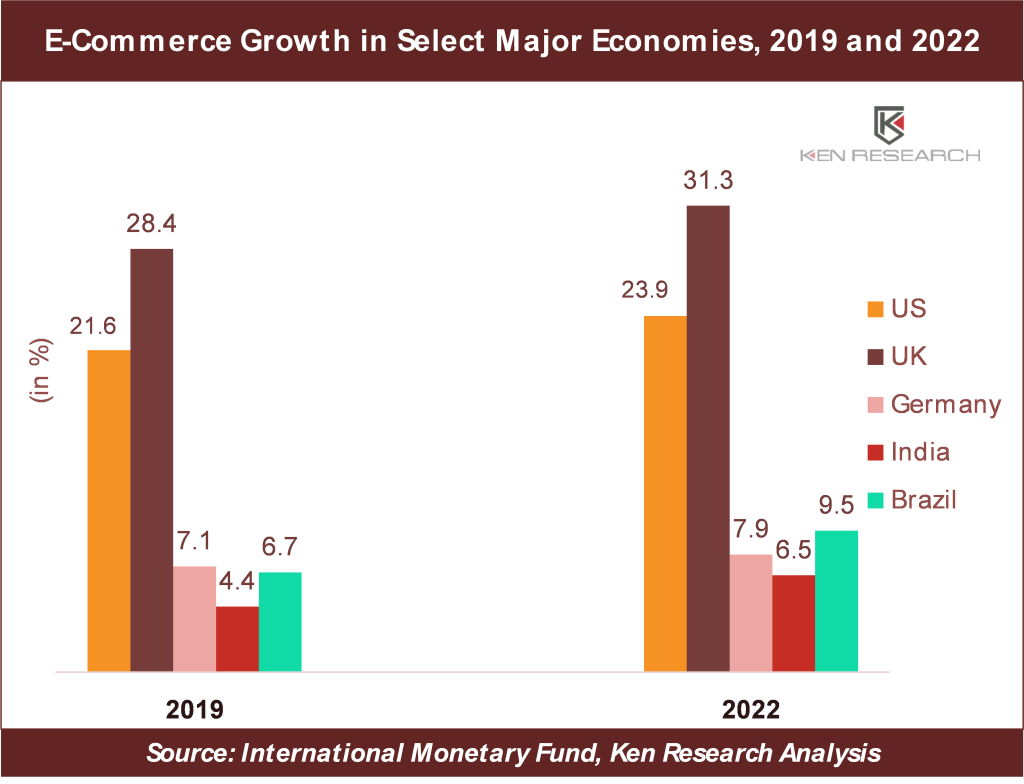

- Real-time WMS software solutions are rapidly being utilized as a result of a significant shift in consumer purchasing behavior for effective order processing, picking, packaging, shipment tracking, and route planning in the e-commerce industry. WMS enables businesses to swiftly adjust to the shifting client needs in the e-commerce and online retail space.

- According to International Trade Administration, an agency in the United States Department of Commerce in 2020 states that of the two consumer focuses, retail consumer goods e-commerce is by far the most dynamic and successful. In 2020, it accounted for 18% of all retail sales worldwide. By 2024, it is anticipated to rise at a rate of over 1% annually, reaching almost 22% of all retail sales worldwide.

- Small-scale companies frequently utilize old techniques to run their warehouses. The adoption of WMS is hindered by large initial investments and significant deployment investments. The adoption of WMS by small-scale enterprises is additionally constrained by the additional expenses associated with license purchases, upgrades, and employee training during the deployment process. Small-scale industries, however, are not aware of the advantages of WMS, which presents a problem for the market's players.

- Despite the initial turmoil caused by the COVID-19 pandemic, steady market expansion was made possible by the booming e-commerce sector and a more useful understanding of the benefits of WMS. Additionally, the crisis has quickened the industry's adoption of WMS as well as other warehouse automation solutions.

