How Nigeria Warehousing Market Evolved?

Logistics and warehousing are important for the economy. Nigeria has five international airports and six seaports for cargo transportation. Murtala Muhammed International Airport is the major commercial airport in Lagos and Lagos Port Complex and Tin Can Port are the two major seaports, both located in the commercial hub of Lagos. Therefore, Lagos is the warehousing hub of Nigeria. Infrastructural developments in the seaports, airports, and SGR have contributed to the facilitation of the International trade increases the demand for more warehouses in the country.

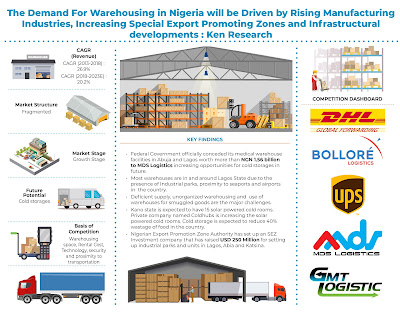

Most warehouses are centered in and around Lagos due to the presence of industrial parks and proximity to seaports and airports. The price charged in Lagos is higher compared to the rest of the places and ranges between USD ~ per square per month depending upon the brand name, space, facilities, and tenure of the contract. Nigeria warehousing market was evaluated to grow from USD ~ million in 2013 to USD ~ million in the year 2018 at a compounded annual growth rate (CAGR) of ~% during the period. In 2018, Nigeria has achieved rank 145 in the Ease of Doing Business Index and rank 112 in Logistic Performance Index.

The increasing middle class and urban-educated population have pushed the demand for shopping centers and e-commerce in Lagos in Nigeria. The increasing retail store and supermarkets have increased the warehousing demand in Nigeria. Growing investments in Industrial parks, growing manufacturing units of the banned products for importing are the factors that are even contributing to increased demand for warehouses in the market.

Nigeria Warehousing Market Segmentation

Revenue by End User

The Food and beverage industry has been contributing ~% due to the increasing trade of food products. Increasing automotive industries, the emergence of retail stores, Cold storages for agricultural and pharmaceutical drugs and medicines are increasing warehousing sector.

By Operational Model

The Industrial/Retail segment has contributed ~% with massive revenue in the year 2018. CFS/ICD warehousing contributes ~% in the market. Cold Storage warehousing has increased due to temperature-controlled products for agricultural goods, seafood.

By Contract and Integrated

Contract warehouses contributed ~% in the warehousing market. Small and medium players lease out their warehousing requirements due to the shortage of good quality warehouses and huge capital requirements.

By Type of warehouses:

Open yards and warehouses are less in number in Nigeria and contribute ~% share in the market due to less ICD’s. Closed warehouses include `% of the warehousing market.

By Region:

All the warehouses are situated in and around Lagos only due to the presence of industrial parks and proximity to seaports and airports. It has around ~ warehouses in the country.

Competitive Scenario In Nigeria Warehousing Market

The market is very fragmented and full of small local players in the warehousing market but now the market is being regulated due to the strict regulations by the concerned authorities. Godowns by individual owners and local smaller firms offer third-party services to international players when needed space at a particular location.

Various competition parameters of warehousing effectiveness are the cost of warehousing, area, and capacity, modern technological equipment, CCTV, Security and proximity to the airport, seaport and railways.

MDS Logistics is a local Nigerian player that has recently sprung up in spite of big International players and is involved in providing huge warehousing space and needed facilities to the government.

The warehouses that are near to Lagos are generally charged higher than other places due to its strategic location, trade centralization and the presence of Industrial parks.

Companies Cited in the Report

DHL Global Forwarding

Bollore Transport and logistics

UPS Logistics

MDS Logistics

GMT Logistics

Nigeria Warehousing Future Outlook and Projections, 2018-2023

Nigeria Warehousing market is projected to grow at a CAGR of ~% during the forecast period 2018-2023 owing to the country’s plans to turn itself into the trading and manufacturing hub of Africa.

The revenue from the warehousing market in the country is anticipated to grow from USD ~ million in 2018 to USD ~ million by the year ending 2023. The key growth drivers of the warehousing sector will be the increasing investment in the industrial parks in export promoting zones with the PPP framework. The growing middle-class population and increasing retail stores and supermarkets will increase the demand for warehousing in the future.

The growing pharmaceutical industry and government support to increase agricultural production will increase the demand for cold storage industries in the future. E-commerce players such as Jumia and Konga, in order to reduce their inefficiencies, are expected to increase the demand for outsourced warehouses in the future.

Key Segments Covered:-

Nigeria Warehousing Market

Revenue by Business Model

Industrial/Retail

CFS/ICD

Cold storage and Agriculture

Revenue by Region

Lagos

Kano

Kaduna

Ogun

Nassaraw

Others

Revenue by Type of Warehouses

Open warehouse

Closed warehouse

Revenue by Contract and Integrated warehouses

Contract warehouses

Integrated warehouses

Revenue by End User

Food and Beverages

Automotive

Consumer retail

Health care

Others (Agricultural products and other perishable commodities)

Revenue by Market Structure

Regulated

Unregulated

Companies Covered:-

DHL

Bollore Transport and Logistics

UPS (United Postal Services)

GMT Logistics

MDS logistics

Key Target Audience

Warehousing Companies

3PL Companies

Consultancy Companies

Real estate companies

E-commerce players

Time Period Captured in the Report:-

Historical Period – 2013-2018

Forecast Period – 2019-2023E

Key Topics Covered in the Report:-

Nigeria Warehousing Market Overview

Nigeria Warehousing Market Size

Nigeria Warehousing Market Segmentation

Competitive Scenario in Nigeria Warehousing Market

Company Profiles of Major Players in Nigeria Warehousing Market

Nigeria Warehousing Market Future Outlook and Projections

Nigeria Warehousing Future Market Size

Nigeria Warehousing Market Future Segmentation

Analyst Recommendations on Nigeria Warehousing Market

For More Information, Refer To Below Link:-

Related Reports by Ken Research:-

+91-9015378249