How Indonesia Peer-To-Peer Lending Market Is Positioned?

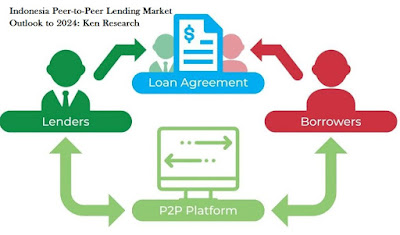

Indonesia Peer-to-Peer lending market was observed to be at a nascent stage since the market was established in 2016 driven by a need to serve the under-banked and underserved businesses and customers in the remote regions of Indonesia. The regulations brought out by the Indonesian Financial Services Authority in 2016 outlined the operational and financial requirements for Peer-to-Peer lending platforms to operate. The market is fragmented with more than 100 platform operators currently registered with the OJK. The improvements in technology and internet connectivity will drive more platforms to establish and reach more customers.

The Indonesia Peer-to-Peer Lending market size has seen major growth since its inception in 2016. The nascent nature of the market, the market has more than doubled every year. The improvement in credit assessment techniques and the use of Artificial Intelligence and Machine learning techniques has driven the increase in borrower base due to more approvals. The Non-performing loans have also been at par with the Indonesian banks and in some cases lower. The number of platform operators has also nearly doubled every year and is poised to grow similarly in the future.

The types of loans disbursed by these platforms are Working Capital loans, Consumptive loans, and Investment loans. Working capital loans occupy the major share for a type of loans since these loans are mostly disbursed to MSMEs. Working capital loans dominate the type of loans disbursed by banks followed by Investment Loans and finally consumptive loans. Peer-to-Peer lending in Indonesia is a recent phenomena. In 2016, Modalku and Crowdo were one of the first companies to obtain regulatory clearance to operate their platforms.

Indonesia Peer-To-Peer Lending Market Overview

The growth in the Peer-to-Peer loan disbursal has seen a large rise in the period 2016-2018. The growth in loan disbursed can be attributed to increasing in mobile phone and internet penetration, two most important infrastructure required to reach the unbanked and underserved businesses and consumers. Working capital loans to SMEs constitute a major share of the total loan disbursed. Historically, due to lack of financial documentation and credit history has left this segment underserved in terms of credit access. The implementation of Big Data analytics and Artificial Intelligence, using non-financial data points such as e-commerce website trends, social media habits among others, by the platform operators provides an alternate method in a credit score Indonesia’s geography poses a significant obstacle for internet and mobile phone penetration as it comprises of more than 17,000 islands across a distance of 5,000 km west to east with unevenly distributed population.

Indonesia Peer-To-Peer Lending Market Segmentation

By Location of Loan Disbursed (Inside Java and Outside Java)

Loan disbursal inside Java was seen to dominate the Peer-to-Peer lending market in Indonesia during 2016-2018, due to the presence of banking system, internet infrastructure and a dominant share of Indonesian GDP. Loans disbursed were dominated by working capital loans. The remaining share was captured by outside Java geography. The growth in loans disbursed inside Java has grown at a CAGR of % in the period 2016-2018 and accounts for % of all loans disbursed by Peer-to-Peer lenders in Indonesia. The total loans disbursed inside Java was IDR Billion in 2018.

The growth in loans disbursed outside Java has grown at a CAGR of % in the period 2016-2018 and accounts for % of all loans disbursed by Peer-to-Peer lenders in Indonesia. The total loans disbursed outside Java was IDR Billion in 2018.

Comparative Landscape in Indonesia Peer-To-Peer Lending Market

The Peer-to-Peer lending market in Indonesia was observed to be highly fragmented with the presence of a few international players from countries like China, Malaysia, and Singapore. It is relatively easier to enter into the Indonesian market as OJK has laid out guidelines to establish and operate. OJK also tests the operational reliability of the platforms for fraud susceptibility and platform failures due to technology. Investree, Modalku, and Koinworks were one of the first companies to gain OJK license and operate in Indonesia. Platforms compete with each other on parameters such as total loans disbursed, loans outstanding, Non-performing loans and borrower and lenders registered on their platforms.

Indonesia Peer-To-Peer Lending Market Future Outlook and Projections

Over the forecast period 2019-2024, the market is estimated to continue growing in terms of loans disbursed and a number of borrowers and lenders participating in the market. The market is expected to grow on the back of improved internet and mobile phone infrastructure. Adoption of digital services on the back of increased e-commerce activities will invite more borrowers and lenders. More platforms are expected to start operations outside of the Java region as the majority of the underserved businesses lie here. Partnerships between various entities involved in the market ecosystem will also increase data sharing and improvement in product and service offering of these entities.

Key Segments Covered:-

By Location of Loan Disbursed

Inside Java

Outside Java

Key Target Audience

Existing Peer-to-Peer Lending Platforms

New Market Entrants- Domestic Platforms

New Market Entrants- International Platforms

Banks and Financial Institutions

Government Bodies

Investors & Venture Capital Firms

Third Party Technology Providers

MSMEs and E-commerce Sellers

Time Period Captured in the Report:-

Historical Period: 2016 -2018

Forecast Period: 2019-2024

Companies Covered:-

Investree

Modalku

Koinworks

Danamas

Mekar

Crowde

Crowdo

Akseleran

Aktivaku

Amartha

Keywords:-

Government Bodies P2P Market Indonesia

Third Party Technology Providers in P2P Market

Peer to Peer Lending Market in Indonesia

Indonesia P2P Lending Industry

Number of Lenders Registered Indonesia P2P Market

Interest Rate Indonesia P2P Lending Market

Indonesia Long Term Interest Rate

Indonesia Peer to Peer Lending Market Platforms

Indonesia Peer to Peer Lending Regulations

Indonesia SME Financing Market

Peer to Peer Lending Market Indonesia

To Know More, Click On The Link Below:-

Related Reports by Ken Research:-

+91-9015378249