Key Trends by Market Segment

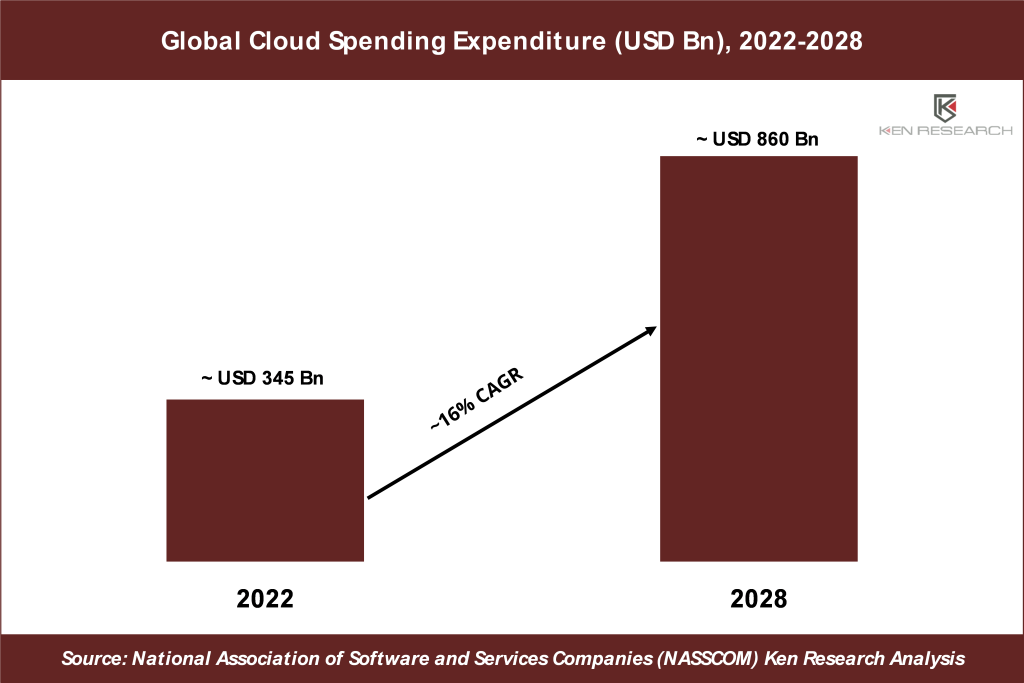

By Deployment Type- Cloud-based segment held the major market share in 2021 due to its 100% web-based feature and accessibility from any device with an internet connection.

- Regardless of the size and complexity of the organization using WMS, advancements in cloud-based services are expected to accelerate the adoption of WMS software. Medium-sized and small-sized firms, which do not require the adoption of complex warehouse technologies and high-speed automation, are primarily responsible for the growing demand for cloud-based systems.

- According to 3PL Central LLC, a WMS solutions provider predicted that cloud-based warehouse management solutions is anticipated to grow and are projected to reach US$ 8.1 billion by 2028. This growth is being fuelled by the adoption of cloud-based WMS, especially among small and medium-sized businesses, as a result of consumer demand and e-commerce.

For more information, request a free sample @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDE2

