Introduction: Understanding the Landscape of the Gold Mining Industry

The Global Gold Mining Industry stands as a cornerstone of the economy, providing essential raw material for various sectors, including jewelry, electronics, and investment. In this comprehensive exploration, we delve into the dynamics of the Gold Mining Market, uncovering trends, insights, and growth prospects shaping its trajectory.

Market Overview:

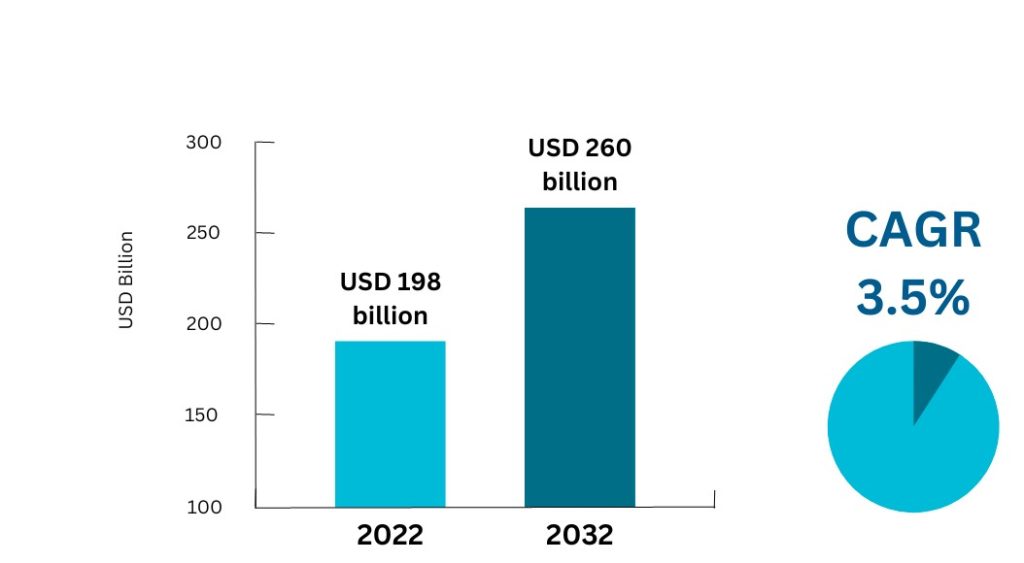

The global gold mining market is currently valued at approximately USD 198 billion, with an expected growth to USD 260 billion by 2030, driven by a Compound Annual Growth Rate (CAGR) of 3.5%. This growth is propelled by several factors, including the rising demand for jewelry, economic uncertainty, and preferences for safe-haven assets. While traditional markets like North America and Europe remain significant, Asia Pacific emerges as a region with rapid growth potential, fueled by increasing urbanization and disposable incomes.

Key Stats:

- Production: In 2022, global gold production reached 3,000 tonnes, with leading producers being China, Australia, Russia, and the United States. These countries boast rich reserves and advanced mining infrastructure, contributing significantly to global supply.

- Demand: The demand for gold is multifaceted, with jewelry accounting for the largest share (50%), followed by central bank reserves (20%) and industrial uses (10%). The enduring allure of gold as a symbol of wealth and status drives demand, particularly in emerging economies like China and India.

- Prices: Gold prices are currently hovering around USD 1,850 per ounce, reflecting market sentiment influenced by geopolitical tensions, economic indicators, and investor sentiment. Price volatility is a characteristic feature of the gold market, presenting both opportunities and challenges for industry participants.

Actionable Insights:

- Invest in Exploration and Development: With increasing demand driving the need for new sources of gold, investment in exploration and development of new deposits is crucial. Exploring under-explored regions, such as Africa and South America, offers opportunities for discovering untapped reserves.

- Technological Advancements: Embracing technological innovations can enhance operational efficiency, reduce costs, and mitigate environmental impacts associated with gold mining. Adopting advanced exploration techniques, automated mining equipment, and sustainable practices can optimize resource extraction.

- Sustainability Initiatives: As environmental and social considerations gain prominence, integrating sustainability into mining operations is imperative. Implementing responsible mining practices, minimizing carbon footprint, and engaging with local communities can enhance the industry's social license to operate.

- Diversification Strategies: Given the cyclicality and volatility of the gold market, diversifying business portfolios can hedge against market risks. Exploring opportunities in related sectors, such as precious metals, commodities, or technology, can offer avenues for growth and resilience.

- Market Monitoring: Keeping abreast of geopolitical developments, economic trends, and regulatory changes is essential for navigating the complexities of the Gold Market. Monitoring shifts in consumer preferences, technological advancements, and investment patterns can inform strategic decision-making.

Challenges and Opportunities:

- Environmental Concerns: Addressing environmental challenges, such as habitat disruption, water pollution, and deforestation, requires proactive measures and adherence to stringent regulations. Implementing sustainable mining practices and leveraging technology for environmental monitoring and remediation can mitigate adverse impacts.

- Regulatory Compliance: Navigating regulatory frameworks and obtaining permits for mining projects can be time-consuming and complex. Regulatory compliance, including environmental assessments, land-use approvals, and community consultations, is crucial for securing operational licenses and maintaining stakeholder trust.

- Market Volatility: Gold prices are susceptible to market volatility driven by geopolitical tensions, economic uncertainties, and currency fluctuations. While price volatility presents trading opportunities, it also poses risks for producers and investors. Strategies for managing price risk, such as hedging, diversification, and cost optimization, are essential for safeguarding profitability.

- Supply Chain Disruptions: Disruptions in the global supply chain, such as labor shortages, logistical bottlenecks, and geopolitical conflicts, can impact production and distribution. Developing resilient supply chain networks, enhancing local sourcing capabilities, and leveraging digital technologies for supply chain management can mitigate risks and ensure continuity of operations.

Conclusion:

The global gold mining market presents a dynamic landscape characterized by opportunities and challenges. Industry stakeholders must adapt to evolving market dynamics, embrace innovation, and demonstrate commitment to sustainability to thrive in a competitive and rapidly changing environment. By leveraging technological advancements, adhering to responsible mining practices, and fostering stakeholder partnerships, the gold mining industry can sustainably meet the growing demand for this precious metal while contributing to economic development and social progress.