How Africa Freight Forwarding Market Evolved?

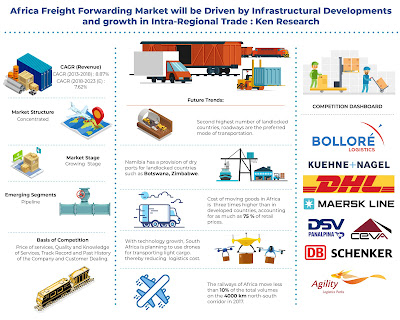

The Africa Freight Forwarding Market contributes most to the logistics market of the continent owning to a total of ~ percentage of the total revenue of the market. However, Africa is lacking behind with respect to the standards of infrastructure present. The intra-regional trade is extremely poor and efforts have been made to improve the same. In 2017 Intra-African trade contributed to only 16.6% of the total exports in 2017 as compared to 68.1% in Europe, 59.4% in Asia and 55% in America.

The market size of the freight forwarding market has increased from USD ~ Billion in 2013 to USD ~Billion in 2018. With the help of the African Continental Free Trade Area there comes to an establishment of a single continental market for goods and services which seeks to increase intra-African trade by cutting tariffs by 90% and harmonizing trading rules at a regional and continental level. If the trade agreement turns out to be successful the intra-African trade is expected to boost by 52.3% by 2022. Plans exist for a high-speed rail network that would connect the border of the continent by 2063.

The standards of infrastructure have proven as a hurdle to the growth of the freight forwarding market in Africa. The intraregional disparities and logistics cost has been high. The companies in East Africa find it relatively easy to establish themselves as compared to West Africa due to government regulations. For the East African Community, the logistics cost ranges between 1.7% and 2.8% of the GDP of those economies. It has also been estimated that a 10% drop in the logistics costs could help increase trade by 25% across the continent.

Africa Freight Forwarding Market and Segmentation

By Mode of Freight

Road transportation dominates the freight forwarding market with a share in an overall market revenue of ~%. Having a very large number of landlocked countries, multimodal transportation plays an important role in bringing cargo from ports to various countries. The pipeline services are still at a growing stage and are expected to grow by ~% with the introduction of pipelines in more countries

By End Users

The major end-users of freight forwarding services in Africa include the Food and Beverage, FMCG and Industrial sectors with a share of ~%, ~%, and ~% respectively. Currently, food dominates the African consumers’ spending which is only expected to change once there is an increase in the levels of income for the people.

By Contract and Integrated Logistics

Without contract logistics, the supply chain would be non-existent in Africa. In urban areas, the traditional model of utilizing delivery trucks and contracting other players for supplying large retailers is used.

Africa Freight Forwarding Market Future Outlook and Projections

E-commerce expected to gain pace in the future and push the logistics market. For logistics companies prospects in the retail and manufacturing sectors are also significant and lead from a period of sustained growth experienced by many African countries. With the abundance of oil in the continent, a number of projects have been going on in different African countries such as Kenya, Uganda, and Botswana which are expected to be completed.

Botswana Freight Forwarding Market and Segmentation

By Mode of Freight

Botswana being a landlocked country uses the road for most of the transportation of goods accounting for a share in the overall market revenue of ~%. The road network leads to boarders with major trading partners in SADC like Namibia, South Africa and Zimbabwe the country is a major exporter of beef, mainly to the EU. The pipeline services are still in its nascent stage.

By Type of Freight

The international freight dominates the freight forwarding market of Botswana. Botswana is the largest producer of gem diamonds which account for 70% of export by value in 2017. For domestic freight, the Trans-Kalahari Corridor is a paved highway corridor that provides a direct route from Walvis Bay and Windhoek in central Namibia, through Botswana, to Pretoria.

By Contract and Integrated

Being a landlocked country and having a large proportion of its cargo coming by sea multi-modal transportation is used extensively. It is for the same reason that most existing logistics players in the market prefer to outsource their services to players who are able to provide these services efficiently and at a low cost.

Competitive Scenario in Botswana Freight Forwarding Market

Being a landlocked country most of the freight forwarding companies have tried to indulge themselves in multimodal transportation. The market for road freight has a number of players increasing the level of competition. With high competition, the smaller companies are facing a problem sustaining and a number of mergers have been taking place at the local level. The air freight market, however, is less competitive having only a few major players. Globalization of supply chains, the steady growth of e-commerce and technological innovations have changed the structure of the logistics market. To remain competitive in the evolving market, logistics providers are exploring new innovations and technologies to streamline their operations.

Botswana Freight Forwarding Market Future Outlook and Projections

The freight forwarding market of the country is expected to grow till 2023 with a CAGR of ~%. This is substantiated by the development programs which have been developed by the government have a completion date of 2021 such as the Mmamabula-Lephalale railway line. The dry ports which are present at Namibia are also being further worked upon which will push the market for Botswana.

