Wax is a broad category of organic compounds that are lipophilic and bendable solids at room temperature that tend to melt at a higher temperature. It includes lipids and higher alkanes that are insoluble in water but soluble in nonpolar, organic solvents. Wax is generally derived from petroleum and bio-based resources which are extracted from crude oil refining. These materials include base oil, natural gas, compounds like polyethylene, plants, and the skin of animals. Wax has applications across paints, bundling, hardware, electrical, ink and coatings, elastic, pharmaceuticals, and beautifying agents.

According to Ken Research Analysis, the Global Wax Market was valued at US$ 5 billion in 2017. Furthermore, owing to the growing demand for wax in various industries for its superior properties like high gloss acting as water and chemical resistance, it is estimated to be US$ 10 billion in 2022 and is expected to reach a market size of US$ 14 billion by 2028 growing with a CAGR of 5%.

For more information, request a free sample @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDE3

Key Trends by Market Segment

By Product Type: The petroleum and mineral wax segment held the largest market share in 2021 of the Global Wax Market according to Ken Research analysis.

- The growth is primarily attributed to the growing demand for petroleum and mineral wax from different end-user sectors such as lighting, packaging, cosmetics, pharmaceutical, and coatings.

- Petroleum and mineral wax have widespread availability, low cost, ease of manufacturing, and catering to the need of various end users are driving the growth of the petroleum and mineral wax market.

- China’s National Development and Reform Commission, stated that the domestic sales of apparel and knitwear stood at around US$ 172.4 billion for the first 11 months of 2019, which represents a growth of about 3% Y-o-Y over the same period in 2018, hence leading to increase in demand for petroleum and mineral wax.

For more information, request a free sample @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDE3

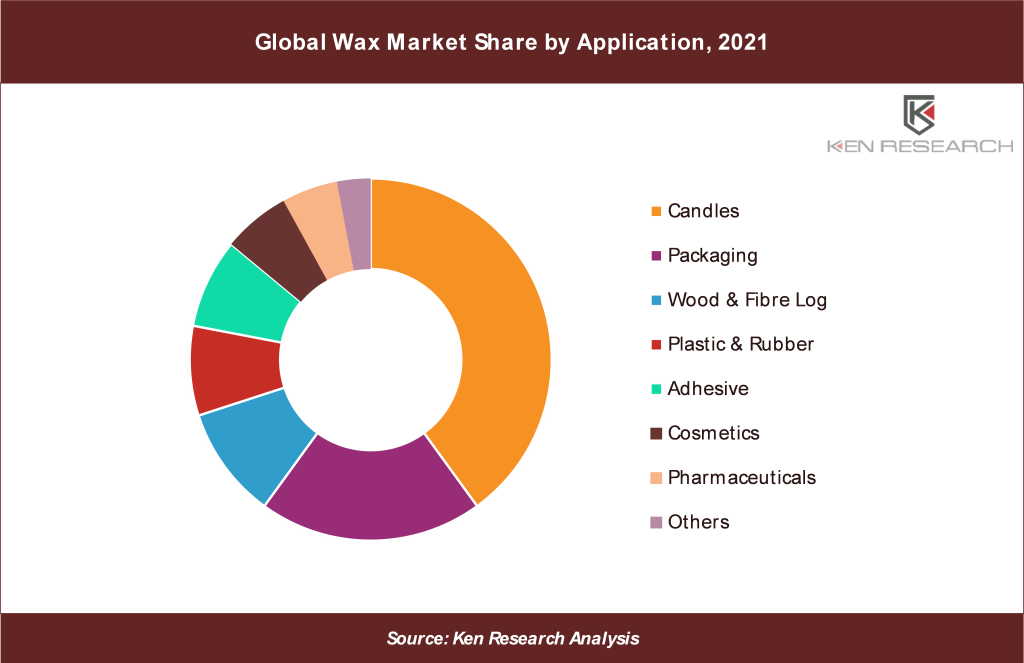

By Application: The candle segment held the largest market share in 2021, owing to the growing demand for aromatherapy through scented candles.

- The use of candles has become a critical household essential, for relaxation, stress reduction, and home decor. The increasing number of distribution channels such as decor, mass merchandise stores, and e-commerce platforms aided the demand for candles worldwide. Candles are considered the most appropriate gifts for Christmas, birthdays, housewarming parties, and others and thus are always in higher demand during the festive seasons.

- According to European Candle Manufacturers Association approx. 140 tons were exported in 2021 as compared to 124 tons in 2020.

