The expansion of the warehouse management system market is mostly due to the rising demand for effective management solutions to boost profitability. The Warehouse Management Systems is forecasted at ~US$ 7 Bn by 2028 says Ken Research Study.

A Warehouse Management System (WMS) is software that aids in the management and intelligent execution of a warehouse's, distribution center, or fulfillment center’s operations. WMS applications provide features like order allocation, order picking, replenishment, packing, shipping, labor management, yard management, and automated materials handling equipment interfaces.

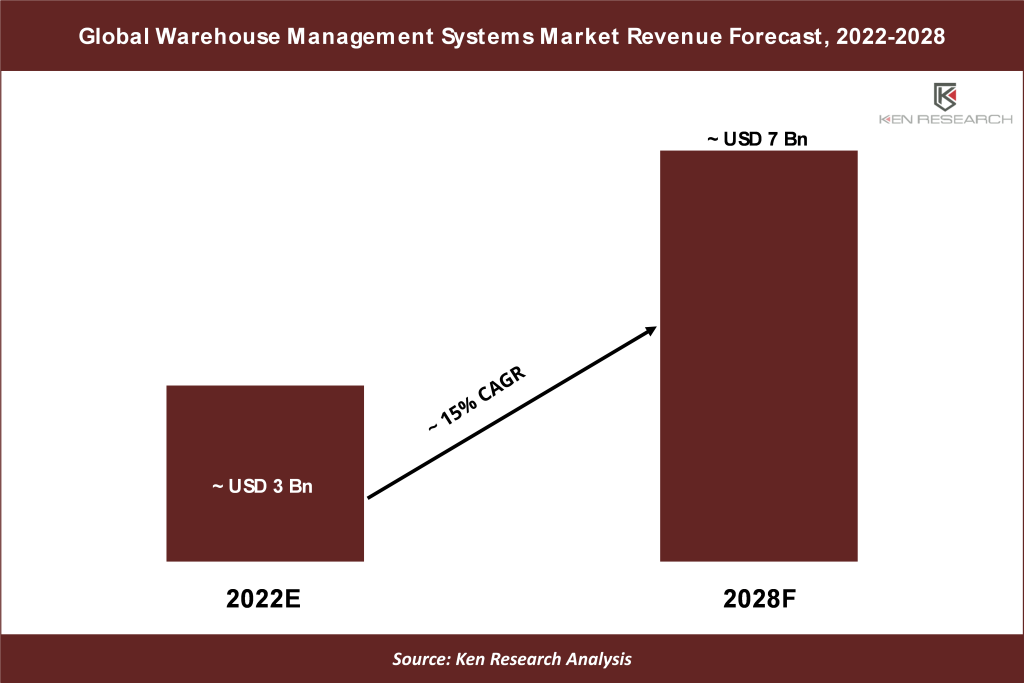

According to Ken Research estimates, the Global Warehouse Management Systems Market – which grew from ~US$2 Billion in 2017 to ~ US$3 Billion in 2022 – is forecasted to grow further into ~ US$7 Billion opportunity by 2028. Ken Research shares 5 key insights on this high opportunity market from its latest research study.

- The market is anticipated to grow at a CAGR of ~15% by 2028 as a result of rapidly changing customer demand and companies' usage of different supply chain strategies.

The Global Warehouse Management Systems Market witnessed a significant expansion, primarily due to the latest development in global logistics, including delivery KPIs, enhanced supply chain flexibility, and cost-cutting, which have pushed 3PL and the supply chain sector to adopt warehouse management systems. The Warehouse Management System Market is expanding due to rising e-commerce and customer online purchasing behaviors. Foreign investments in developing economies are being fueled by several factors, including favorable trade conditions, progressive government policies, and lower company taxes. Due to Industry 4.0 and digitization, one of the key segments of the WMS market in emerging countries has expanded quickly over the analyzed period. WMS demand is expected to increase significantly as a result of shifting supply chain strategies used by product producers and quickly rising consumer demand, particularly in the transport & logistics, and retail industries. One of the key factors driving the market expansion is the requirement for manufacturers to automate warehouse management procedures and reduce costs globally. The system's capacity to deliver goods quickly through the shortest shipping routes could be the cause of the system's skyrocketing demand. The market is forecast to reach ~US$7 Bn by 2028 from ~ US$3 Bn in 2022, witnessing a CAGR of ~15% during this period.