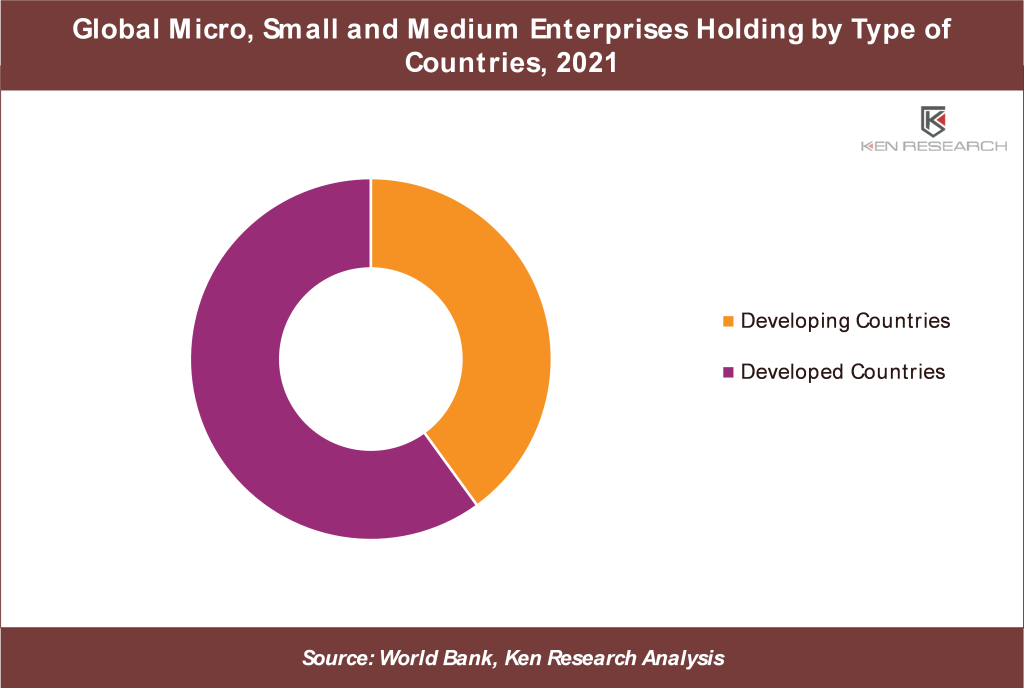

By Component Type- The software segment accounted for the highest market share in 2021, mostly due to the growing use of WMS software by small to medium-sized enterprises (SMEs) globally.

- Since online software is convenient to use, most developed and developing countries prefer to utilize it, which now has led to the software segment dominating the market.

- In November 2021, Fishbowl, a software company, developed a new online version of its inventory management software.

By Tier Type- Advanced WMS (Tier 1) held the major market share in 2021 owing to the maximum level of interconnectivity and functionality of advanced wms.

- Advanced WMS includes and fully integrates the main functions like slotting, labor management, transportation management, and yard management. Tier 1 WMS frequently provides the option to configure business rules within the system. Customization is enabled by the software without the need for extra, specialist programming which enables more seamless upgrading.

- In April 2015, a new powerful warehouse management system from IQMS has already been released. This directed pick-and-put-away distribution system is based on rules and is believed to be competitive with Tier 1 WMS systems. Tessy Plastics Corp., Blue Horseshoe, and IQMS worked together to create Advanced WMS as a supply chain management consultant project.

By Function Outlook- Systems Integration & Maintenance segment held the major market share in 2021, due to various functions that WMS performs such as receiving and storing inventory, optimizing order selection and shipping, and making recommendations on inventory replenishment.

- Businesses can more effectively monitor and optimize their operations by integrating warehouse management systems with other effective software programs.

- Organizations might obtain accurate and comprehensive information about warehouse management, transportation, and distribution, and utilize that knowledge to make better decisions by integrating warehouse management systems with transportation management systems. Additionally, it allows for better use of the fleet and other essential resources.

By End-User- The transportation and Logistics segment held the major market share in 2021, due to the expansion of e-commerce sector, rising income levels, and the quick adoption of WMS.

- According to the Council of Supply Chain Management Professionals (CSCMP), the leading global association for supply chain management professionals, in 2022 stated that United States business logistics costs (USBLC) grew by 22.4% to US$1.85 trillion, nearly 8% of the US$23 trillion GDP predicted for 2021.

- Logistics and supply chain organizations are rapidly implementing WMS to streamline their processes and boost productivity and efficiency in their warehouses. The segment will continue to expand as consumers are becoming more aware of the advantages of having a well-integrated WMS, such as efficient warehouse operations to match rising demand.