Namibia Freight Forwarding Market Segmentation

By Mode of Freight

The road freight accounts for about 60-70% of the cargo in terms of volume that is transported in the country and earns revenue of USD ~ million towards the freight forwarding market. Its port Walvis Bay is the country’s largest commercial port and behaves as a link to the multimodal transport corridors to the local, southern and landlocked countries. There are mainly three corridors that connect the Walvis Bay with other SADC countries in Africa. They include Walvis Bay-Ndola-Lubumbashi Development Corridor, the Trans-Cunene Corridor, and the Trans-Kalahari Corridor.

By Type of Freight

The international freight dominates the freight forwarding market with a revenue percentage share of ~%. The United States is the major trading partner for Namibia; however, the majority of the imports are coming from South Africa into the country.

By Contract and Integrated Logistics

The freight forwarding players in Namibia believe that with the help of contract logistics the cost of the supply chain management will be reduced and they would be able to operate more efficiently. While developments were ongoing, on the shipping lines in the ports of Namibia, the players preferred to outsource their logistics projects as there were a lot of delays caused in transported the cargo from one place to another.

Competitive Scenario in Namibia Freight Forwarding Market

The sea freight companies in the country are dominated over by a few major international players. There are local players but they only cater to the county and not to the landlocked countries which have their dry ports in Namibia. The Namibia University of Science and Technology provides logistics courses and there have been a number of recent developments to stress on the courses in order to solve the issue of inadequate human resources for logistics in the country. The road freight market of Namibia is highly fragmented with a number of players holding a significant market share.

Namibia Freight Forwarding Market Future Outlook and Projections

The market is expected to see a CAGR growth of ~% from 2018- 2023 (E). The country has a master plan of becoming the logistics hub for the SADC countries by 2025. The plan mainly focuses on low land prices, an increase in volumes being served, meeting international standards of infrastructure and the removal of critical bottlenecks in key corridors. Unlike Durban port (RSA) and Dar es Salaam port (Tanzania) with their long history of acting as major gateways, Walvis Bay port (Namibia) has not been fully used and is yet to be regarded as a substantial gateway to the landlocked areas.

Key Segments Covered:-

By Mode of Service ((Road Freight, Rail Freight, and Air Freight, Revenue and Freight Volume, Cost, Major Flow Corridors)

By Contract and Integrated Logistics

By End Users (Food, Beverages and Consumer Retail, Automotive and Healthcare and Others)

Companies Covered

Africa

Bollore Africa Logistics

Kuehne Nagel

DHL

Maersk

DSV Panalpine

CEVA Logistics

DB Schenker

South Africa

Imperial Logistics

Onelogix

Santavo Limited

DB Schenker

ID Logistics

DSV-Global Transport and Logistics

Kenya

DHL

Kuehne Nagel

Panalpina

CEVA Logistics

DB Schenker

Maersk Line

Agility Logistics

FedEx

Tanzania (Competitive Landscape)

Alistair

MeTL

Maersk Line

CMA CGM

Uganda

Bollore Transport and Logistics

Spedag Interfreight

Maersk Uganda Limited

Kenfreight Uganda Limited

CMA CGM Uganda

Union Logistics Uganda Limited

Nigeria

DHL

BHN Logistics

Bollore Africa Logistics

ABC Transport

United Postal Services

Red Star

Maersk

Mediterranean Shipping Company (MSC)

TSL Logistics

Namibia (Competitive Landscape)

A Van der Walk

TransNamib

DB Schenker

Pacific International Lines

Pronto Air and Ocean Freight

Woker Freight Service

Botswana (Competitive Landscape)

Transport Holding

Bollore

Seabelo Carriers

Country Profiles

South Africa

Kenya

Tanzania

Uganda

Nigeria

Namibia

Botswana

Key Target Audience

Freight Forwarding Companies

Freight Forwarding Consultancy Companies

Contact Logistics Companies

Venture Capitalists, PE

Freight Tech Companies

Consulting Companies

Investment Banks

Time Period Captured in the Report:-

Historical Period – 2013-2018

Forecast Period – 2019 -2023

Key Topics Covered in the Report:-

Africa Freight Forwarding Industry

Africa Freight Forwarding Market Size

Africa Freight Forwarding Charges

South Africa Freight forwarding Market

Bollore Freight Volume Africa

Air Freight Volume Africa

Cargo Volume Africa

Logistics Infrastructure in Africa

Africa Freight Forwarding Major Companies

Africa Freight Transport Market

Major Air Freight Companies in Africa

South Africa Logistics Cost

For More Information, Refer To Below Link:-

Related Reports by Ken Research:-

+91-9015378249