In the ever-evolving landscape of finance, the Banking Market stands at the forefront of change. As technology advances and consumer expectations shift, the banking industry undergoes a remarkable transformation. In this blog post, we will explore key aspects of the banking market, from industry reports and market size to emerging trends and the future of banking.

Banking Industry Reports and Market Size:

To understand the pulse of the banking sector, industry reports and market size data serve as invaluable resources. According to recent reports, the open banking market is experiencing substantial growth, and its size continues to expand globally. In 2024, it is projected that the Net Interest Income in the Banking market worldwide will reach a staggering amount of US$5.8tn. The market is predominantly dominated by Traditional Banks, which are expected to have a projected market volume of US$5.0tn in the same year. As financial institutions embrace openness, collaboration, and innovation, the banking landscape is undergoing a paradigm shift. These reports offer comprehensive insights into the current state of the banking industry, highlighting key metrics and trends that shape its trajectory. Professionals and stakeholders keenly analyze these reports to make informed decisions and stay ahead of the curve.

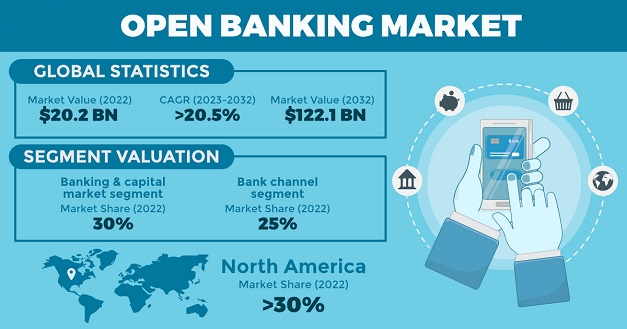

Global Open Banking Market Size:

Open banking, a disruptive force in the financial world, has gained significant momentum. The global open banking market size is a crucial indicator of the industry's shift towards collaboration, innovation, and enhanced customer experiences. As traditional barriers crumble, open banking fosters an ecosystem where data sharing and interoperability drive new opportunities and business models.

Consumer Banking Industry and Mobile Banking Market:

Consumer banking has witnessed a paradigm shift with the rise of mobile banking. The convenience of accessing financial services through smartphones has redefined how consumers interact with banks. Mobile Banking Market Research Reports delve into user behavior, adoption rates, and technological advancements, providing a roadmap for banks to enhance their digital offerings and remain competitive.

Banking Industry Trends and Current Developments:

Staying abreast of banking industry trends is paramount for institutions aiming to adapt and thrive. From embracing digitalization to addressing cybersecurity challenges, the industry is navigating a dynamic landscape. Understanding current trends, such as the integration of artificial intelligence and blockchain, empowers banks to innovate and meet evolving customer expectations.

Data Analysis in Banking Sector:

Data is the lifeblood of the modern banking sector. The ability to harness and analyze data effectively is a game-changer. Data analysis in the banking sector goes beyond mere information processing; it facilitates personalized services, risk management, and strategic decision-making. As data analytics tools become more sophisticated, banks can unlock new insights that drive operational efficiency and customer satisfaction.

The Future of Banking Industry:

Peering into the future, the banking industry is set for continued transformation. Technological advancements, regulatory changes, and shifting consumer preferences will shape the landscape. The future of banking promises a fusion of traditional banking services with cutting-edge technologies, creating an environment where agility and innovation are paramount.

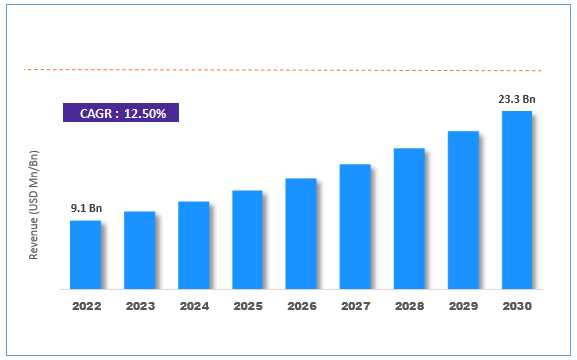

Global Banking Market Size and Sector Research:

The global banking market size encapsulates the vastness and complexity of the industry on a global scale. Sector research reports provide in-depth analyses of regional variations, regulatory landscapes, and emerging markets. Understanding the global dynamics enables banks to tailor strategies that resonate with diverse customer bases and regulatory environments.

Banking Software Market Size and Development:

As technology becomes increasingly integral to banking operations, the banking software market size becomes a key metric. The development in banking industry software plays a pivotal role in enhancing efficiency, security, and customer experience. From core banking systems to innovative fintech solutions, the software landscape is central to the industry's evolution.

Conclusion:

The banking market is a dynamic ecosystem where change is not only constant but also necessary for survival. From leveraging industry reports and analyzing market size to embracing open banking and navigating through evolving trends, banks must proactively adapt to thrive in the ever-evolving landscape. As the future unfolds, the banking sector's ability to innovate, collaborate, and prioritize customer-centric solutions will be the driving force behind its continued success.