- From the past 5 years, there has been very little growth in the area of arable land available in the country; however, the demand for food has been persistently increasing. This could result in a shift towards the adoption of more agrochemical product usage and mechanization in the farming process. In 2018, Indonesia recorded an arable land of 571.1 sq km in the country.

- The agrochemicals market in Indonesia is expected to witness a drive towards sustainable, cost-effective crop protection chemicals to ensure that input costs remain as low as possible due to limited financing resources available with farmers.

- Approximately 10.0%-12.0% of the pesticides circulating in the Indonesian market are either illegal or counterfeit in nature. This acts as a major challenge for manufacturers thereby decreasing their overall revenue in the country. Apart from this, the companies have to regularly organize counterfeit drives to raise product awareness which results in a further increase in their operating expenses.

Shift towards Sustainable, Cost-Effective, and Environment-Friendly Methods of Production: Owing to the integrated pest management system in the country, Indonesian farmers are shifting towards sustainable and organic methods of production, which would increase the demand for Biopesticides and other organic products in the country. Also, with increased regulations such as RSPO, there is a greater need for developing organic substitutes for chemicals used in agriculture by manufacturers.

Prolonged Dry Seasons: In the past 5 years, Indonesia suffered from dry seasons by approximately 3-4 times which majorly impacted production and sales of agricultural products in the country. Prolonged dry seasons are expected to occur again in the future and given Indonesia’s high dependency on rainfall for irrigation, there is a greater need for farmers to adopt alternative methods of increasing productivity such as increased usage of pesticides, fertilizers, and other crop nutrient providers.

Increased Investment in Research & Development Activities: International companies in Indonesia on average spend 10.0%-13.0% of their yearly revenue on research & development activities in order to develop new active ingredients in the country, which would supplement the launch of new products types in the market. Several companies such as Bayer, BISI, and FMC have lined up their product launches in upcoming years depending on the growing trends and demand in the market.

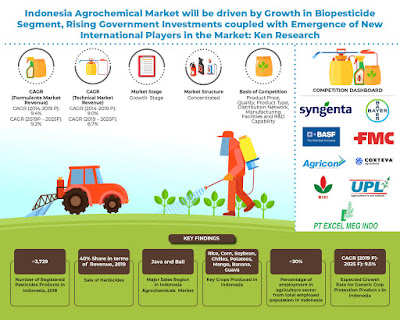

Analysts at Ken Research in their latest publication “Indonesia Agrochemicals Market Outlook to 2025- By Type of Pesticides (Herbicides, Insecticides, Fungicides, Bio Pesticides and Others), By Type of Crop Protection Product (Generic and Patented), By Form of Agrochemicals (Liquid, Granule, and Powder), By Application (Cereals, Vegetables, Fruits and Plantations) and By Sales Regions (Java & Bali The region, Sulawesi, Sumatra, and Kalimantan)” suggested that the agrochemical market in Indonesia will grow by a CAGR of approximately 9.2% in terms of sales value during the forecast period 2019-2015, owing to factors such as growing agriculture products demand, entry of new national and international players, new mergers and acquisitions and increased government support.

Key Segments Covered: -

By Types of Pesticides

Herbicides

Insecticides

Fungicides

Biopesticides and Others

By Type of Herbicides

Glyphosate

Paraquat

Atrazine

Others (including Metsulfuron, Acetochlor etc)

By Type of Insecticides

Pyrethroids

Abamectin

Rynaxypyr

Chlorpyrifos

Others (including Azadirachti, Bacillus thuringiensis)

By Type of Fungicides

Triazole

Strobilurin

Contact Fungicides including Propionic, Chlorothalonil

Others (including Carbendazim, Organomerkuri, Sodium Dichromate)

By Type of Crop Protection Product

Generic

Patented

By Form of Pesticide

Liquid

Granules

Powder

By Types of Crops

Cereals

Vegetables

Fruits

Plantation

By Type of Cereal Crops

Rice

Corn

Soybean

Others (including maize, barley and other cereal crops)

By Type of Vegetables

Onion

Chillies

Tomato

Potatoes

Cabbage

Others

By Type of Fruits

Citrus

Banana

Mango

Others (Including Guava, Mangosteen, and other fruits)

By Type of Plantation: -

Oil Palm

Sugarcane

Rubber and Tea

Forestry

By Region

Java and Bali Region

Sulawesi

Sumatra

Kalimantan

Key Target Audience

Venture Capitalist Firms

Agrochemical Manufacturers

Raw Material Suppliers

Research & Development Institutes

Government Bodies & Regulating Authorities

Time Period Captured in the Report: -

Historical Period: 2014-2019P

Forecast Period: 2019P-2025F

Companies Covered: -

PT Syngenta Indonesia

PT Bayer Indonesia

PT Bina Guna Kimia (FMC)

PT Bima Kimia Nufarm

PT Corteva Agriscience

PT BASF Indonesia

PT UPL Indonesia

PT Agricon

PT Dharma Guna Wibawa

Bingei Agung

PT Excel Meg Indonesia

PT BISI International Tbk

Key Topics Covered in the Report: -

Indonesia Crop Protection Business

Indonesia Insecticides Market

Indonesia Seed Treatment Market Revenue

Indonesia Sugarcane Production Industry

Crop Protection Products Indonesia

Crop Protection Services in Indonesia

Indonesia Rice Crop Protection Products

Indonesia Rice Production Market

Indonesia Agrochemicals Import Value in USD Thousand

Indonesia Agrochemicals Market Distributors

For More Information On The Research Report, Refer To Below Link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249