How European Machine Tool Market Is Positioned In Europe?

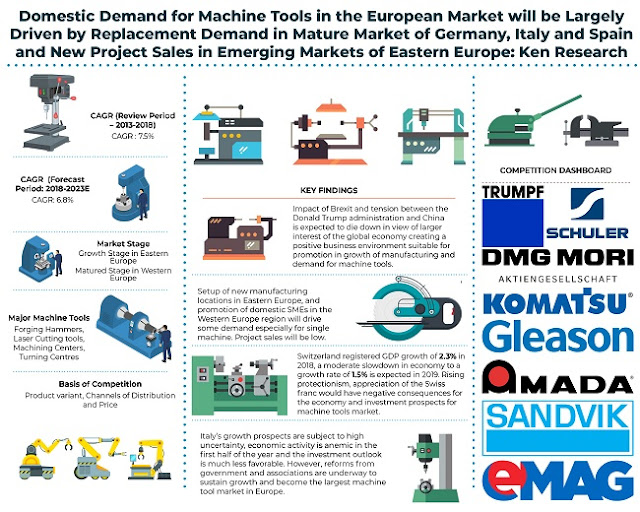

Europe Machine tools market is in the matured stage and has been the market leader for centuries before the shift happened to Japan and the US market. The European market has registered growth in the last five years registering a CAGR of ~% during the period. Growth was mainly driven by demand from Italian and German-made products which are in high demand across the European and global market. Switzerland and Spain are other significant countries which have focused on the export of machine tools. The revenue generated from domestic consumption in the European market increased from USD ~ billion in 2013 to USD ~ billion in 2018.

Forming tools are used in wire manufacturing which accounts for the majority of the sales in the electric industry. Forging and machining hammers which are extensively used in manufacturing many tools and components that may be exposed to strain and impact are among the most demanded to form machine tool in the European region. Italy registered the highest growth rate and was largely driven by increased production and imports. Robotic machinery is in high demand accounting for ~% of the total machine tools sales.

Germany is the largest machine tool market in the entire European region both in terms of domestic consumption and production. The domestic consumption of machine tools increased from USD ~ million in 2013 to USD ~ million in 2018 registering a five-year CAGR of ~%.

Domestic manufacturing in Germany has slowed down and the trend is expected to remain the same for the next few years before the recovery may take place. Machine tools market in Europe is expected to register a decline in growth rate due to poor manufacturing scenario. It is expected to increase from USD 22.8 billion in 2018 to USD ~ billion in 2023.

Europe Machine Tool Market Segmentation

By Type of Machine: Cutting machine tools largely dominated the market accounting for ~% of the total consumption by revenue in 2018. Together these machines generated an estimated revenue of USD ~ billion in 2018. Forging and machining hammers which are extensively used in manufacturing many tools and components that may be exposed to strain and impact accounted for USD 6.4 billion in sales during 2018 in the European market.

By Direct and Distributor Sales: Standard machines are widely used by SMEs and distributors act as a source for supplying these materials. The distributors also act as a contact center for after-sales service and repairs. Germany, Spain, Italy has a much higher number of machine tool distributor as compared to other countries. Eastern European countries have very few distributors of machine tools as industrial development is concentrated into few towns and cities. Together distributors accounted for 80% of the machine tool sales. Direct selling is only executed in case of large project sales or certain specific customization.

By Type of End Users: Automobile industry is the largest consumer segment for machine tools in the European market contributing revenue of USD 8.0 billion in 2018. Investments in setting up and modification of existing manufacturing units to manufacture electric and hybrid vehicles has driven the demand for efficient machine tools in the region. Metalworking is the largest sector contributing to the engineering segment. It is expected to register significant growth in the years to come due to the rise in the number of SMEs. Engineering segment contributed USD 3.7 billion in 2018. Electric and Electronic product manufacturing units and Aerospace are other major end-users of machine tools accounting for USD 2.5 billion and USD 2.7 billion respectively in terms of revenue.