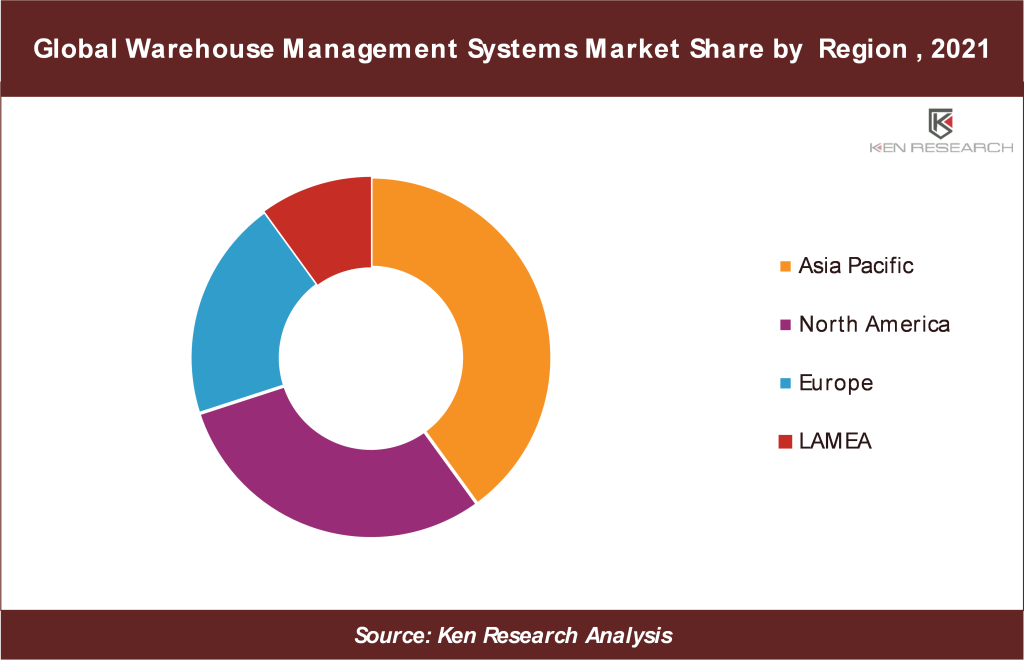

By Geography- Asia Pacific is expected to be the fastest growing market during the forecast period due to the robust economic growth and ongoing advancements in inventory management and warehouse management systems, businesses are investing extensively in these systems to maintain growth and boost productivity.

- According to the Ministry of Commerce, in 2021, stated that Chinese companies already run more than 1,900 abroad warehouses with a combined floor area of 13.5 million square meters.

- According to the Ministry of Commerce & Industry India, which administers two departments, the Department of Commerce and the Department for Promotion of Industry & Internal Trade, in 2021 reported that about 14% of India's GDP is currently invested in logistics. In developed countries such as the US, Hong Kong, and France, the ratio of logistics costs to GDP is around half (4-5%) that in India (6-9%).

To more regional trends, Ask for a Customization @ https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2MDE2

