· More than 70% of cold warehouse capacity

below 10,000 Pallets, Large warehouses needed post GST linked warehouse consolidation.

·

Cold

storages with agricultural products occupy ~53% of the overall space, 31st

October 2020.

· The market

is highly concentrated in places like Vashi, Taloja and Panvel. The rising

urban population, developed transport infrastructure in these regions along

with the proximity to the sea and upcoming airport has been the key factors

leading to the growth of the cold storages in these areas.

· Specialized cold chain companies such as Kool Solutions, Snow-Ex,

ColdStar Logistics and Winter Logistics have entered the Cold chain industry in

the last 10 years (FY’10-FY’20).

Pharmaceutical Push: India emerged as a world Pharma hub

contributing to 10% of world production by volume. The Pharma Industry has seen

continued growth with turnover at INR 2.7 Tn in 2019, with exports increasing

from INR 1.3 Tn in 2017 to INR 1.4 Tn in 2019.

Increasing Market Demand: Maharashtra

is host to more than 10,000 companies in the food processing sector with a number

of multinational companies having their production facilities with requirement

of cold storage facilities.

Launch of ‘Export Cold Zone’ by Mumbai Airport: The Mumbai International Airport Ltd has launched

the world’s largest airport-based temperature-controlled

facility known as the ‘Export Cold Zone’ for processing and

storage of agro and pharma products. The exclusive terminal can hold

over 700 tonnes of such cargo at one time with a combined annual

capacity of 5.25 lakh tonnes.

Indian Food Service Market Gaining

Momentum: The food

services market in India has shown consistent growth since Fiscal 2014 and was

estimated at ₹4,096

billion in FY’2019, ending March 2019. Unorganized market accounted for ₹2,535 bn,

followed by the organized standalone segment, the chain market and restaurants

at hotels, each accounting for ₹1,096 billion, ₹350 billion

and ₹115

billion, respectively.

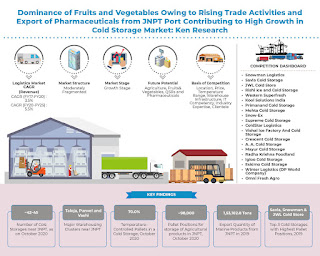

The report titled “Business Potential for Cold Storage

Facility in JNPT Outlook to FY25 – Driven by increasing Trade of food products

and Pharmaceuticals along with growth in QSR” provides a comprehensive analysis on the status of the cold

storage market in the JNPT area in Mumbai. The report covers various aspects

including the current market scenario in JNPT, pricing trends, pros and cons

for setting up cold storage in the area, major growth drivers, investment in

infrastructure, tech disruptions and innovations, and competition benchmarking.

The report concludes with market projections for future of the industry

including forecasted industry size by revenue and pallet positions along with

potential end users.

JNPT

Cold Storage Market

Pallets By Temperature Range

Freezers

Chillers

Ambient

Pallets By End Users

Agriculture

Pharmaceuticals

QSRs

Bakery and Confectionery

Dairy

Meat and Seafood

Others

Companies Covered:-

Snowman

Logistics

Savla

Cold Storage

JWL

Cold Store

Rishi

Ice and Cold Storage

Western

Superfresh

Kool

Solutions India

Primanand

Cold Storage

Mehta

Cold Storage

Snow-Ex

Supreme

Cold Storage

ColdStar

Logistics

Vishal

Ice Factory And Cold Storage

Crescent

Cold Storage

A.

A. Cold Storage

Mayur

Cold Storage

Radha

Krishna Foodland

Igloo

Cold Storage

Eskimo

Cold Storage

Winter

Logistics (DP World Company, Lease from Allana)

Omni

Fresh Agro

Alps

Ice and Cold Storage

Khanna

Ice and Cold Storage,

Bhoir

Ice Factory and Cold storage Pvt LTD,

Libran

Cold Storage

iAhmed

Cold Storage

Key

Target Audience:-

Cold

Storage Companies

Cold

Chain Association

End

Users for Cold Storage Companies

3PL

Companies

Consultancy

Companies

Logistics/Warehousing

Companies

Real

Estate Companies/ Industrial Developers

Time

Period Captured in the Report:-

Historical Period – 2017-2019

Forecast Period – 2020-2025F

Key Topics Covered in

the Report:-

JNPT Cold Storage

Market Introduction

JNPT Infrastructure

Pros a Entry Barriers

and Pre-requisites for Cold Storage Facility in JNPT, Mumbai

Pros and Cons for

Setting up Cold Storage Facility in JNPT, Mumbai

Reasons for End User

Companies to Shift down to JNPT, Mumbai

Number of Cold

Storages in JNPT Area, 2020

Cold chain warehousing

potential for multiple commodities (F&V Market, Meat and Seafood, Ex-Im

Temperature Controlled Consignments, Confectionary, Ice Cream, Frozen Food,

Dairy, Pharmaceutical, RTE/ RTC etc.)

Competition Assessment

in JNPT Area separately for Cold Storage Assessment on the Basis of Nature of

Competition, Competitive Factors and Major Companies

Number of Cold Storage

in JNPT, Mumbai segregated by Organized and Unorganized Sector Including

parameters such as Price Per Pallet, Type of Facilities, Size, Major Clients,

End User Catered, Revenues*, Employees, Vintage and others.

Preferred Location

Assessment in JNPT Area

Financial Model to

Setup Cold Chain Facility in JNPT Area

Future Potential for

the Demand of Cold Storage Space in JNPT, Mumbai

For More Information

on the research report, refer to below link:

Related Reports:-

Follow Us:-

LinkedIn | Instagram | Facebook | Twitter | YouTube

No comments:

Post a Comment