How Brazil Diagnostic Labs Market Is Positioned?

Diagnostic Labs industry in Brazil had begun to evolve in the early 1900s. In the late 1960s laboratory automation process arrived in the country and was capable of processing diagnostic tests more efficiently and in greater volume in the country.

In 2000, the Private Supplementary Healthcare System (ANS) came into existence for the Brazilian population which was followed by the consolidation of independent laboratories to clinical groups.

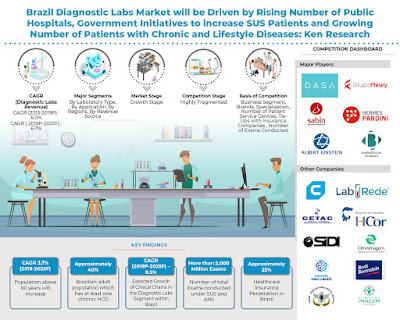

The industry is booming with the growing number of patients under the Universal Health System (SUS), the growing elderly population (Above 65 Years), the rising number of patients with chronic diseases and growing investment to increase the number of patient service centers. The reported number of death cases due to the presence of NCDs among all other diseases caused ~% of the deaths in the country during the year 2018.

The Revenue from diagnostic labs market in terms of value was accounted at USD ~ Billion in 2013. The market grew with a CAGR of ~% in the time period of 2013-2019P and was evaluated at USD ~ Billion in 2019P. Market Size of Diagnostic Labs in Brazil in terms of the number of examinations conducted was recorded at ~ million with a CAGR of ~% during the period 2013-2019P. Growth in the Diagnostic Labs industry was also seen in terms of a number of laboratories with ~ laboratories at the end of 2019P. The economy is growing with ~million ANS healthcare insurers and ~million SUS healthcare insurers in 2018.

How Brazil Diagnostic Labs Market Segmented?

By Type of Labs

The diagnostic labs market in Brazil is highly fragmented with around ~ independent players and ~ clinical chains. Independent labs dominate the market in terms of revenue in Brazil largely due to their presence in almost every city and their locations nearer to hospitals and clinics.

By Application

Radiology accounted for the highest percentage share of ~% in terms of revenue during the year 2019P. However, in terms of the number of examinations conducted, clinical analysis dominated the market with ~ million exams conducted during the year 2019P in Brazil.

By Radiology Tests

X-Rays accounted for the highest percentage share of ~% in terms of a number of exams in the country. It is followed by Ultrasound wherein the exams are largely conducted for Gynecology and Obstetrics. MRI and CT scans accounted for the lowest share of ~% and ~% in terms of a number of examinations conducted during the year 2019P.

By Type of Clinical Analysis Tests

Routine tests in Brazil accounted for the highest share of ~% and ~% in terms of revenue and in terms of a number of exams during the year 2019P largely due to high preference and most recommended routine exams. The majority of the routine tests are conducted by independent laboratories in the country.

By Region

Southeast Region in Brazil accounted for the highest revenue share of ~% in 2019P largely due to the number of laboratories and hospitals in that region. In 2018, the South region is the second the highest region with~% share in terms of revenue followed by South, Midwest, and North.

By Revenue Source

Healthcare Operators and Insurers accounted for the highest percentage of ~% in terms of revenue wherein, a major proportion of patients are referred by doctors. Out-of-Pocket is the second major revenue source with a ~% share in terms of revenue from this segment.

How Is The Competitive Landscape Of Diagnostic Labs Market In Brazil?

Diagnostic Labs Market in Brazil is a highly fragmented market with the presence of many independent laboratories and clinical chains. There are more than ~ independent laboratories in the country.

The laboratories in Brazil are operating in different business segments with different brands and collection points. These laboratories majorly compete on the basis of Number of Exams, Examination Portfolio, Major Specialization, Patient Service Centers and Tie-Ups with Hospitals and Healthcare Insurance companies. The major diagnostic groups that are operating in Brazil are Dasa Group, Fleury Group, Hermes Pardini, Allier Medicos a Frente, Diagnostics do Brasil, Albert Einstein Medicina Diagnostica, Sabin Diagnostics, and others.

What Is The Future Outlook And Projections For Brazil Diagnostic Labs Market?

Brazil Diagnostic Labs Market revenue is anticipated to reach from USD ~ billion in 2019P to USD ~ billion by the end of 2025 with a CAGR of ~% during the period 2019P-2025F. The market is growing owing to multiple factors that include an increasing number of Public Hospitals, Government activities to increase SUS patients, growing health insurance penetration, rising disposable income, growing aging population, per capita health expenditure, rising demand for tele medicines and artificial intelligence in laboratory equipment and process.

Growing Government Healthcare Expenditure and an increasing number of chronic and lifestyle diseases including HIV, diabetes, and others coupled with Growing and improving access to healthcare services and the number of laboratories will drive the demand for Diagnostic Labs in the coming future.

Key Segments Covered:-

By Type of Labs

Single Independent

Chains

By Application

Radiology

MRI

CT scan

Ultrasound

X-Ray

Others

Clinical Analysis

Routine

Specialized

By Region

South-East

South

North-East

Mid-West

North

By Revenue Source

Healthcare Plan Operators and Insurers

Out-of-Pocket

Public System

Key Target Audience

Medical Device Manufacturers

Medical Device Distributors

Public and Private Hospitals

Medical Device Importers

Diagnostic Lab Players

Government Associations

Diagnostic Imaging Device Companies

Time Period Captured in the Report:

Historical Period: 2013- 2019P

Forecast Period: 2020 – 2025

Companies Covered:

Albert Einstein Medicina Diagnostica

Alliar Medicos a Frente

Boris Berenstein

BP Medicina Diagnostica

Cedi

Cepem

CETAC

Clinica da Imagem do Tocantins

Clinica Imagem

Cura

DASA

DB Diagnosticos do Brasil

DMS Burnier

Grupo Fleury

HCOR

Hermes Pardini

Hospital Sirio-Libanes

Lab Rede

Omnimagem

Sabin Medicina Diagnostica

Senne Liquor Diagnostico

Sidi

Sir Radiologia

Key Topics Covered in the Report:-

Brazil Medical Device Market Distributors

Brazil Diagnostic Imaging Device Companies

Brazil Medical Device Market Manufacturers

DASA Group Net Revenue in USD Million

Fleury Group Gross Revenue in Percentage in 2018

Alliar Imaging Brazil Growth Rate in USD Million

Brazil Point-Of-Care Testing devices Manufacturers

POCT Market in Latin America

Brazil Diagnostic Imaging Market

Brazil Pathology Tests Market

Brazil Ultrasound Market Share

Brazil X-Ray and CT scan Market

For More Information on the research report, refer to below link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

No comments:

Post a Comment