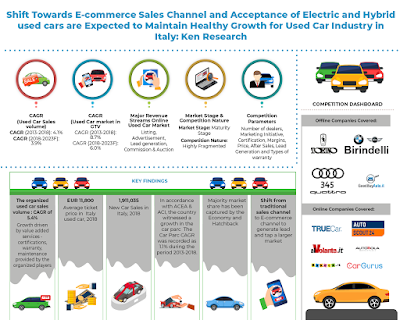

“Amplified demand for young used cars and the shift towards the E-commerce sales channel have driven the growth of the used car market in Italy.”

Shift from Traditional Sales Channel to E-commerce Channel: Italy is witnessing a growth in the listing of a used car on the online platforms by dealers as well as private individuals. The car buyers’ are now more aware and informed about the used car industry owing to which they research the use of cars online before they make a decision to purchase a particular brand. Also, as the companies list their used cars online along with the purchase price, it becomes easier for the buyer to compare the best possible options with its price and specifications. The immediacy of use, the ability to quickly find what the customers are looking for and to have access to a wider offer compared to traditional channels are the main reasons which drive a customer to look for a used car online.

Analysts at Ken Research in their latest publication “Italy Used Car Market Outlook to 2023 – Led by Surge in Demand for Used Cars Backed by Improved Quality and Inspection of Used Cars” believe that the used cars industry in Italy has been growing and is expected that it will expand further owing to the used cars entering the market from car rental companies, the surge in demand for young used cars, the entrance of used car dealerships in the country, better services provided by the dealerships such as car financing, insurance, inspection and others, the rising number of online used car companies and others. The market is expected to register a positive CAGR of 3.9% in terms of sales volume of used cars and 6.0% in terms of Gross Transaction Value (GTV) during the forecast period 2018-2023F.

A surge in the sourcing of used cars from Rental companies: The private customers have developed an interest in the used cars provided by the rental companies owing to the certified documentation provided by these rental companies on the used cars. The sale of used cars to private customers was witnessed to increase in the past few years. The car rental companies have also increased the purchase of a used car in Italy. The used car allows cheaper rental offers, becoming more and more an affordable and appreciated option. Some of the main market players, such as LeasePlan or Arval, have begun to take advantage of the opportunities that used car represents. Cars that left the NLT (Northern Light Technologies) park in the first quarter of 2018 were distributed 7% to individuals, 11% exported and 79% to dealers.

Accessibility of Financing options: Companies operating through organized channels have tie-ups with banks and related financial institutions, thereby providing their customers with added financial assistance. As a result, leading to increased used car sales in Italy. Italy used car dealerships were not providing the financing options in the past few years as their primary focus was on the sale of the used car, owing to which the customers had to finance their used cars from banks which charged a huge interest rate. With the availability of car financing options at the dealerships over the years has eased the purchase of a used car in Italy for the customers.

Key Segments Covered:-

By Type of Market Structure:

Organized Market

Multi-brand Dealerships

OEM Certified Dealerships

Unorganized Market

Customer to Customer

Online Sales

Local Dealers

By Car Make:

Fiat

Volkswagen

Renault

Ford

BMW & Mini

Opel

Mercedes

Audi

Toyota

Citroen

Nissan

Skoda

Others (Peugeot, Jeep, Dacia, Hyundai, Lancia, Kia, Alfa Romeo, Suzuki, MCC, Mini, Seat, Volco, Land Rover, Mazda, Jaguar, Honda, Mitsubishi, Porsche, Subaru, Maserati, Ssangyong, Dr, Mahindra, Ferrari, Lotus, Lada and rest)

By Year of Ownership:

<2000

2000-2002

2003-2005

2006-2008

2009-2012

2013-2018

By Kilometers Driven:

Less than 5,000

5,000-20,000

20,000-50,000

50,000-80,000

80,000-120,000

Above 120,000

By Type of Used Cars:

Economy/Hatchback

MPV’s/Sedan

SUV’s

Key Target Audience

Offline Dealers

Online Portal

Organized Multi Brands Dealers

OEM Certified Dealerships

Online Portal

Private Equity and Venture Capitalist

Industry Associations

OEM Manufacturers

Automotive Manufacturers

Car Auction Companies

Time Period Captured in the Report:-

Historical Period - 2013-2018

Forecast Period – 2019-2023

Companies Covered:-

Online Dealerships:

True Car

Autoscout24

Bakeca.it

Alvolante.it

Autorola Marketplace

Cargurus

Offline Dealerships:

Auto Torino

Denicar FCA

Birindelli Auto Srl

Mocautogroup

GoodBuyAuto

Autoquattro

Schiatti Car Srl

Auto 500

Key Topics Covered in the Report:-

Italy Used Car Market Overview and Genesis

Italy Used Car Market Supply Chain

Business Model Prevalent in Italy Offline Used Cars Market

Italy Used Car Market Size by GTV and Sales Volume

Italy Used Car Market Segmentation

Snapshot on Italy Used Car Auction Market

Government Regulations in Italy Used Car Market

Trends and Development in Italy Used Car Market

Issues and Challenges in Italy Used Car Market

Snapshot on Italy Online Used Cars Market

Competition Scenario in Italy Offline Used Cars Market

Italy Used Car Market Future Outlook and Projections, 2019-2023F

Analyst recommendations

Success Case Studies in India Used Car Market-OLX

For More Information On The Research Report, Refer To Below Link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249