Buy Now

The report titled “Philippines Used Car Market Outlook To 2025: The Pandemic Incited Increased Demand for Used Cars coupled with Increased Internet Penetration provides for Resilience in the Used Cars Market during the Economic Crisis”- provides a comprehensive analysis of the used car market trends and performance in the Philippines. The report covers several aspects such as volume of used cars sold & market size in terms of gross transaction value, target audience, growth facilitators, Government regulations, constraints & challenges faced by the industry, and so on. The report also covers a snapshot of the Philippines online used car market, business models, value chain analysis, SWOT analysis, buying decision parameters, competitive scenario, and company profiles. Philippines Used Car Industry report concludes with projections for the future of the industry market size, market segmentation, the impact of Covid-19, and analyst take on the future market scenario.

Philippines Used Car Market Overview and Size:

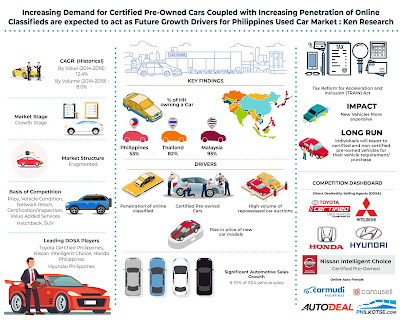

Philippines Used Car market is in its growth phase, having grown at a CAGR of 7.4% (by value in PHP Billion) during 2015-2020. A surge in the demand of private cars, coupled with convenient financing facilities, increasing per capita income, increased internet penetration and enhanced digitalization of the used car's space have been the salient factors leading to the growth of the used cars market in the Philippines.

Philippines Used Car Market Segmentations

By Market Structure (Unorganized, and Organized): The used car market in Philippines is primarily dominated by the unorganized segment occupying ~55% of the overall used cars market space. Most of the organized players operate in the Metro Manila region.

By Sales channel (B2C- Multi-brand Dealers, DDSAs, and Bank Repossessed Car Auctions): The used cars in the organized B2C market of Philippines are primarily sold via three channels- multi-brand dealers, Direct Dealership ales Agents, and Banks’s auctioning repossessed cars. The major share of the Philippines Used Car organized market is captured by the Multi-Brand dealers. On the other hand, volume of cars sold through Bank Repossessed and Direct Dealership Sales Agents is ~10% in the year 2020.

By Source of Lead generation (Online, Dealership walk-ins): In Philippines, the Used Car market has carved a niche in the online space. More than 4/5ths of the lead generation for used cars in the organized segment happened via the online platforms. The DDSAs (OEMs) have their own websites, and pages on social media, whereas several multi-brand dealers prefer listing their inventory on the classified platforms as well. Facebook is gaining traction as an online space for buying and selling used cars in the Philippines.

By Type of Car: Sedans and SUVs are quite popular in the Philippines. Since the terrain of the country is generally rugged (especially in the Northern Luzon area), the demand for light commercial vehicles such as SUVs and MPVs is quite high. Pickup trucks are also a popular light commercial vehicle type preferred in Philippines.

By Price: The price range of PHP 300k to 500k accounted for the highest percentage share of used cars sold in Philippines in 2020. Sedans are a widely demanded car type in the country and generally the Sedan used cars fall in this particular price range.

By Brand: Toyota is the market leader in Philippine’s accounting for the major share of sale of used cars by volume. Japanese brands such as Toyota, Honda, Nissan, Mitsubishi, and others, are the most preferred due to strong brand preference, reliability, longer life span, and higher retention value of the used vehicle.

By Region: Most of the used car’s market is concentrated in the NCR (Metro Manila) region. Since, it is the most economically developed region in the Philippines, the average age of replacement of cars is quite low, leading to more used cars availability in the area.

By Ownership Period: Generally, any new car in Philippines is owned for 4-6 years before it sold off. Therefore, the average age of used cars in the country also lies within the same bracket.

By Kilometers Driven: Since the average age of a used car in the Philippines is ~5 years and the average mileage of a used car happens to be approximately 50,000 kilometers. Therefore, cars with a mileage of 40,000-60,000 kilometers dominate the used cars market in Philippines in the year 2020.

By Fuel: Gasoline and diesel are the majorly preferred types of fuel in the country. The adoption of electric vehicles is at a very nascent stage accounting less than 1% share in the overall Philippines used car market currently.

Snapshot on Online Used Car Landscape

The online Used Car Market has been gaining traction in the last few years. There has been an immense expansion in the lead generation of used cars via the online means in the last decade. Facebook plays a key role in expanding the used cars market in Philippines. Emergence of online auto-portals and classified platforms such as Carousell, Carmudi, AutoDeal, Philkotse, Automart, etc., have provided increased visibility and credibility to the customer-to-customer transactions in the unorganized segment. The increasing internet penetration of the used cars market in the country is contributing positively to the growth of the industry.

