Online B2B Packaging Industry Of India

The presence of many entities including numerous manufacturers provides fierce competition. MSMEs contribute a major part of the revenue generated in the industry. Large scale players are few in numbers but contribute ~% of the overall revenue in the industry. The Indian packaging industry is the ~ fastest growing industry in India, contributing to ~% to the global packaging industry.

Bottlenecks faced in the Industry can be understood as a lack of R&D facilities along with High value of input costs & low availability of skilled manpower. There is also a lack of technological facilities in terms of effective utilization of the capacity. Furthermore, the report talks about the various government schemes & initiatives which are directly or indirectly affecting the packaging industry in India today.

Survey Demand Analysis

- The survey analysis showcases what sort of end-user industries to target in order to maximize production capacity utilization

- What sort of packaging material provides highest returns, & furthermore what kind is best to cater to for which industry

- Highest demand for packaging come which region.

New Demand Trends Witnessed

Prevalence of Transit packaging providing an increase in the number of parcels provides a future focus point. Furthermore, Omnichannel packaging talks about the various features a product should have in order to gain an edge over traditional packaging methods.

Survey Supply Analysis

The Survey supply analysis covers trends & practices on the following parameters:

- Manufacturing Plants

- Business Vintage

- Packaging Material

- End-User Relations

- Credit Periods

- Third-Party Relations and Several Other Factors

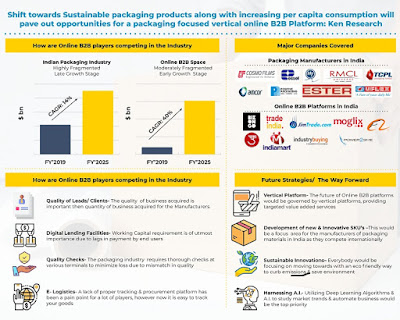

Packaging Industry Future Outlook

Future Market Trends & The Way Forward

The future of the packaging industry is dependent on new and changing consumer preferences along with ever-expanding E-commerce space & need for sustainable products. The growing Indian packaging industry needs to focus on key areas such as Safety, Environment Protection, Reusability and Recyclability of packaging material along with innovative ways to increase sustainable use of the materials with a view to promoting the growth of the sector in a more sustainable way.

Online B2B Platform Overview

Service Portfolio of Online B2B Platforms

The services provided include Online Marketplaces as well as Listing Places. The other major service provided includes Business Enablement service which includes Digital Ancillary services & SaaS support to the onboarded members.

Demand Survey Analysis

The survey talks about important characteristics of an online B2B survey & explains the relationships between different entities. It provides an insight regarding the business leads & their conversion ratio as well as the association period. It further explains the credit cycle & the average order value associated with the different natures of entities in the industry.

Key Segments Covered: -

By Nature of Packaging

Flexible Packaging

Rigid Packaging

By Type of Packaging Material

Plastic

Paper

Glass

Metal

Wood

Others (Special Laminate Sheets, Woven Materials)

By End Users

Food & Beverage

Pharmaceutical

Consumer Electronics

Personal & Home care

Other End Users (Automobile, Textile, Construction, Medical Devices)

By Regions

Tier 1 Cities

Tier 2 Cities

Tier 3 Cities

Key Target Audience

Packaging Manufacturers

Packaging Distributors

Machinery Industry

Plastic Industry

Glass Industry

Paper Industry

FMCG Industry

Online Commerce Industries

Online B2B facilitating Entities

Packaging Industry Associations

Government Associations

Government Agencies

Private Equity and Venture Capitalist Firms

Time Period Captured in the Report:

Historical Period: FY’2014-FY’2019

Forecast Period: FY’2019-FY’2025

Companies Mentioned:

Indian Packaging Industry Competitive Ecosystem

Balmer & Lawrie

Jindal Polyfilms

Cosmo Films

Ester

Essel

Polypack

TCPL

Time Technoplast

Uflex

Radha Madha Corp. Ltd

Other Players- Pharpur 3P, Amcor Limited, Huhtamaki PPL, Hindustan Tin Works Ltd, Shetron & Umax Packaging Ltd.

Online B2B Platform Competitive Ecosystem

IndiaMart

Trade India

Bizongo

Udaan

Industry Buying

Moglix

Power 2 SME

Other Players include Alibaba, Ninjacart etc.

Key Topics Covered in the Report: -

Online B2B Platform for the packaging Industry

Production Costs of Packaging in India

Operating Model Packaging Industry

India MSME Packaging Manufacturers

Total Packaging Manufacturers India

India Packaging Per Capita Consumption

MSME Digital Adoption Rate India

Online B2B Platform Competition India

Online B2B Platform Bottlenecks India

India Balmer & Lawrie Packaging Industry Revenue

Jindal Polyfilms Production Capacity Analysis

Preference of the B2B Marketplace in India in 2019

For More Information on The Research Report, Refer to Below Link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249