The report titled publication

“Brazil Diagnostic Labs Market Outlook to 2025 - by Type of Labs (Single Independent and Chains), By Application (Clinical Analysis and Radiology), By Region(South-East, South, North-East, Mid-West, and North), By Revenue Source (Healthcare Plan Operators and Insurers, Out-of-Pocket and Public System)” provides a comprehensive analysis of the Diagnostic Labs market in Brazil. The report also covers the overview and genesis of the industry, overall market size in terms of revenue, Number of Exams and Number of Patient Service Centers. It also includes segmentation on the basis of Lab type, sales by region, by Application and end-user, trends, and developments, issues, and challenges, government regulations, value chain analysis, SWOT analysis, competitive scenario and company profiles of major players. The report concludes with future market projection and analyst recommendations highlighting the major opportunities and cautions for new and existing players in the market.

Brazil Diagnostic Labs Market Overview and Size

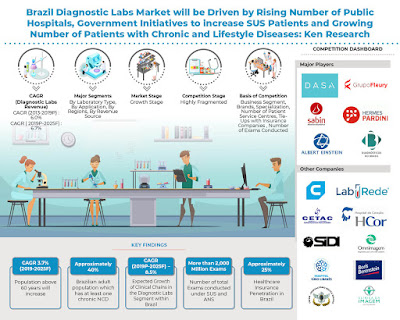

Brazil Diagnostic Labs market in terms of revenue increased at a single-digit CAGR during the review period 2013-2019P. The market has witnessed significant growth owing to the presence of many independent laboratories. The intensity of competition among independent labs and clinical chains, increasing healthcare expenditure, improving healthcare infrastructure, rising elderly population, and insurance penetration will improve the revenues from Diagnostic Labs in the country. The growing demand for routine tests and cost per test are the parameters that will affect the growth in the revenues of the Diagnostic Labs market.

Brazil Diagnostic Labs Market Segmentation

By Single Independent and Clinical Chains: Brazil is a highly fragmented market with the presence of many independent labs and clinical chains. Clinical Chains largely conduct specialized tests wherein a fully automated system is used during the examination. Independent laboratories on the other hand generally conduct Radiology examinations and capture the audience of the regions they are present in.

By Application: Clinical Analysis has dominated the market in terms of the number of examinations conducted as a majority of the population takes all the tests that are recommended due to lower costs associated with such types of examinations. However, radiology accounted for comparatively the highest percentage share in terms of revenue largely due to the cost variations that are associated with these types of tests.

By Clinical Analysis: Routine tests accounted for the highest percentage share in terms of a number of exams and in revenue during the year 2019P largely due to the knowledge, awareness and high recommendation of these tests by the doctors or physicians during any clinical check-up.

By Radiology: X-Rays accounted for the highest percentage share in terms of a number of exams in the country. It is followed by an Ultrasound that is largely conducted for Gynecology and Obstetrics. MRI and CT scans accounted for the lowest share in terms of a number of examinations conducted during the year 2019P.

By Region: Southeast the region in Brazil that includes Sao Paulo and Rio de Janeiro accounted for the highest revenue share in 2019P due to the highest number of laboratories in the following states, highest population ratio with a larger number of an aging population and high purchasing power in that region. Southeast region is followed by the South and Northeast regions in Brazil comparatively due to a large number of laboratories and populations in that region.

By Revenue Source: Healthcare plan operators and insurers are the major sources of revenue in this sector. Since the costs associated with these tests are usually high, people tend to go with the insurance. It was then followed by Out-of-Pocket expenses made by Brazilians. Public System accounted for the least percentage share in terms of overall revenue from the diagnostic labs market in Brazil.

Competitive Landscape

Diagnostic Labs in Brazil is a highly fragmented market with more than 20,000 laboratories in the country. The laboratories in the country compete on the basis of parameters that include a number of examinations, examination portfolio, equipment used, number of service centers, number of brands, regional presence, the price per test, revenues, marketing activities and tie-ups with Public and Private Hospitals, Clinics and Health Insurance Companies. Some of the major diagnostic groups that are present in Brazil include DASA Group, Fleury Group, Hermes Pardini, Alliar Medicos a Frente, Diagnostics do Brasil, Sabin Diagnostica and others. Players that provide diagnostic imaging services in Brazil compete largely on the basis of prices, however clinical analysis players, on the other hand, compete on the basis of the number of examination offerings.

Brazil Diagnostic Labs Market Future Outlook

Diagnostic Labs industry in Brazil is expected to witness a single-digit growth rate in the forecast period 2019-2025. Rising penetration of insurance, increasing per capita health expenditure and fully automated processes to manage higher workload in laboratories in Roraima, Alagoas, Sergipe and Tocantins, the states of Midwest and North region are expected to drive the revenues from the Diagnostic labs market in the coming years.

Key Segments Covered:-

By Type of Labs

Single Independent

Chains

By Application

Radiology

MRI

CT scan

Ultrasound

X-Ray

Others

Clinical Analysis

Routine

Specialized

By Region

South-East

South

North-East

Mid-West

North

By Revenue Source

Healthcare Plan Operators and Insurers

Out-of-Pocket

Public System

Key Target Audience

Medical Device Manufacturers

Medical Device Distributors

Public and Private Hospitals

Medical Device Importers

Diagnostic Lab Players

Government Associations

Diagnostic Imaging Device Companies

Time Period Captured in the Report:

Historical Period: 2013- 2019P

Forecast Period: 2020 – 2025

Companies Covered:

Albert Einstein Medicina Diagnostica

Alliar Medicos a Frente

Boris Berenstein

BP Medicina Diagnostica

Cedi

Cepem

CETAC

Clinica da Imagem do Tocantins

Clinica Imagem

Cura

DASA

DB Diagnosticos do Brasil

DMS Burnier

Grupo Fleury

HCOR

Hermes Pardini

Hospital Sirio-Libanes

Lab Rede

Omnimagem

Sabin Medicina Diagnostica

Senne Liquor Diagnostico

Sidi

Sir Radiologia

Key Topics Covered in the Report:-

Brazil Diagnostic Labs Market Value Chain Analysis

Brazil Diagnostic Labs Market Overview and Genesis

Brazil Diagnostic Labs Market Size

Brazil Diagnostic Labs Market Segmentation

SWOT Analysis in Brazil Diagnostic Labs Market

POCT Market in Brazil

Competitive Scenario in Brazil Diagnostic Labs Market

Brazil Diagnostic Labs Market Future Projections, FY’2019-FY’2025F

Analyst Recommendations

For More Information on the research report, refer to below link:-

Related Reports by Ken Research:-

India POCT Market Outlook to 2023 - By Major Devices (Blood Glucose Testing Kits, Infectious Disease Testing Kits, Blood Gas Electrolytes, Pregnancy and Fertility Testing Kits, Cardio-Metabolic Monitoring, Anticoagulant Management, Cholesterol Testing Kits and Others), By End Users (Hospitals & Clinics, Consumers/ Individuals, Diagnostic Labs, Home Healthcare and Others), By Distribution Channel (Distributors and Direct Sales), By Consumables and Instruments and By Region