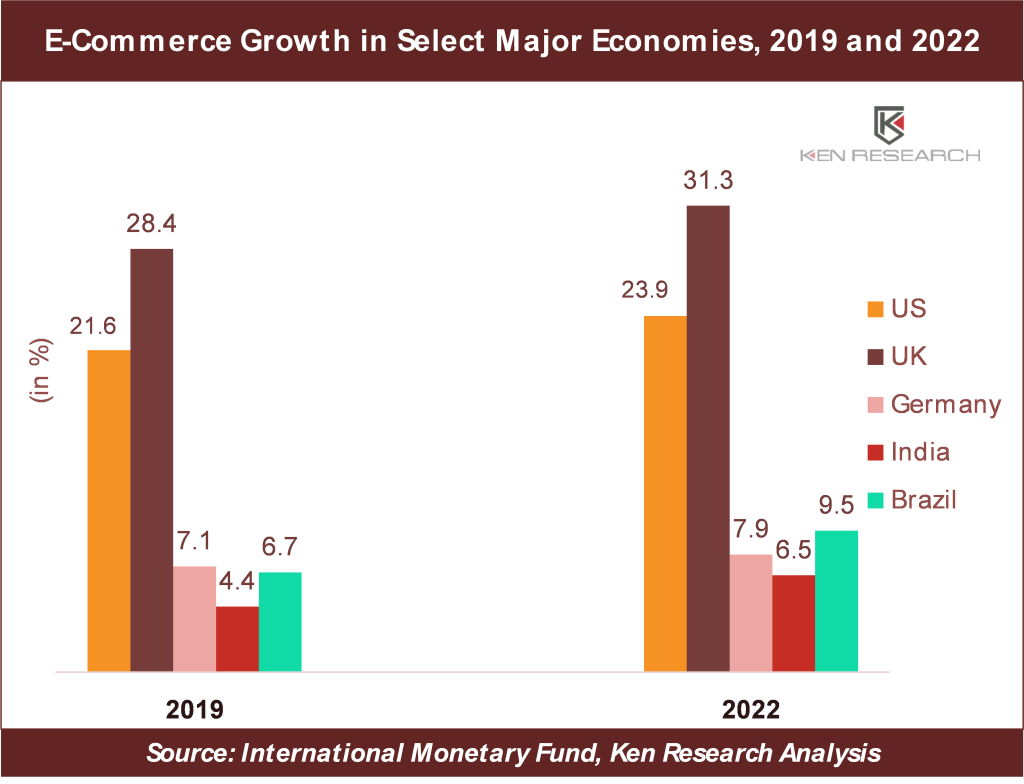

- An Increase in E-Commerce Demand Is Propelling the Worldwide Market for Warehouse Management Systems.

A major factor driving the warehouse management systems market is the rise in the e-commerce sector as a result of the COVID-19 pandemic. The warehouse management system, which is used to monitor orders, pick products, manage the placement of bins, shelves, and/or pallets, and keep track of product returns, is crucial to the operation of e-commerce. It is crucial to automate the process for accurate allocation, packaging, and shipment of orders because the demand for e-commerce products fluctuates frequently and causes a significant number of backorders. The emergence of cutting-edge technology, including cloud computing and software-as-a-service (SaaS), among many others, has drawn supply chain operators' attention to the adoption of warehouse management systems by offering an end-to-end operation with higher efficiency and transparency.

