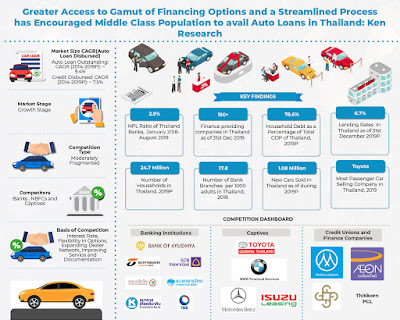

Thailand’s Auto Finance Market is in the maturity stage, driven by road infrastructure development, economic growth in the country, and a dramatic increase in trading partners and export earnings. Major entities in the market are Banks and Captives that are 90-100 years old offering variety of financing services.

- Thailand’s market uses the traditional way of banking including manpower and face-to-face transactions instead of online processes.

- Nowadays, many non-banks have jumped into the Auto-finance business and they are doing it in a simpler way than banks.

- The automotive industry in Thailand is the largest in Southeast Asia and the 10th largest in the world.

Growth in Online Retail and Liberal Trade Arrangements: There will be a rise in demand for commercial vehicles due to ongoing government investment, expansion in online retail, and logistics. The car manufacturers of the country plan to increase demand by releasing new models (including both the internal combustion engine and electric vehicles). With this, the greater trade openings under the current ASEAN Free Trade Area agreement would permit Thailand to export more automobiles to the rest of the region.

Used car financing more accessible and inexpensive: Thailand's government announced subsidies for electric vehicles is anticipated to increase the country's demand and sales for vehicles. Due to various financing companies' policies that make used car financing more accessible and inexpensive, used car financing may experience an increase in the segmentation of the type of vehicle funded in the upcoming years. In addition to this, to enhance the volume of new car loans, Thailand's leading banks also have the chance to strategically work with the original equipment manufacturer.

Shift from ICE to EV and Rapid Digitalization: Due to the increased energy efficiency, affordability, and environmental friendliness of electric vehicles, the market has experienced a transition away from internal combustion engines. As a result, EVs are now preferred over ICE vehicles in Thailand. To enhance the consumer experience, auto financing organizations are leaning more and more toward advanced technical developments. Online automobile sales have developed into a "one-stop-shop" service that gives customers direction and customization. In order to enhance and automate the delivery and use of financial services, such as payment gateways and trading platforms, new technology-based firms are joining the Thai car finance sector.

Analysts at Ken Research in their latest publication “Thailand Auto Finance Market Outlook to 2026F- Driven by Road Infrastructure Development and Economic Growth in the Country” observed that the Auto Finance market is an emergent market in Vietnam at a rebounding stage from the economic crisis after the pandemic. The immense infrastructural development projects in the country, partnerships, and mergers with other banks along with the adoption of digitalization are expected to contribute to the market growth over the forecast period. The market is expected to grow at a 7.4% CAGR during 2021-2026F owing to the increasing purchasing power of consumers, adoption of EVs, and new government policies.

To learn more about this report Download a Free Sample Report

Key Segments Covered:-

Thailand Auto Finance

By Type of Vehicle financed

- New cars

- Used cars

- Motorcycles

By Distribution channels

- Banks & Subsidiaries

- NBFC's

- Captives

By Type of Financing

- Passenger Vehicles

- Commercial Vehicles

By purpose type

- Loans

- Lease

By Tenure of the loans

- 1 year

- 2 years

- 3 years

- 4 years

- 5 years and above

Key Target Audience:-

- Banks and their Subsidiaries

- NBFCs

- Captive Finance Companies

- Government and Institutions

- Automobile Companies

- Car Dealers

- Government and Institutions

- Existing Car Finance Companies

- OEM Dealerships

- New Market Entrants

- Investors

- Automobile Associations

Time Period Captured in the Report:-

- Historical Year: 2016-2021

- Base Year: 2021

- Forecast Period: 2021– 2026F

Companies Covered:-

Banks and Subsidiaries

- TMBThanachart Bank

- Ayudhya Bank

- Siam Commercial Bank

- TISCO Bank

- Kiatnakin Bank

- Kasikorn Bank

- Others (Including ICBC Bank, Citi Bank, Bangkok Bank, and Krungthuri Bank)

Visit this Link: - Request for custom report

Captives

- Toyota Leasing Thailand

- Honda leasing

- Mercedes-Benz leasing

- BMW Financial Services

- Others

NBFC's

- Muangthai Capital

- Asia Sermkij Leasing

- Nakhon Luang Capital Limited

- Thitikorn

- Summit Capital

- Group Lease

- Aeon Thana Sinsap

- G Capital Public Limited

- Others (Thai Ace Capital, SGF Capital, JMT Network, Phatra Leasing Company, Mitsib Leasing)

Key Topics Covered in the Report:-

- Thailand Automotive Market Overview

- Thailand Automotive Finance Market Overview

- Ecosystem of Thailand Auto Finance Market

- Business Cycle and Timeline of Thailand Auto Finance Market

- Thailand Auto Finance Value Chain Analysis

- Market Sizing Analysis of Thailand Auto Finance Market, 2016-2021

- Thailand Auto Finance Market Segmentation (By Type of Vehicle Financed, By Distribution Channel, By Tenure Loan, By Purpose Type, By Type of Motor Vehicle), 2021

- SWOT Analysis of Thailand Auto Finance Industry

- Trends and Developments in Thailand Auto Finance Industry

- Decision Making Parameters for Selecting Car Loan Vendor

- Issues and Challenges in Thailand Auto Finance Industry

- Growth Drivers of Thailand Auto Finance Market

- Government Regulators and Initiatives in Thailand Auto finance Industry

- Competition Framework for Thailand Auto Finance

- COVID-19 Impact on Thailand Auto Finance Market

- Future Outlook and Projections of Auto Finance Market in Thailand, 2021-2026F

- Market Opportunities and Analyst Recommendations

For more insights on the market intelligence, refer to below link:-

Related Reports by Ken Research:-

UAE Auto Finance Market Outlook to 2026F