“Increase in mobile and internet penetration along with the adoption of digital technology and improvement in credit-assessment related technology has driven the increase in borrower base and an increase in loan disbursement.”

Analysts at Ken Research in their latest publication “Competition Benchmarking: Indonesia Peer-to-Peer Lending Market Outlook to 2024” believe growth in e-commerce activity driving seller activity, adoption, and integration of digital technology with e-commerce, entry of new platform operators and their ability to cover a wider geography, improvement in the internet and mobile phone penetration and increased participation of banks and financial institutions are some of the factors that will drive the market to register a near 50% CAGR in terms of loan disbursement for the period 2019-2024.

Growth within Java: Loans disbursed in Java have dominated the Indonesia Peer-to-Peer lending market. Share and growth in loans disbursed in the Java region have increased for the period 2016-2018. Java accounts for a majority of the economic activity in Indonesia. Other factors such as, population, literacy rates, and a number of lenders and borrowers and the presence of banking system and increase in mobile phone and internet penetration helped accelerate the growth in loans.

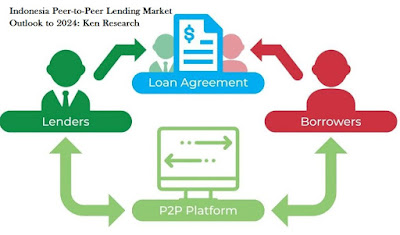

Funding MSME: SMEs in Indonesia face a USD 75 Billion funding gap. Banks’ reluctance to fund these businesses on account of the risk they have given rise to the development of the Peer-to-Peer lending industry The use of unconventional data to assess borrower risk has given rise to a new form of credit assessment as opposed banks’ traditional system. Investors have been drawn to these platforms for their attractive returns and low commission charges.

With mobile phone penetration, the industry is expected to scale to ~IDR 430 trillion in terms of loans disbursed by 2023. The problem of financial inclusion still persisted due to lack of financial literacy. This was tackled by means of collaborating with different partners like banks, e-commerce and payment platforms to reach a wider audience.

Supportive Regulatory Environment: The Indonesia regulatory authority, OJK, has promptly introduced regulations, learning from the mistakes of the Chinese authorities. OJK has introduced two regulations since 2016 to combat the problem of illegal and unreliable P2P platforms. The process of registration is a two-stage process. The first stage is a registration with intent to operation. The second stage is licensing, where a company has to prove operational reliability with respect to platform risk mitigation, customer data safety, and fraud detection and prevention. In addition to the second regulation, the authority has set up a Sandox system where registered platforms can go through an operational reliability test to find weaknesses.

Key Segments Covered:-

By Location of Loan Disbursed

Inside Java

Outside Java

Key Target Audience

Existing Peer-to-Peer Lending Platforms

New Market Entrants- Domestic Platforms

New Market Entrants- International Platforms

Banks and Financial Institutions

Government Bodies

Investors & Venture Capital Firms

Third-Party Technology Providers

MSMEs and E-commerce Sellers

Time Period Captured in the Report:-

Historical Period: 2016 -2018

Forecast Period: 2019-2024

Companies Covered:-

Investree

Modalku

Koinworks

Danamas

Mekar

Crowde

Crowdo

Akseleran

Aktivaku

Amartha

Keywords:-

Government Bodies P2P Market Indonesia

Third Party Technology Providers in P2P Market

Indonesia MSMEs and E-commerce Sellers P2P Market

Indonesia Long Term Lending Market

Indonesia P2P Lending Market

Peer to Peer Lending Industry Indonesia

Indonesia P2P Lending Commission Margin Size

Number of Borrowers Registered Indonesia P2P Market

Indonesia Peer to Peer Lending Market Partners

Peer to Peer Lending Market in Indonesia

Indonesia P2P Lending Industry

Number of Lenders Registered Indonesia P2P Market

Interest Rate Indonesia P2P Lending Market

Indonesia Long Term Interest Rate

Indonesia Peer to Peer Lending Market Platforms

Indonesia Peer to Peer Lending Regulations

Indonesia SME Financing Market

Peer to Peer Lending Market Indonesia

To Know More, Click On The Link Below:-

Related Reports by Ken Research:-

+91-9015378249