What Is The Competition Scenario In Italy Used Car Market?

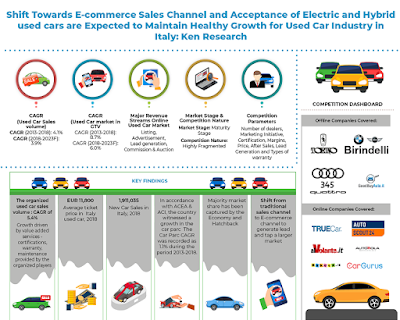

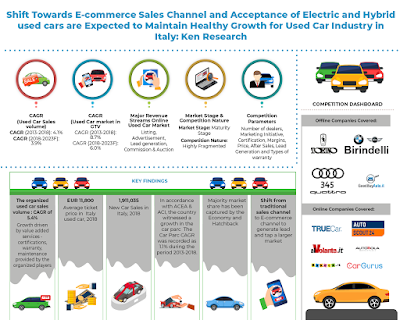

Competition within Italy used cars the market was observed to be highly fragmented along with the presence of a large number of OEM certified dealerships, local dealers, multi-brand dealers, and individual sellers.

The OEM-certified dealers and multi-brand dealers make up the organized space in the used car market which accounts for around ~% of the market share in 2018. The multibrand dealership was observed to dominate the organized market of Italy with a market share of ~% in the year 2018. The local dealers and the individual seller’s together form the unorganized space in the overall used car market in Italy, which accounts for approximately ~% market share in the country, 2018. Major leaders in the offline dealerships in Italy used the car market include Auto Torino, Denicar FCA, Birindelli Auto Srl, Mocautogroup, GoodBuyAuto, Autoquattro, Schiatti Car Srl, Auto 500 and others. The online used car leaders in Italy used car market include true car, Autoscout24, Bakeca.it, Alvolante.it and other.

Most of the lead generation of the used car is contributed from the offline dealership stores. This is due to high reliability towards the offline dealerships as compared to booking the used cars online. Parameters on the basis of which the used car dealerships compete are Number of dealers, Marketing Initiatives, Certification, Margins, Price, after-sales, Lead generation and Types of warranty.

Snapshot on Online Used Car Market

The surge in the number of online used car companies has to lead to an increase in the listing and advertisements by the used car dealers in the country. The online auctions companies’ have eased the process of bidding in an auction hazel free at the consumer’s convince. The customers can bid on the used cars in the auction without even visiting the store, which has contributed to the development of the online auction market of used cars. Few popularly used car brands amongst the Italy online portals are Fiat, Volkswagen, Renault, Ford, and others. According to the industry articles, 70% of the consumers look for a used car online and then make a purchase at the store.

The used car dealerships in Italy have shifted from the traditional sales channel to the E-commerce sales channels owing to the increasing preference of the customers to search for a used car online before purchasing from a dealership. The online used car companies have made a comparison and the valuation of the used cars easier, attracting more customers.

Italy has witnessed a huge number of online searches for used cars as stated by INDICATA for the first seven months of 2019, which is expected to continue in the future.

The growth stage of the online channel for lead generation in Italy is at a growth stage with increasing preference of consumers to search for a used car online. Some of the leading players in the online used car market include Truecar, Autoscout24, Bakeca.it, Alvolante.it, Autorola Marketplace, Cargurus, BCA, Adesa, and others.

Snapshot on Auction Market

Used car Auction or Auto auctions are a method of selling the used cars at a platform (online or offline) where a large number of bidders bid on the used cars and the final bid the sale price of the used car. The dealers and the private individuals have a chance to get the used cars at a very low cost at the used car auctions. The price dealers pay for cars at auction vary with the age and model of the vehicle, the level of repair required before retail and the type of auction where it is sold.