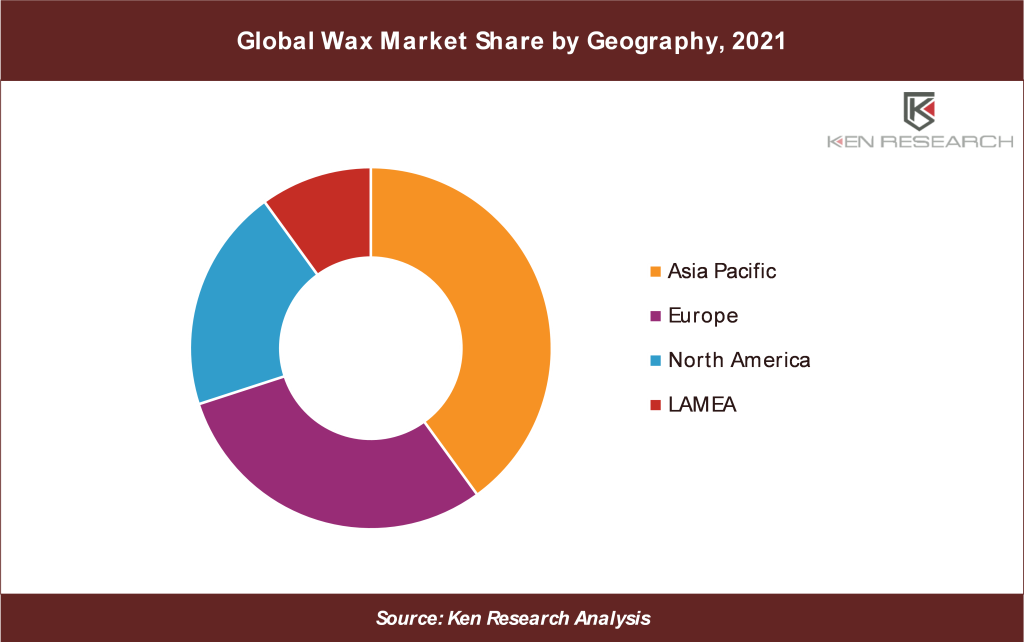

By Geography: Asia Pacific is expected to account for the largest share among all regions within the total wax market, during the forecast period 2022-2028

- The growth is primarily due to the rising living standards and increasing industrialization, specifically in countries like China and India. The low labor, raw material, and operational costs are also major factors propelling the growth in the Asia Pacific region. The region’s usage of cosmetic and personal care goods is expanding owing to the result of increased attention on personal appearance, and an aging population.

- China is one of the largest producers, consumers, and importers of wax, and India is one of the largest producers of beeswax in the world. India has the potential to keep 200 million bees council capable of producing over 15 kilotons of beeswax, according to the Economic Advisory Council Beekeeping Development Report 2019.

To more regional trends, Ask for a Customization @ https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2MDE3