Snapshot on Germany Machine Tool Market Segmentation

Market Size: The domestic consumption of machine tools increased from USD ~ million in 2013 to USD ~ million in 2018 registering a five-year CAGR of ~%.

By Type of Machine: Metal cutting machine is in high demand across Germany. Strong focus on the automobile industry, electric equipment, shipbuilding, high precision equipment is some key industries driving the demand for both cutting and forming tools. Metal Cutting contributed USD ~ million and Metal Forming contributed USD ~ million in 2018.

Segmentation Region: Northern part of Germany is the largest consumer of machine tools in the country. Schleswig-Holstein, Mecklenburg-Vorpommern, Lower Saxony Hamburg, and Bremen are major cities in the northern part of Germany. North Germany contributed USD ~ million and Western Germany contributed USD ~ million.

By Type of End Users: Automobile industry of Germany is among the strongest in Europe. They account for the majority of the production of passenger cars in the region contributing USD 3,474.0 million. The aerospace industry in Germany was estimated at Euro 40 billion in 2018 is expected to grow at a fast rate considering the strong manufacturing base and availability of relevant resources for future growth. In 2018, it contributed USD 772.0 million. The demand for machine tools in the Energy segment contributed USD 1,158.0 million.

Future Projection

Poor domestic demand is the key reason for such slow growth. It is expected to increase from USD 7,720.0 million in 2018 to USD 8,404.5 million in 2023 registering a five-year CAGR of 1.6%.

What Is The Future Of Machine Tools Market In Europe?

Machine tools market in Europe is expected to register a decline in growth rate due to poor manufacturing scenario. Project sales will below. Many mergers and acquisitions are expected in the near future to gain technology and economies of scale. Technology companies may partner with existing manufacturers who can utilize their manufacturing capacity to integrate the technology. Impact of Brexit and tension between the Donald Trump administration and China is expected to die down in view of larger interest of the global economy creating a positive business environment suitable for promotion in the growth of manufacturing and demand for machine tools. It is expected to increase from USD ~ billion in 2018 to more than USD 31 billion in 2023.

Key Segments Covered:-

By Type of Machine Tools

Cutting Machine Tool (Machining Centres and Flexible machines, Turning Machine, Laser and electric discharge machine, Milling machines, Grinding, honing, lapping and polishing machines, Transfer machines, Gear cutting and finishing machines, Drilling machines, boring machines, and boring-milling machines, Sawing and cutting-off machines)

Forming Machine Tool (Forging machines and hammers including presses, Wire working machines, bending, folding and straightening machines, shearing, punching, notching machines)

By End Users

Automobile Industry

Aerospace

Energy

Engineering

Electrical and Electronics

Others

By Sales Channel

Direct Sales

Distributor Sales

By Country

Germany

France

Italy

Switzerland

Time Period Captured in the Report:-

Historical Period – 2013-2018

Forecast Period – 2019-2023

Key Companies Covered:-

Trumpf

DMG Mori Aktiengesellschaft

Schuler

Mazak

Gregory Fischer Machining Solution

Amada

Komatsu

Sandvik

Gleason

Flow International

EMAG

600 Groups

Heller

Chiron

Key Topics Covered in the Report:-

Switzerland Machine Tools market

Electrical Engineering machine Tools market Europe

Aerospace Machine Tools market Europe

Europe Machine Tools market in Energy Sector

Italy Machine Tools Industry

Switzerland Machine Tools Industry

Germany Wire and Cable Industry

Automobile Industry in Europe

Europe Aviation Aircraft Manufacturing

Germany Metal Cutting Tools Market

Europe Machine Tools Domestic Sales in USD Million

European Machine Tools Industry

Italy Machine Tools market Share

Switzerland Machine Tools market Analysis

Germany Machine Tools market Outlook

Automobile Machine Tools market Europe

Engineering Machine Tools market Europe

Direct Sales Machine Tools Market in Europe

Dealers of Machine Tools Europe

For More Information, Refer To Below Link:-

Related Reports like Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

No comments:

Post a Comment