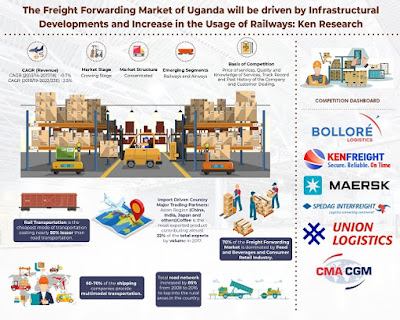

Due to the government policies, tax slabs and monopoly of international players, the freight forwarding market of Uganda has experienced a slow growth rate in 2017/18.

Analysts at Ken Research in their latest publication “Uganda Freight Forwarding Market Outlook to 2023 – By Rail, Land, Air Freight Forwarding; International and Domestic Freight, Integrated and Contract Logistics Freight Forwarding; By End Users (Food, Beverages, and Consumer Retail, Automotive Industry, Healthcare, Others)” believe that the Freight Forwarding Market of Uganda is experiencing slow growth due to the government regulations. In the previous elections, the tax slabs were increased tampering the growth of the market. Being landlocked investments must be directed towards roadways and railways in order to improve land freight and help the market grow.

High Traffic at Borders: Being a landlocked country, Uganda resorts to multimodal transportation for most of its cargo. 70% of the cargo comes in from Mombasa which has led to a 6% increase in traffic at the borders in 2016. The development of roads will help curb this problem.

Government Initiative: Government had introduced a Northern Economic Corridor multi-modal plan consisting of road, rail, pipeline and inland waterways transport to link Uganda to Kenya, Rwanda, Burundi, the Democratic Republic of Congo and Southern Sudan. It’ll help bridge the gap between countries by providing a modal shift function among rail, truck, and the inland waterway. It also focuses on reducing export cost by improving container depot functions.

Discovery of Oil: In 2006 the country had confirmed its discovery of oil. The logistics companies had played a vital role in building on it post 2006. The equipment will be transported from Busia using the port of Mombasa and Mutukula using the port of Dar-es-Salaam of Tanzania. Once the oil and gas in Uganda get functional the increase in the jobs has been estimated to be 150,000 a part of which is said to be specifically for the logistics companies.

Focus on International Trade: The AfCFAT agreement between the African regions is expected to increase the Intra African trade by 52.3%. Uganda is mainly an import driven country and the government is focusing on its FTAs in order to increase trade with neighboring countries.

Rise in Technology: The freight forwarding companies are focusing on technologies that would help them keep a track of the cargo being transported preventing the loss of cargo and allowing timely delivery of products. Asycuda World is an online portal which helps keep a track of all the sea cargo which is unloaded at Mombasa and brought to the country by road.

Key Segments Covered:-

Freight Forwarding Market By

Freight Revenue by Mode

Road Freight (Revenue, Cost, Major Developments, Road Categories, Major Products transported, Major Companies

Rail Freight (Revenue, Volume, Railway Network, Major Product’s transported, major companies)

Air Freight (Revenue, Cargo Traffic, Cost, Import and Export of Mails, Commercial-Non commercial movements, Major products transported, Major Companies)

Revenue by Freight

Domestic Freight (Revenue, Road Freight, Air Freight, Rail Freight)

International Freight (Revenue, Road Freight, Air Freight, Rail Freight)

Freight Revenue by Flow Corridors

Asian Region

Common Market for Eastern and Southern Africa (COMESA) Region

European Union

North America

Others (includes South/Central America, other African regions)

Freight Revenue by Contract Logistics and Integrated Logistics

Freight Revenue by End Users

Food, Beverages and Consumer Retail

Automotive

Health Care

Health Care

Others (includes construction, chemicals and others)

Key Target Audience

Trucking Companies

Express Logistic Companies

E-commerce Logistics Companies

Airlines

Shipping Companies

Contact Logistics Companies

Mail/ Courier/ Postal Companies

Time Period Captured in the Report:-

Historical Period: 2013-14 to 2017-18

Forecast Period: 2018-19 to 2022-23

Companies Covered:-

Bollore Transport and Logistics Uganda

Spedag Interfreight Uganda Ltd

Maersk Uganda Ltd

Kenfreight Uganda Ltd

CMA CGM Uganda Ltd

Union Logistics Uganda Ltd

Keywords:-

International Freight Companies in Uganda

Uganda Freight Forwarders

Warehousing & Freight Forward Services in Uganda

Sea Freight Clearing and Forwarding Rates Uganda

Uganda Freight Forwarding Market Future Outlook

Cost air express and ground express services Uganda

Bollore Transport Freight Forwarding Revenue

Freight Forwarding Trucking Companies Uganda

Freight Forwarding Market Uganda

Freight Forwarding Industry Uganda

Number of cold storage warehouse in Uganda

Demand for owned and 3PL warehouse in Uganda

Cost of setting up a warehouse in Uganda

Uganda International Freight Revenue

For More Information, Refer To Below Link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249