How Belgium Freight Forwarding Market Evolved?

Belgium is the ideal country to establish a logistics base for the entire continent of Europe. It’s strategically located between Northern and Mediterranean Europe and has major cities of the continent at a very feasible distance away. It boasts of a highly developed transport network of roads, railways, waterways, and airports, thus enabling smooth and uninterrupted movement of freight.

Belgium secured an LPI score of 4.04 in 2018 and ranked 3rd in the world, thereby making it one of the best countries in the world in terms of the logistics market. Freight forwarders specialize in arranging to ship merchandise on behalf of its shippers. They usually provide a full range of services such as tracking inland transportation, negotiating freight charges, freight consolidation, cargo insurance, and filing of insurance.

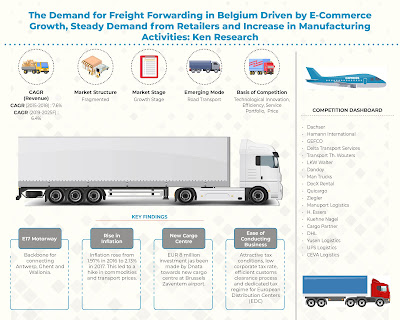

Belgium Freight Forwarding Industry was evaluated to grow from USD ~ million in 2015 to USD ~ million in the year 2018 at a compounded annual growth rate (CAGR) of ~% during the period.

The growth was mainly due to a shift in consumer preferences towards e-commerce, steady demand from retailers and an increase in manufacturing processes. The E17 motorway acts as a backbone for connecting Antwerp, Ghent, and Wallonia. This corridor performed strongly during this period with respect to logistics demand.

Belgium offers attractive tax conditions with a low corporate tax rate, efficient customs clearance process and the dedicated tax regime for European Distribution Centers (EDC). This has attracted logistics companies from various countries to do business in Belgium.

Belgium Freight Forwarding Market Segmentation

By Mode of Freight

The highest share over the years by revenue was captured by road in Belgium. The roads pave the way to access the important markets within the country and to consumers from nations bordering the country. The share of sea freight fluctuated over the years, owing to fluctuating oil prices. The shipping industry in Belgium is negatively impacted by the over-concentration of a large number of players, thereby leading to a surplus capacity of players, leading to lower overall revenues. Airfreight witnessed the highest growth in revenue amongst all the modes, owing to it having the highest freight cost.

By Cargo Volume

The Port of Antwerp catered to about ~% of the total maritime volume of Belgium in 2018. The declining freight share of Zeebrugge Port has been distributed between rising shares of Antwerp and Ghent Port. Brussels The airport's cargo community specializes in the handling of time and temperature-sensitive goods.

By International Flow Corridors

Europe and Asia are the major trade partners in Belgium. Major freight destinations within Europe include Netherlands, Germany, France, Ireland and the United Kingdom whereas major partner countries in Asia include China, Japan, India, and Turkey. Belgium had a trade surplus of about EUR 16.1 billion in 2018. The district of Flanders accounted for the largest share for generating exports to the UK. About 4,000 containers depart from Zeebrugge daily to the UK and scores of customs officials are hired at ports for the same.

By Type of Freight

Owing to Belgium’s international trade volumes, domestic freight forwarding revenue is lesser. Majority international cargo in bulk and heavy cargo such as petrochemicals, diamonds, automobiles, chocolates and carpets traded with countries such as Netherland, Germany, France and the USA.

Competitive Scenario in Belgium Freight Forwarding Market

Belgium currently houses over 200 freight forwarding companies, leading to fierce competition. Post the enlargement of the EU; Belgium freight forwarders have witnessed higher pressure of competition from Central and Eastern Europe. This along with the advent of e-commerce paints the competitive landscape of the country. In order to protect themselves from the regional competition, firms are isolating multinational strategies and trying to achieve economies of scale and optimal production within specific regions. Outsourcing is also being increasingly done to achieve cost and production efficiency. Trucking companies have now begun aggregating and consolidating trucking activities, or began to specialize themselves in particular types (for example tank trucks) or in specific regions (primarily, Benelux).

Belgium Freight Forwarding Future Outlook and Projections

Belgium Freight Forwarding Market is expected to register a high CAGR of ~% during 2018-2025. This is mainly due to adoption of advanced technology such as blockchain by Antwerp Port, EUR 3 billion investments by Belgian Railways Board, which includes reducing number of rail logistics centers from 62 to 50 by 2022 and introducing two new tracks between Ghent and Bruges. Airfreight capacity is expected to Increase by 3% till at least 2025 and is also likely to rise further till 2030.

Key Segments Covered:-

Belgium Freight Forwarding Market

By Mode of Freight (Revenue, Freight Ton KMs, Major Products, Freight Cost)

Road Freight

Air Freight

Sea Freight

Rail Freight

Pipeline

By Cargo Volume

Road Freight Cargo Volume

Air Freight Cargo Volume by Airports

Sea Freight Cargo Volume by Seaports and type of maritime freight

By International Flow Corridors (Revenue, Major Countries, Major Products, Recent Developments)

Europe

Asia

NAFTA

Middle East

Africa

By Type of Freight (Revenue, Major Regions, Major Products)

International Freight

Domestic Freight

Companies Covered:-

Ziegler

Manuport Logistics

- Essers

Kuehne Nagel

Cargo Partner

DHL

Yusen Logistics

UPS Logistics

CEVA Logistics

Dachser

Hamann International

GEFCO

Delta Transport Services

Transport Th. Wouters

LKW Walter

Dandoy

Man Trucks

DocX Rental

Quicargo

Key Target Audience

Freight Forwarding Companies

E Commerce Logistics Companies

3PL Companies

Consultancy Companies

Trucking Companies

Trucking Aggregator Companies

Time Period Captured in the Report:-

Historical Period – 2015-2018

Forecast Period – 2019-2025

Key Topics Covered in the Report:-

Contract Logistics Revenue Belgium

Belgium Domestic Freight Companies Share

Pipeline Transport Market Belgium

Belgium Rail Freight Revenue Share

Import and Export Cargo Cost Belgium

Belgium cold-storage space in SQM

International Freight Companies in Belgium

LKW Walter Belgium cargo transportation Charges

Container freight stations Niagara

Cargo Shipping Cost to Belgium

Road Freight Industry Belgium

Freight Transportation Cost Belgium

Belgium Freight Forwarding Industry

Freight Forwarding Industry Belgium

Logistics Infrastructure in Belgium

For more information, refer to below link:-

Related Reports by Ken Research:-

+91-9015378249