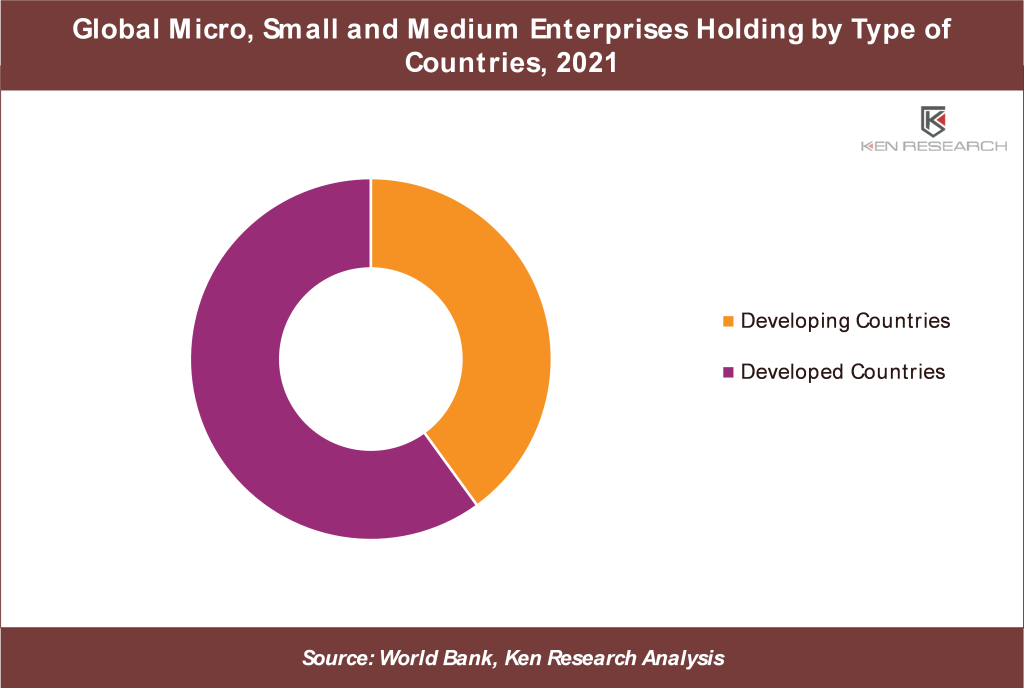

- A Significant Barrier to The Market's Growth Is Small-Scale Industries' Lack of Understanding of WMS.

Small-scale businesses typically employ outdated methods to run their warehouses. Small-scale business owners may view the costs associated with installing a WMS as an unnecessary outlay given the low annual income of these sectors. Similar to that, they have a limited workforce, making it difficult and expensive to hire a trained individual to maintain WMS. Business owners in small-scale sectors sometimes fail to understand the advantages of adopting WMS because they are reluctant to replace outdated systems and have constrained expansion plans.

Furthermore, the deployment of WMS requires substantial investments, and WMS comes at a high upfront cost. The adoption of WMS by small-scale enterprises is additionally constrained by the additional expenses associated with license purchases, upgrades, and employee training during the deployment process.

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDE2

WMS implementation improves labor productivity, lowers operating costs, and warehouse operations efficiency. The players in the WMS industry, however, have difficulty because small-scale industries are not aware of the advantages of WMS. The International Finance Corporation (IFC), in 2019 estimated that 65 million firms, or 40% of formal micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financing need of US$5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending.

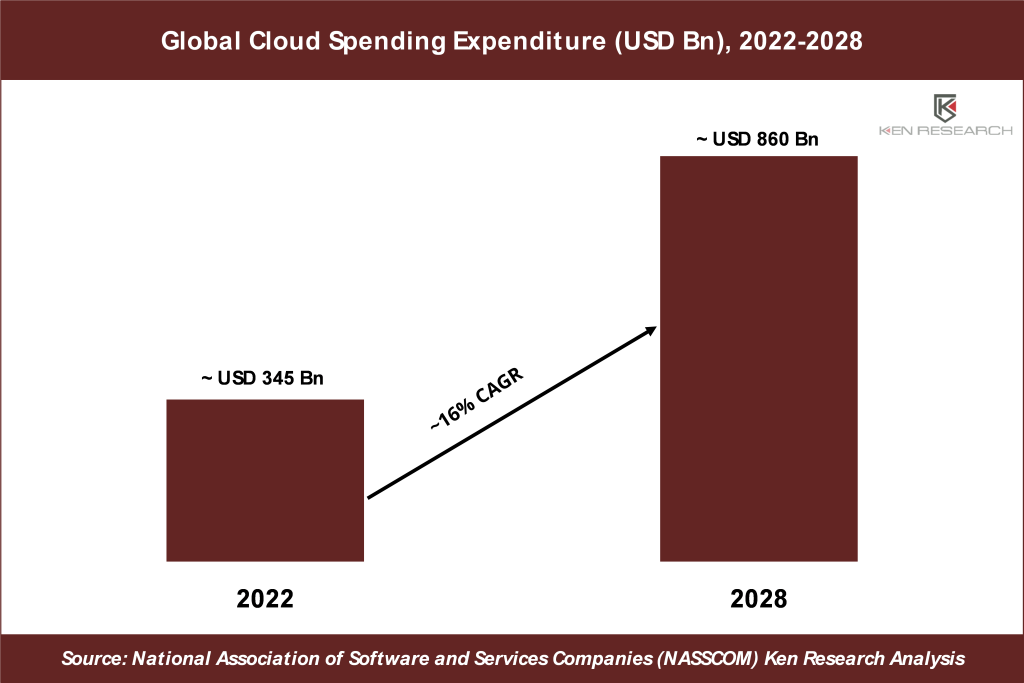

- Cloud-Based Segment to Dominate the Market as It Boosts Warehouse Productivity.