Competitive Landscape of Philippines Used Car Market

There exists intense competition in the highly fragmented market with various OEM certified, brand authorized dealerships, multi-brand outlets & independent (standalone as well as clustered dealers) operating in the industry. While the banks also fall under the B2C organized segment, they do not exhibit any competitive characteristics as their sole purpose of auctioning the repossessed cars is to recover the losses incurred due to the delinquency of the borrowers. In order to compete with OEM certified cars, certain multi-brand dealers have started providing value added services in order to retain and expand their market share. However, the segment remains quite unexploited as not many dealers are currently providing any value-added services.

Philippines Used Car Future Outlook & Projections

The used car industry in Philippines is expected to demonstrate a decent growth in the future. It is expected to increase at a five-year CAGR of 8.9% (by value in PHP Billion) from 2020 to 2025E. It is expected that the share of the organized segment in the used cars space will increase over time as more brands are planning to enter the OEM pre-owned certified space. Certain foreign established C2B players are too considering Philippines Used Car market a growing and profitable venture. Moreover, people in Philippines are realizing the advantages of buying a pre-owned car and there has been a shift in the general consumer preferences.

Key Segments Covered: -

By Market Structure

Organized

Unorganized

By Sales Channel

Multi-brand Dealers

Direct Dealership Sales Agents

Bank Auctions

C2C (Customer to Customer) Transactions

By Source of Lead generation

Online

Dealership walk-ins

By Car Segment

Sedan

Hatchback

SUV

MPV

Pickup Vans

Others (convertibles, coupe, crossover, sports vehicles, and many more)

By Price

Less than PHP 100,000

PHP 100,000-300,000

PHP 300,000-500,000

PHP 500,000-700,000

PHP 700,000-1,000,000

More than PHP 1,000,000

By Brand

Toyota

Mitsubishi

Hyundai

Ford

Nissan

Honda

Isuzu

Suzuki

Others (Kia, Mazda, Mercedes, Audi, and many more)

By Region

Metro Manila

Northern Luzon

Southern Luzon (except Metro Manila)

Visayas

Mindanao

By Ownership period

Less than 2 years

2-4 years

4-6 years

6-8 years

More than 8 years

By Mileage

Less than 10,000 Kms

10,000-20,000 Kms

20,000-50,000 Kms

50,000-75,000 Kms

75,000-100,000 Kms

Above 100,000 Kms

By Fuel

Petrol

Diesel

Others (Hybrid and Electric)

Companies Covered

OEM Dealerships

Toyota Certified

Nissan Intelligent Choice

BMW Premium Selection

Mercedes Benz Certified Pre-owned

Banks (Repossessed Car Auctions)

EastWest Bank

Security Bank

BDO Unibank

Online Portals – Online Auto Classified Platforms

Carmudi

Carousell

AutoDeal

Automart

Zigwheels

Philkotse

Multi-Brand Dealers

Carmax

Carmix (by Lausgroup)

Automobilico

All Cars

Five Aces

Berylle Car Sales

Time Period Captured in the Report: -

Historical Period – 2015-2020

Forecast Period – 2021-2025

Key Topics Covered in the Report

Philippines Used Car Market Overview

Philippines Used Car Market Size, 2015-2020

Philippines Used Car Market Segmentation, 2020

Growth Drivers in Philippines Used Car Market

Issues and Challenges in Philippines Used Car Market

Government Regulations

Ecosystem and Value Chain of Used Car Industry in Philippines

Customers Purchase Decision Making Parameters

Cross Comparison between Major OEMs and Multi-brand Dealers and Company Profiles & Product Portfolios

Snapshot on Online used car market

Future Market Size and Segmentations, 2020-2025E

Covid-19 Impact on the Industry & the way forward

Pricing Analysis (By Age, Mileage, Brand and Car type)

Depreciation Calculation Tool

Analyst Recommendations

For More Information on the research report, refer to below link: -

Philippines Used Car Market Future Growth

Related Reports by Ken Research: -

Indonesia Used Car Market Outlook To 2025 – By Market Structure (Organized & Unorganized), By Type Of Car (MPVs, Hatchbacks, SUVs & Others), By Brand (Toyota, Honda, Daihatsu, Suzuki & Others), By Vehicle Age, By Mileage, By Customer Age And By Region (DKI Jakarta, East Java, West & Central Java, North Sumatera & Others)”

Saudi Arabia Used Car Market Outlook To 2025- By Market Structure (Organized & Unorganized), By Type Of Car (Sedans & Hatchbacks, SUVs & Crossovers, Pick-Ups And Luxury), By Brand (Toyota, Hyundai, GMC & Chevrolet, Ford And Others), By Type Of Sourcing, By Age Of Vehicle (Less Than 1 Year, 1-3 Years, 3-5 Years & More Than 5 Years), By Kilometers Driven (Less Than 50,000 Km, 50,000-80,000 Km, 80,000-120,000 Km & More Than 120,000 Km) And By Region (Northern, Southern, Central, Eastern And Western)”

Philippines Auto Finance Market Outlook To 2024- Growing Prominence Of Captive Finance And Surge In Used Car Sales Supporting Disbursement For Auto Loans”

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249