The country has witnessed growth in the online used car auction platforms, which has eased the purchase of a used car for the customers. Car brokers with dealer licenses can give ordinary buyer’s access to cars that otherwise only dealers could buy. As a result, the car auction industry has grown in size and popularity, making it an excellent resource. Auctions take place in many forms such as Physical Auctions (In-lane auctions), digital auctions and mobile auctions.

few major players in the used car auction industry in Italy are BCA (British Car Auction), ADESA (Cars on the web), Autorola Marketplace, Aste Auto and others. However, the market in Italy is saturated in terms of a number of auction dealers in the used car space.

There are different types of used car auctions which include Dealer auctions, Dynamic auctions, Blind Auction, Target the auction, and Buy now auction, Fleet auction, and Manufacturing auction.

Italy Used Car Market Future Outlook and Projections

Over the forecast period 2018-2023F, Italy Used Car market Gross Transaction Value (GTV) is further anticipated to increase to EUR ~ Billion by the year 2023F, thus showcasing a CAGR of ~%. The used car sales in Italy are forecasted to expand from ~ thousand units of used cars sold in 2018 to ~ thousand units of used cars sold in 2023F, growing at a Compound Annual Growth Rate (CAGR) of ~%. The country is also expected to witness growth in the average ticket price of a used car in the next few years by a CAGR of ~% during the period 2018 to 2023F. Low prices, easy availability of spare parts and higher resale value are some of the reasons contributing to the popularity of used cars in Italy. Rental companies have become one of the important sources of cars entering the used car market in Italy which has contributed to the growth of the market. The country is witnessing an increase in the number of used car dealers who are advertising their used cars for sale to the customers. The presence of these online portals in the country has made it convenient for the sellers as well as the consumers to meet at an online portal for the sale and purchase of the used cars. Demand for electric and hybrid cars is anticipated to grow in the future and would eventually lead to the growth of the used car market.

Key Segments Covered:-

By Type of Market Structure:

Organized Market

Multi-brand Dealerships

OEM Certified Dealerships

Unorganized Market

Customer to Customer

Online Sales

Local Dealers

By Car Make:

Fiat

Volkswagen

Renault

Ford

BMW & Mini

Opel

Mercedes

Audi

Toyota

Citroen

Nissan

Skoda

Others (Peugeot, Jeep, Dacia, Hyundai, Lancia, Kia, Alfa Romeo, Suzuki, MCC, Mini, Seat, Volvo, Land Rover, Mazda, Jaguar, Honda, Mitsubishi, Porsche, Subaru, Maserati, Ssangyong, Dr, Mahindra, Ferrari, Lotus, Lada and rest)

By Year of Ownership:

<2000

2000-2002

2003-2005

2006-2008

2009-2012

2013-2018

By Kilometers Driven:

Less than 5,000

5,000-20,000

20,000-50,000

50,000-80,000

80,000-120,000

Above 120,000

By Type of Used Cars:

Economy/Hatchback

MPV’s/Sedan

SUV’s

Key Target Audience

Offline Dealers

Online Portal

Organized Multi Brands Dealers

OEM Certified Dealerships

Online Portal

Private Equity and Venture Capitalist

Industry Associations

OEM Manufacturers

Automotive Manufacturers

Car Auction Companies

Time Period Captured in the Report:-

Historical Period - 2013-2018

Forecast Period – 2019-2023

Companies Covered:-

Online Dealerships:

True Car

Autoscout24

Bakeca.it

Alvolante.it

Autorola Marketplace

Cargurus

Offline Dealerships:

Auto Torino

Denicar FCA

Birindelli Auto Srl

Mocautogroup

GoodBuyAuto

Autoquattro

Schiatti Car Srl

Auto 500

Key Topics Covered in the Report:-

Ratio of used to new cars Italy

Italy Used Car Market

Used Cars for Sale in Italy

Used cars from Italy

Import of used cars in Italy

Online listings used cars in Italy

Used Car Auction Italy

Second-hand cars by Kilometer Driven

Types of Used Cars in Italy

Transfer of Ownership in Italy

Used cars for sale in Milano Italy

Multi-Brand Used Car Dealership Market

Online Used Car Market Business Model

Best Selling Used Cars Market in Italy

Repossessed Cars for Sale in Italy

For More Information On The Research Report, Refer To Below Link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249