How Is The Philippines Frozen Storage Market Positioned?

During the 1980s till 2002, Philippines frozen storage industry was considered to be in its nascent or emerging phase. Owing to the geographical location, the country experiences a high average annual temperature ranging from +21C to +32C. This results in high demand for low-temperature control services including cold and frozen storage pallets. However, during this phase, there was an acute shortage of cold chain solutions especially in rural areas which augmented the demand in this industry. On the contrary, the market also faces challenges of high maintenance costs indicating a dire need for government and private initiatives to instill momentum in the sector. The year 2002 witnessed the formation of the Cold Chain Association of the Philippines, commonly referred to as CCAP with over 100 logistics and construction companies as its members.

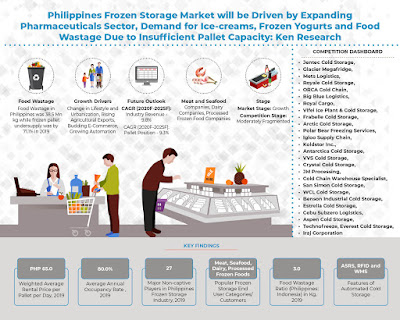

Consequently, initiatives such as the Philippines National Cold Chain Program launched in 2004 by USDA Food for Progress, Philippine Nautical Highway System and introduction of the RORO system in 2015 also propelled the frozen industry of the country. Presently, the market is in its growth stage and has constantly risen to owing to factors such as increasing demand for frozen transport and blast freezer services, an increase in per capita income and growing consumer preference for fast food products. Budding e-commerce business and online grocery shopping have also positively impacted the frozen storage business.

What Is the Philippines Frozen Storage Demand Side Analysis?

To assess the demand for frozen pallets in the Philippines, our team compared the Philippine market with the Indonesia market including frozen food production and imports estimating the amount at ~ million tons and ~ million tons during 2019 for the Philippines and Indonesia respectively. Thus, for the number of pallet positions per ton to be at par between the Philippines and Indonesia, the Philippines should have ~ pallet positions, implying a shortage of around ~ pallets. Moreover, since the Philippines have ~ times higher food wastage than Indonesia, the additional pallet position required in the Philippines was around ~ pallets in 2019.

What Is The Demand-Supply Gap For Frozen Storage Pallets In the Philippines?

The Philippines required additional ~ pallet positions to meet the frozen food consumption requirement accounting for food wastage. In the next five years till 2025, we are anticipating this gap to be reduced to approximately ~ pallet positions as various players complete their respective expansion projects.

What Is The Scenario Of Food Wastage In Southeast Asian Nations?

As per Ken Research Analysis, the Philippines have the highest food wastage in Southeast Asia. The increasing population in the region, especially the Philippines is anticipated to augment the demand for food and beverages requiring cold storage. Cold chain sector is projected to require increasing initiatives, including investments by both the government and private sector to overcome challenges of food wastage as the shortage of cold storage pallets is a key contributor to this wastage.

According to the Journal of Developments in Sustainable Agriculture 11, Institute of Food Science and Technology, substantial post-harvest losses of up to ~% were recorded from the initial harvesting, grading, packaging, and transportation from field to storage and distribution to the consumers in the Philippines. The cold chain system allows the transfer of agricultural produce from farm to market at controlled temperature and relative humidity. Most growers in the Philippines lack farm to cold storage facilities. Thus, perishable produce is often left in the open or kept under ambient temperature conditions.

What Is The Scenario Of Competition In the Philippines Frozen Storage Market?

There are estimated ~ non-captive players that provide accredited freezer services with a temperature range of -10C to -40C to clients in the Philippines. The market is presently in the growth stage and expected to only get more fragmented by 2025. Major players in the Philippines Frozen Storage Market include Jentec Cold Storage, Glacier Megafridge, Mets Logistics, Royale Cold Storage and ORCA Cold storage which account for approx. ~% of market share by pallet position. Level of automation, level of certification, provision of blast freezers, provision of cold transport, and location of cold storage warehouses, high pallet capacity and price per pallet per day are a few key competing factors among these major players.

What Is The Future Outlook Of Philippines Frozen Storage Market?

Philippines frozen storage market is expected to register a positive CAGR of ~% over the forecast period 2019-2025. The key contributing factors for such high growth include mounting of foodservice industry owing to change in lifestyle and consumption habits, increasing infrastructure investment to improve connectivity for cold transport business, high domestic demand for fish and seafood products, rising ISO and LEED certifications, growing meat consumption and rise in the level of competition. The increasing competition in the industry will result in a significant price drop by the year 2025.

Key Segments Covered:-

Types of Products:

Meat and Seafood

Dairy Products

Vaccination and Pharmaceuticals

Fruits and Vegetables

Processed Frozen Products

Key Target Audience

Cold Storage Companies

Frozen Storage Companies

Captive Cold Storage Companies

Captive Frozen Storage Companies

Logistics Companies

Non-captive Companies

Cold Chain Associations

Logistics Associations

Private Equity Firms

Venture Capitalists

Time Period Captured in the Report:

Historical Period: 2019

Forecast Period: 2020F-2025F

Companies Covered:

Jentec Cold Storage

Glacier Megafridge

Mets Logistics

Royale Cold Storage

ORCA Cold Chain

Big Blue Logistics

Royal Cargo

Vifel Ice Plant & Cold Storage

Frabelle Cold Storage

Arctic Cold Storage

Polar Bear Freezing Services

Igloo Supply Chain

Koldstor Inc.

Antarctica Cold Storage

VVS Cold Storage

Crystal Cold Storage

JM Processing

Cold Chain Warehouse Specialist

San Simon Cold Storage

WCL Cold Storage

Benson Industrial Cold Storage

Estrella Cold Storage

Cebu Subzero Logistics

Aspen Cold Storage

Technofreeze

Everest Cold Storage

Iraj Corporation

Key Topics Covered in the Report:-

Benson Industrial Cold Storage Market Size

Cold Storage industry in Southeast Asia

Cold Storage Market in APAC

Logistics Companies in Philippines

Philippines Dairy Products Market Analysis

Philippines Ready to Meals Market Size in PHP Billion

Philippines Restaurants Market Growth Rate

Philippines Weighted Average Rental Price

Production of Poultry in Philippines in Thousand metric Tons

Refrigerants Used for Cold Storage of Meat in Philippines

Temperature Controlled Storage in Philippines

Vegetables Blast Freezer Market Philippines

For More Information on the research report, refer to below links:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249