Competitive Landscape

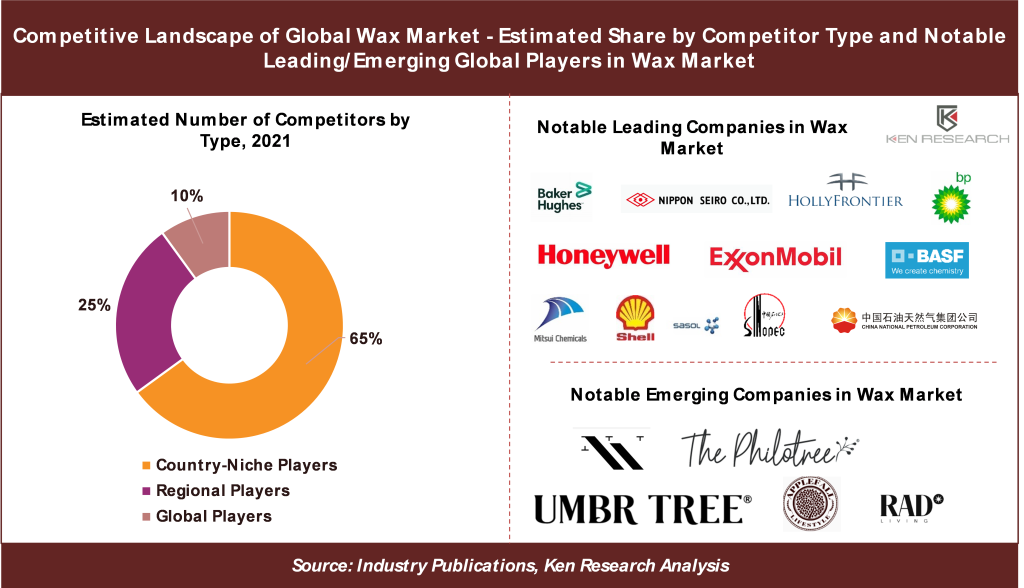

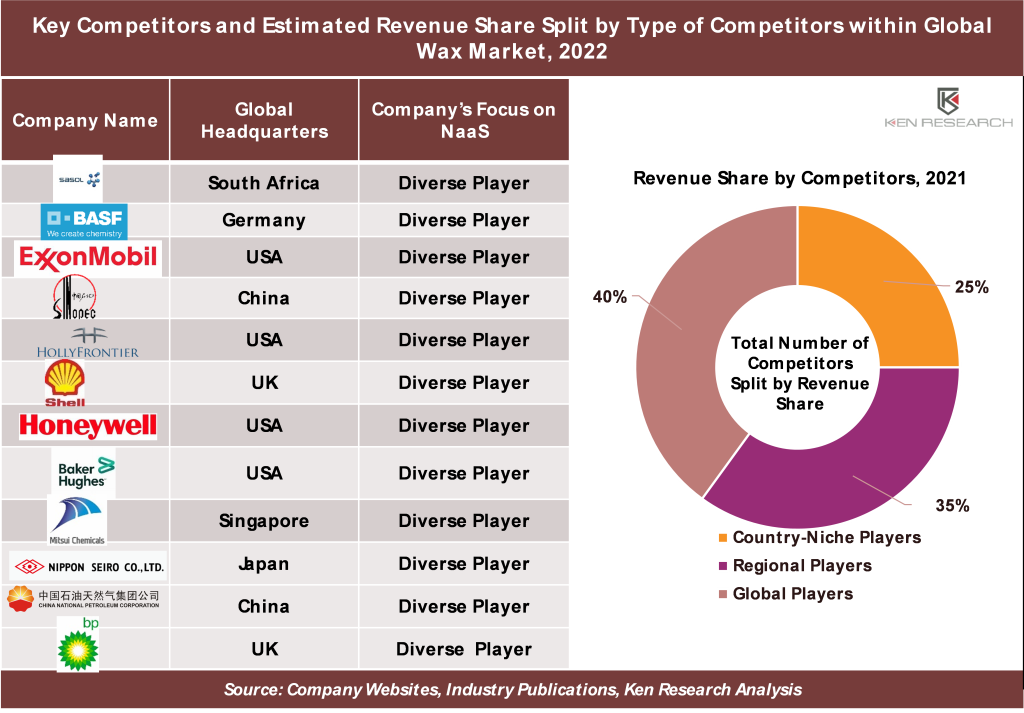

The Global Wax Market is highly competitive with ~350 players which include globally diversified players, regional players as well as a large number of country-niche players each with their niche in candle manufacturing, plastic, and rubber, adhesive, cosmetic, and pharmaceutical products. Large global players constitute ~10% of competitors, while regional players represent the second largest number of competitors. Some of the major players in the market include Sasol Ltd., BASF SE, Exxon Mobil Corporation, Sinopec Corp, Holly Frontier Corporation, Royal Dutch PLC, Honeywell International Inc., Baker Huges Company, Mitsui Chemicals Inc., Nippon Seiro Co., Ltd, China National Petroleum Corporation, BP PLC., and among others.

Conclusion

The Global Wax Market Size, Segments, Outlook, and Revenue Forecast 2022-2028 is forecasted to continue positive growth during the forecast period primarily driven by the growing demand for wax in various industries because of its superior properties like high gloss, water, and chemical resistance. Though the market is highly competitive with approximately 350 participants, few global players control the dominant share and regional players also hold a significant share. The market size is estimated to be US$ 10 billion in 2022 and is expected to reach a market size of US$ 15 billion by 2028 growing with a CAGR of 5%. Asia Pacific is the dominating region, owing to the rising living standards and increasing industrialization.

Note: This is an upcoming/planned report, so the figures quoted here for a market size estimate, forecast, growth, segment share, and competitive landscape are based on initial findings and might vary slightly in the actual report. Also, any required customizations can be covered to the best feasible extent for Pre-booking clients, and the report delivered within a maximum of two working weeks.

Market Taxonomy

By Product Type

- Petroleum and Mineral Wax

- Paraffin Wax

Microcrystalline Wax

- Synthetic Wax

- Gas to Liquid Wax

Polymer Wax

- Natural Wax

- Beeswax

- Vegetable Wax

By Application

- Candles

- Packaging

- Wood & Fire Logs

- Plastic & Rubber

- Adhesive

- Cosmetics

- Pharmaceuticals

- Others (Rheology, Soap wax, Floor Polishes)

- North America

By Geography

USA

- Canada

- Mexico

Europe

- France

- Italy

- Germany

- Spain

- UK

Asia Pacific

- China

- India

- Japan

South Korea

- Australia

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- Sasol Ltd.

- BASF SE

- Exxon Mobil Corporation

- Sinopec Corp

- Holly Frontier Corporation

- Royal Dutch PLC

- Honeywell International Inc.

- Baker Huges Company

- Mitsui Chemicals Inc.

- Nippon Seiro Co., Ltd

- China National Petroleum Corporation

- BP PLC.