Competitive Landscape

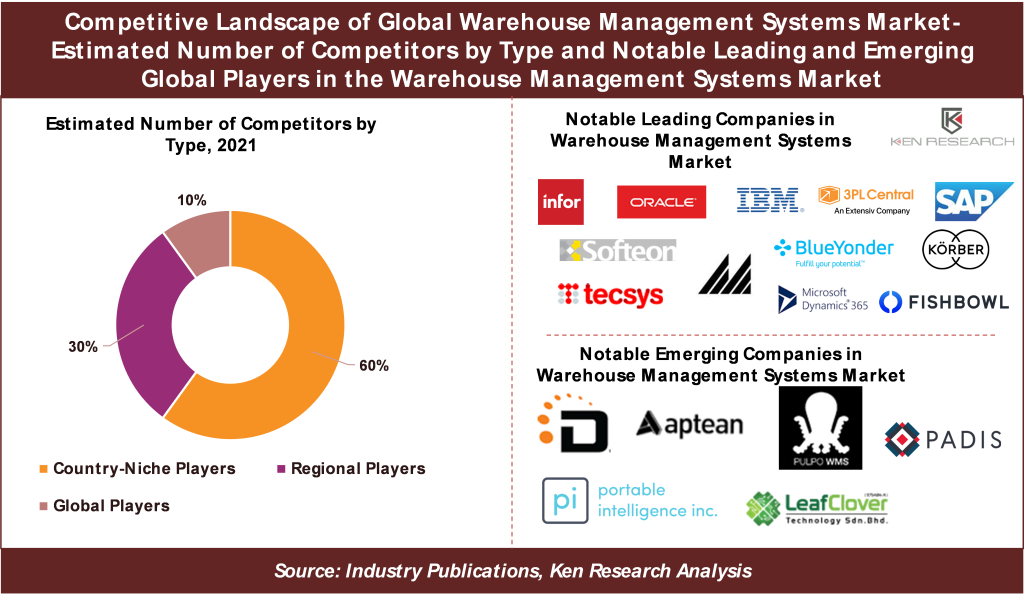

The global warehouse management systems market is extremely competitive with ~1,000 players, which include globally diversified players, regional players as well as a large number of country-niche players having their niche in supply chain software for multiple end-user industries.

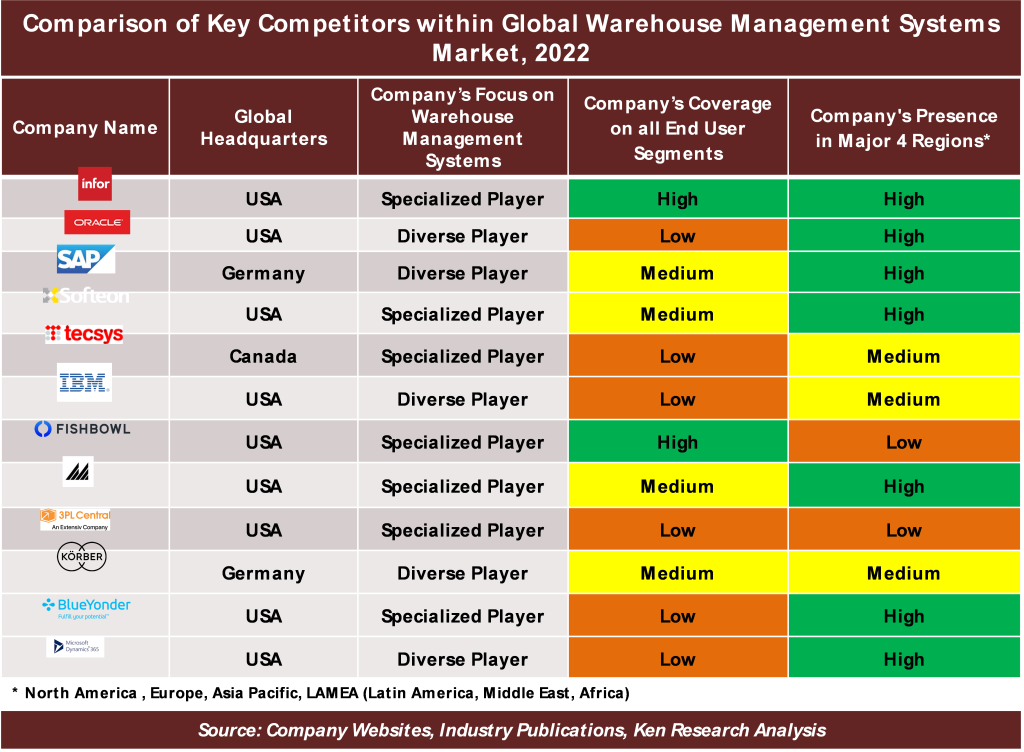

Country-niche players hold the largest market share, while regional players hold the second largest share. Some of the major players in the market include Infor, Oracle, SAP SE, Softeon, Tecsys, IBM Corp., Fishbowl, Manhattan Associates, 3PL Central LLC, Körber AG, Blue Yonder Group, Inc., Microsoft Dynamics 365, and others.

