In the dynamic landscape of the financial industry, the retail banking sector stands as a crucial pillar, catering to the diverse financial needs of individuals and households. This blog will delve into the depths of the retail banking market, exploring its current state, future prospects, and the key trends shaping its trajectory.

Retail Banking Market Share and Industry Size:

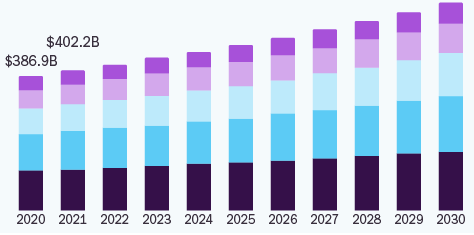

Market share within the retail banking sector is a crucial metric, reflecting the competitive positioning of various players. According to the latest research, the global Retail Banking market size was valued at USD 6561.6 million in 2022 and is expected to expand at a CAGR of 10.88% during the forecast period, reaching USD 12196.8 million by 2028. As traditional banks vie for market share, newer entrants disrupt the status quo, intensifying competition. The industry size, on the other hand, is influenced by macroeconomic factors, regulatory changes, and the overall health of the global economy.

Understanding the Retail Banking Sector:

The retail banking sector, a cornerstone of the broader financial services industry, focuses on serving the financial needs of individuals and small businesses. This segment encompasses a range of services, from traditional savings and checking accounts to loans, mortgages, and investment products. The retail banking market plays a pivotal role in driving economic growth by facilitating financial inclusion and providing a foundation for personal and entrepreneurial endeavors.

Retail Banking Market Size and Scope:

The retail banking market has witnessed significant growth in recent years, with its size expanding globally. A closer look at the global retail banking market size reveals a robust ecosystem that continues to evolve in response to technological advancements, changing consumer preferences, and regulatory dynamics. Underlining its substantial contribution to the financial services sector.

Future of Retail Banking:

The future of retail banking appears to be intricately woven with technological innovations, digital transformations, and an unwavering commitment to customer-centricity. With the rise of fintech disruptors and the increasing prevalence of digital channels, traditional retail banks are compelled to adapt and innovate. Mobile banking, artificial intelligence, and blockchain technologies are expected to play pivotal roles in shaping the future landscape of the retail banking industry.

Global Retail Banking Market Trends:

Several trends are steering the course of the retail banking industry. The adoption of digital banking platforms, enhanced data analytics for personalized services, and the integration of artificial intelligence in customer interactions are among the prominent trends. Moreover, sustainability and ethical banking practices are gaining momentum, reflecting the growing awareness and preferences of consumers for socially responsible financial institutions.

Retail Banking Market Analysis:

A comprehensive retail banking market analysis unveils the competitive landscape, regulatory challenges, and emerging opportunities. Financial institutions are investing in technology to streamline operations, reduce costs, and enhance the overall customer experience. Collaboration between traditional banks and fintech entities is becoming increasingly common, fostering a synergistic approach to innovation and service delivery.

Conclusion:

The retail banking market is at a crossroads, navigating through the currents of change driven by technology, consumer behavior, and global dynamics. As we look ahead, the industry's resilience and adaptability will determine its success in meeting the evolving needs of customers. Keeping a keen eye on trends, market analysis, and collaborative opportunities will be key for players in the retail banking sector to thrive in this ever-evolving landscape.