“Growth in the E-commerce sector and increasing demand for Industrial and Retail warehousing has driven the Warehousing market in Saudi Arabia”

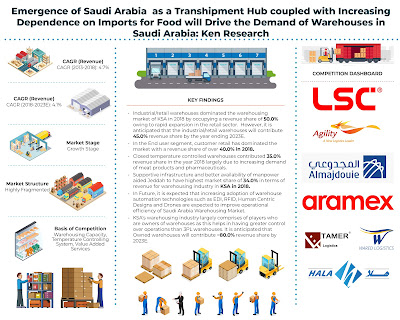

The report titled “Saudi Arabia Warehousing Market Outlook to 2023 - By Business Model (Industrial/Retail, Container Freight/Inland Container Depot and Cold Storage), By End Users (Consumer Retail, Food and Beverages, Healthcare, Automotive and Others) and E-Commerce Warehouses” believe that the warehousing market in Saudi Arabia has been increasing largely due to growth in the retail sector, an increase in manufacturing activity in the country and expansion in international trade. The market is expected to register a positive CAGR of 4.1% in terms of revenue during the forecasted period 2018-2023E.

Emergence as a Transhipment Hub: Saudi Ports Authority signed a long-term memorandum-of-understanding (MoU) with Saudi Industrial Services Co (SISCO) to expand Red Sea Gateway Terminal (RSGT) at Jeddah Islamic Port (JIP) which will bolster the aim of turning Jeddah into a transhipment hub for the Middle East. Saudi Arabia has emerged as a transhipment hub for goods which will increase customer’s demand for modern warehouse solutions at cheaper costs in the country.

Rising Foreign Direct Investment: The country undertook economic diversification and opened doors to industrial, retail and logistics players by allowing 100.0% FDI ownership in the year 2018. Majority of the international players who are seeking industrial premises in the kingdom requires large warehousing space however, owing to a limited supply of state-of-the-art warehousing facilities; they prefer leasing land and constructing facilities in accordance with their needs and preferences. In addition, the increasing digitization is paving way for automated warehousing technologies, ASRS and several other advanced techniques of warehousing in the country.

Rising Number of Logistics Players: The growing logistics market of Saudi Arabia is simultaneously witnessing an increasing number of new players and existing players expanding their current level of operations. For instance, Wared Logistics has started the first of a series of temperature controlled warehouses mid-2012. Also, the logistics chain of UAE, Al Futtaim began with the operations of its second warehousing facility in Riyadh in July 2018, by scaling up the local distribution centre with the total warehousing space of 15,000 Sqm.

Key Segments Covered:-

By Business Model

Industrial/Retail

Cold Storage

Container Freight/Inland Container Depot

By Type of Warehouses

Closed Temperature Controlled Warehouses

Closed Non-Temperature Controlled Warehouses

Cold Storage

Open Yards

By End Users

Consumer Retail

Food and Beverages

Healthcare

Automotive

Others

By Cities

Jeddah

Riyadh

Dammam

Others

By Ownership

Owned Warehouse

Third Party Logistics (3PL) Warehouses

Key Target Audience

Warehouse Companies

Logistics Companies

Trading Companies

Real Estate Companies

Construction Companies

Time Period Captured in the Report:-

Historical Period: 2013-2018

Forecast Period: 2018-2023

Companies Covered:-

LSC Logistics

Agility Logistics

Almajdouie Logistics

Mosanada Logistics

Tamer Logistics

BAFCO International Logistics and Shipping

Hala Supply Chain Services

United Warehouse Company Limited

Wared Logistics

Takhzeen Logistics

Etmam Logistics (Shahini Group)

Aramex

Khaden Logistic

Panda Retail Company

Keywords:-

Saudi Arabia Warehousing End Users Market

Saudi Arabia Warehousing Industry Services

Owned Warehouses Market Saudi Arabia

3PL Warehouses Saudi Arabia

3PL Services in Saudi Arabia

Third Party Logistics Companies Saudi Arabia

Saudi Arabia Business Model Warehouses

Saudi Arabia Industrial Warehouses Market

Saudi Arabia Retail Warehouses Market

Saudi Arabia Warehouse Robotics Market

Riyadh Warehouse Market Size

Dammam Warehouse Market Revenue

Saudi Arabia LSC Logistic Services Market

Saudi Arabia Agility Logistics Market

Saudi Arabia Almajdouie Logistic Market

Saudi Arabia Mosanada Logistics Services

Saudi Arabia Warehousing Industry Trends

Saudi Arabia Warehousing Market Projections

For more information, refer to below link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249