The leading global specialist companies such as Infor, Softeon, Tecsys, Fishbowl, Manhattan Associates, 3PL Central LLC, Blue Yonder Group, Inc., and Microsoft Dynamics 365 are highly focused on providing significant supply chain software for various functions that can be used across multiple industries, including Automotive, Food and Beverages, Healthcare, Logistics and Transportation, and more.

Recent Developments Related to Major Players

- In August 2022, Infor announced that Infor WMS has been implemented by Mooneh, a third-party logistics company handling storage and delivery on behalf of top worldwide pharmaceutical corporations.

- In September 2021, 3PL Central, a specialist in cloud-based warehouse management systems (WMS) developed for third-party logistics (3PL) warehouses, acquired Scout Software, a leading inventory and Warehouse Management system for brands and merchants expanding their e-commerce fulfillment capabilities.

- In April 2021, the Infor Warehouse Management Systems (WMS) has been released on the Amazon Web Services (AWS) cloud environment, according to an announcement by Infor Japan KK and Atena Corporation, Japan's top direct marketing and outsourcing firm.

- In May 2020, Manhattan Associates, Inc released the Manhattan Active Warehouse Management Solution. It is the first cloud-native enterprise-class warehouse management system (WMS) in the world, and it never needs to be upgraded.

- In April 2019, HighJump (Körber) debuted its most recent technology, HighJump CLASS, for the modelling and design of warehouse and logistics. HighJump CLASS equips companies throughout the world to maintain their competitiveness and connect to the future supply chain.

Conclusion

The Global Warehouse Management Systems Market Size, Segments, Outlook, and Revenue Forecast 2022-2028 is anticipated to continue growing at a substantial rate of ~15% owing to the recent developments in global logistics, including delivery KPIs, enhanced supply chain flexibility, and cost-cutting, which have pushed 3PL and the supply chain sector to adopt warehouse management systems. The warehouse management system market is expanding due to rising e-commerce and customer online purchasing behaviors. Foreign investments in developing economies are being fuelled by several factors, including favorable trade conditions, progressive government policies, and lower company taxes. Consequently, one of the main areas for WMS market growth is in emerging nations. Though the market is highly competitive with ~ 500 participants, few global players control the dominant share and regional players also hold a significant share.

Note: This is an upcoming/planned report, so the figures quoted here for a market size estimate, forecast, growth, segment share, and competitive landscape are based on initial findings and might vary slightly in the actual report. Also, any required customizations can be covered to the best feasible extent for Pre-booking clients and report delivered within a maximum of 2 working weeks.

Market Taxonomy

By Deployment Type

- On-premise

- Cloud-Based

By Component Type

- Hardware

- Software

- Services

By Tier Type

- Advanced WMS (Tier 1)

- Intermediate WMS (Tier 2)

- Basic WMS (Tier 3)

By Function Outlook

- Labor Management System

- Analytics & Optimization

- Billing & Yard Management

- Systems Integration & Maintenance

- Consulting Services

By End User

- Automotive

- Food & Beverages

- Healthcare & Pharmaceuticals

- E-commerce

- Chemicals

- Electricals & Electronics

- Metals & Machinery

- Retail & Consumer goods

- Education

- Transportation & Logistics

- Manufacturing

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Australia, Rest of Asia Pacific)

- LAMEA (Latin America, Middle East, Africa)

Key Companies

- Infor

- Oracle

- SAP SE

- Softeon

- Tecsys

- IBM Corp.

- Fishbowl

- Manhattan Associates

- 3PL Central LLC

- Körber AG

- Blue Yonder Group, Inc.

- Microsoft Dynamics 365