Logistics is energetic for the economic performance of any economy. Nigeria has poor infrastructure and logistical problems along with delayed customs processes and congestion on the roads. It is an import-based country and the economy is reliant on the export of crude oil. Nigeria was ranked 145 out of 190 economies during 2018 in comfort of doing business Index and ranks 112 in the Logistics Performance Index (2018). The growth in Nigeria logistics Market has been owing to the Infrastructural developments in Railways and Airways, advancement in foreign ties with other countries and the growing e commerce segment.

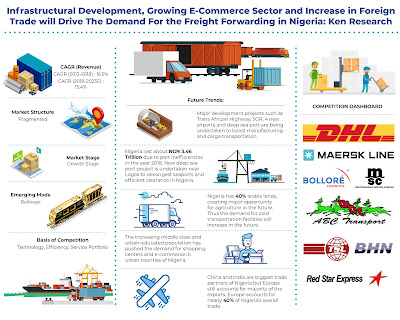

According to the report analysis, ‘Nigeria Logistics and Warehousing Market Outlook to 2023 – By Sea, Land, Pipeline, Air Freight Forwarding; International and Domestic Freight, Integrated and 3PL Freight Forwarding; By Warehousing (Industrial/ Retail, ICD/CFS, Cold Storage, Others), By End Users, 3PL Warehousing, Type of Warehouses; By Courier Express and Parcel Logistics and E-commerce Logistics’ states that the competition within Nigeria Logistics and Warehousing Market is greatly fragmented in nature with the existence of national and international players such as DHL, FedEx, Redstar, UPS, GMT Logistics, MDS logistics, GIG, ABC transport, Bollore, Maersk Line, TSL and many more. The competition in the freight forwarding entities is more than warehousing owing to the existence of multiple players with diversified solutions at the competitive prices. The logistic cost in the market is tremendously high leading to contraction of manufacturing segment in the GDP.

The country is well-known for its oil and gas exploration and exports to other countries. The oil and gas companies’ whose essential business is not logistics, desire outsourcing the work to other logistics partners who have superior fleet size and admittance to all the resources and technology that will ease out their functions and short-term requirement for them. Companies dealing with unpreserved items and dangerous goods have complex transportation and warehousing requirements. Aggregator platforms such as kobo logistics are becoming extremely prominent that has linked the truckers with the companies to decrease the logistics cost and augment their freight.

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MjgzOTIz

In addition, the boom of e-commerce and simplification of e-payment systems such as Paystack, PIN based debit cards in Nigeria have augmented the requirement of couriers and parcel market in the country. The growing prominence of online shopping will also underwrite towards a long-term growth for EDS (Express Delivery Segment) in future. The growth of e-commerce business has led to a convergence of B2B and B2C traffic, with parcel logistics providers progressively embracing both to serve the clients’ Omni channel supply chains.

The entire Logistics Market in Nigeria is projected to augment during the forecasted duration due to growing requirement for E Commerce Product, Augmenting International trade and Growth in Domestic Manufacturing. It is projected that there will be an augment in investment towards industrial parks in export encouraging zones with PPP framework. The augmenting middle-class population and growing retail stores and supermarkets will propel the requirement of warehousing in future. The logistics companies are projected to invest in advanced technologies solutions such as autonomous logistics, real-time tracking and automation in order to deliver an advanced customer service.

For More Information on the Research Report, refer to below links: -

Nigeria Logistics And Warehousing Market Analysis

Related Report: -

Related Report: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

Follow Us: -