Cloud-based services are completely web-based and accessible from any device with an internet connection. The organization doesn't need to retain any hardware on its premises because other servers are used to operate and store the program data. The client's involvement with cloud-based services is minimal because the service provider handles the majority of the installation and management remotely. A business can manage its inventory operations effectively and comprehensively with the help of a cloud-based warehouse management system. They no longer need to install bulky physical servers and deal with their expenses and complications. This enables them to concentrate on their primary tasks, such as production, sales, and marketing. This is the main reason why the majority of businesses opt for cloud-based WMS for their warehouses from the initial phase.

The world's first enterprise-class cloud-native warehouse management system (WMS), which incorporates all facets of distribution and never needs upgrades, was unveiled in May 2020 by Manhattan Associates Inc., a leading provider of warehouse management software. Manhattan Active WM introduces a new level of speed, adaptability, and usability in distribution management because it is entirely composed of microservices and is very elastic. The National Association of Software and Services Companies (NASSCOM), in 2019 stated that Cloud computing expenditures are estimated to reach USD 345 billion by 2022 and expand at a CAGR of ~16% to reach USD 860 Bn by 2028.

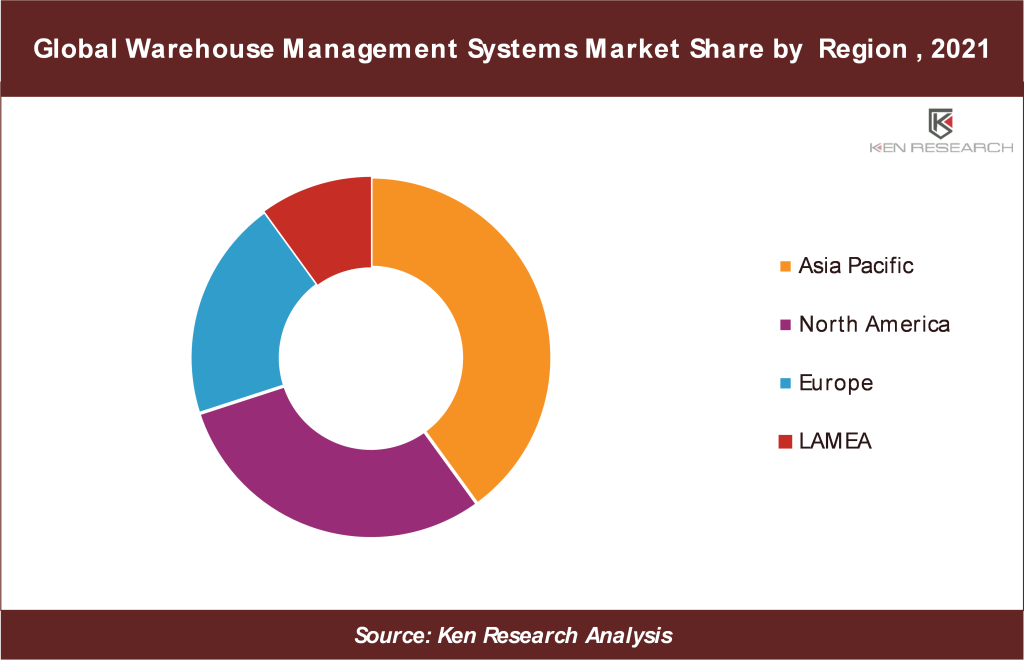

- Asia Pacific is Projected to be the Fastest Growing Region in the Global Warehouse Management Systems Market.

The expansion of the WMS market in the Asia Pacific region is being fuelled by the presence of growing nations like India, Bangladesh and many more. The Indian government's "Make in India" program has sparked the development of manufacturing and storage facilities there. India is also pushing toward modern engineering, manufacturing, and digitization. The country is proposing and building new industrial facilities for the healthcare and automobile industries. One of the biggest consumers of energy and power in India. India is going toward sustainable and renewable sources because of its huge energy consumption, and solar energy is one of such sources. In every region of India, new manufacturing facilities are being established to produce electric vehicles and solar equipment. A market opportunity for warehouse management systems is being created in the Asia Pacific region as a result of all these changes.

For more information on the research report, refer to the below link:

Follow Us

LinkedIn | Instagram | Facebook | Twitter

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

No comments:

Post a Comment