VR Gaming centers, trampoline parks, bowling alleys, and family entertainment centers are expected to see greater footfall as these destinations will be spread across major cities across Saudi Arabia.

- The percentage of household expenditure spent on leisure and entertainment is expected to rise from 2.9% in 2019 to 6% by 2025, which is forecasted to drive the establishment of entertainment destinations.

- Saudi Arabia is divided into 3 large cities, 3 medium cities, and 7 small cities. Amusement Parks and Family Entertainment Centres are expected to be established in these cities in corresponding sizes bringing the total FECs to nearly 66 by 2030.

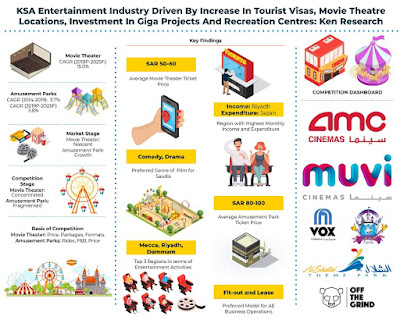

- 7 movie theatre chains have received operating licenses as of January 2020, while only three chains are operations as of December 2019. The number of movie theatres operational by the end of 2025 is expected to cross 60.

Growth in Retail Real Estate Industry: Retail real estate includes the development of regional and super-regional malls, community centers, and entertainment destinations among others. The growth in the supply of retail real estate is expected to grow by 9.8% CAGR and the occupancy rate is expected to average 92% for the period 2019-2025. With 100% FDI allowed in retail real estate since 2016, foreign entities can find favorable investment terms additionally for entertainment-related destinations such as movie theaters, gaming centers, FECs, and mini amusement parks among others

.

A growing need for Partnerships within the Movie Theater Ecosystem: Movie theater industries are expected to hedge their entry into the Saudi Arabian movie theater market with some sort of partnerships within the movie ecosystem including advertising rights sellers, movie distribution companies, and business groups with existing licenses in Saudi Arabia and screen format providers. Such partnerships are expected to drive entry into the movie theater industry. For instance, Indian theater chain PVR and UAE Majid Al Futtaim have signed an MoU for entry into Saudi Arabia and other regional markets.

The report titled “Saudi Arabia Leisure and Entertainment Market Outlook to 2025 – Movie Theater Market by Revenue (Ticket Admissions, Food and Beverage Sales, Advertisements and Sponsorships), Amusement Park Industry (Ticket Admissions, Food and Beverage, Merchandise, Games and Others(Parking, Sponsorships and Royalty)) and Alternate Entertainment Avenues (VR Gaming, Bowling Alley and Trampoline Parks)” by Ken Research suggests that household expenditure on leisure and entertainment is expected to drive the market in terms of revenue for the forecast period 2019-2025. The Saudi government’s Vision 2030 is expected to favor investors looking to establish entertainment destinations in terms of ownership, return on equity, payback period and funding assistance among others. The movie theater and amusement park markets are expected to grow at a CAGR of 15% and ~6% respectively for the forecast period 2019-2025.

Key Segments Covered: -

Movie Theater Market

Ticket Admissions

Food and Beverages

Advertisements and Sponsorships

Amusement Park Market

Ticket Admissions

Food and Beverages

Merchandise

Games

Others (Parking, Royalty and Sponsorships)

Alternate Entertainment Investment

VR Gaming Center

Bowling Alley

Trampoline Parks

Key Target Audience

Movie Theater Companies

Film Distribution Companies

Screen Format Companies (IMAX, 4D, 4DX)

Government Entities

Amusement Park Operators and Chains

Real Estate Developers

Mall Operators and Groups

Time Period Captured in the Report:

Historical Period – 2014-2019

Forecast Period – 2019-2025

Companies Covered in Report:

AMC Theaters

VOX Cinemas

MUVI Cinemas

Al Hokair Group

Al Shallal Theme Park

Off the Grind

Emirates Bowling Alley

BOUNCE Trampoline Park, Jeddah

Key Topics Covered in the Report: -

Saudi Arabia VR Gaming Revenue

Movie Theater Investment Saudi Arabia

MUVI Cinemas Sales Revenue

AMC Theatres Revenue Saudi Arabia

entertainment policy of Saudi Arabia

Saudi Arabia entertainment ventures

Media and Entertainment Industry in Saudi Arabia

Tourism, leisure and Entertainment in Saudi Arabia

Funding Model for Amusement Parks in KSA

Theme and Water Parks in Saudi Arabia

Number of Hajj Pilgrims in Thousands KSA

Saudi Arabia Theme Park Industry,

Tourism and entertainment in Saudi Arabia

For More Information on the research report, refer to below link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249