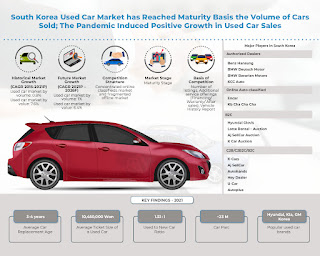

While the Automotive Sectors of Most Countries Struggled to Show Resilience during the Economic Crisis Incited by Covid-19, South Korea’s Used Cars Market Witnessed a Steep Increase in Car Sales: Ken Research

Key Findings

- Online Classified are analysing the patterns of purchase by customers and capturing it through fintech and other tools such as digital marketing, enabling them to provide tailor-made solutions for customer. AI and ML are being used to transform the car buying experience for customers.

- The Dealers in the used car market are scattered and small scale. The primary reason behind this was the law introduced by the Korean Government in 2013 which has been revoked in 2019. Since 2022, domestic new Car players such as Kia and Hyundai are expected to enter the market and provide quality vehicles certified by them.

- Local cars, such as those from Hyundai and Kia, have become pricier, which lowered the entry bar and created room for imported cars to join the market. This will propel growth of the organized used car sector as the sales occurring through the certified pre-owned car dealerships in the country will increase.

Growing demand for Authorized Used Cars Outlets in the Market: Consumers are either scammed by a dealer or they try to directly purchase a used car from an owner to avoid scams. The situation is serious for consumers in terms of both intangible and tangible damages they can suffer. This has led foreign carmakers to actively run secondhand car businesses in South Korea with their own brand authentication systems, to instill trust in drivers buying their used models.

Increasing Used Car Sales due to Covid-19: The pandemic made owning a car an unavoidable aspect of an individual’s life as travelling via public transport can be risky. People who preferred public transport during the pre-Covid times are now the potential customers of the used cars market. Subsequently, the pandemic does not seem to completely subside soon, the demand for used cars will keep increasing. Since most of these people who could not afford a car in the first place would prefer the most optimal solution available, that is, purchasing a pre-owned car.

Growing popularity of Digital Showrooms: The online space in the used cars market has been gaining traction over time on account of Covid-19 protocols that forced several dealers to introduce virtual showrooms. These digital platforms help facilitate minimum in-person contact during the process of selling a car by providing 360 degree view of the interiors of the car to enhance digital experience of consumers. Use of advanced technologies such as AI is helps to valuate car online by providing pictures.

Improved Focus on Value-Added Services: Since there are a higher proportion of organized players in the used cars segment, more dealers have shifted their focus on providing value-added services to survive the increasing competition. It has been observed that many of the multi-brand dealers too have started providing additional services such as extended warranty, insurance, after sales services, assistance in paperwork, etc., to become a ‘one-stop’ destination for used car buyers.

Organized Segment’s Share to Rise: Organized dealers which include authorized or multi brand dealerships with higher inventory or more number of physical outlets in South Korea, contribute to the majority of the market share. The share of organized dealers is expected to further rise in the future as big domestic players are anticipated to enter the market. Moreover, buying used cars from organized players comes with the added advantage of availing maximum value added services. Especially for Medium valued to Premium used cars, it is seen that customers are more concerned about the after sales services and warranties that are provided for the vehicle.

Analysts at Ken Research in their latest publication “South Korea Used Car Market Outlook To 2026: Relaxed Government Regulations on Big Companies Entering Used Car Market to Facilitate Increase in the Used Cars Sales and Improve the Organized Market Share” observed that South Korea is in a growth phase in the used car market in South East Asia and is gradually recovering from the economic crisis after the pandemic. The increasing E-Commerce penetration is giving a boost to this industry. Going forward, the industry is expected to demonstrate further growth in the short-medium term fueled by the growth of online used car platforms that provide convenience to both buyers and sellers. South Korea Used Car Market is expected to grow at a CAGR of 1% on the basis of sales volume over the forecast period 2021P – 2026F.

Key Segments Covered

- By Market Structure

- Organized

- Unorganized

- By Organized Channel Source of Lead generation

- Online

- Dealership walk-ins

- By Sales Channel

- B2C

- C2C

- By Type of Car

- Luxury Sedan

- Sedan

- Hatchback

- SUV

- MPV

- Others (Sports car, Station wagon)

- By Engine Size

- 2000 CC and Below

- 2000 CC – 3000 CC

- 3000 CC – 4000 CC

- 4000 CC and Above

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTE1MDY3

- By Brand

- Hyundai

- Kia

- GM Korea

- Renault Samsung

- Ssangyong

- Benz

- BMW

- Genesis

- Audi

- Volkswagen

- Others (Includes both domestic and international brands)

- By Region

- Gyeonggi

- Seoul

- Gyeongnam

- Gyeongbuk

- Incheon

- Busan

- Chungnam

- Dae-Gu

- Jeonnam

- Jeonbuk

- Chungbuk

- Gangwon

- Gwangju

- Daejeon

- Ulsan

- Jeju

- Sejong

- By Age

- 0-2 Years

- 2-4 Years

- 4-6 Years

- 6-8 Years

- 8-10 Years

- More than 10 Years

- By Mileage

- Less than 20,000

- 20,000 – 40,000 Km

- 40,000 – 60,00 Km

- 60,000 – 80,000 Km

- 80,000 – 100,000 Km

- Over 100,00 Km

- By Fuel

- Petrol

- Diesel

- Electric

- Others (Petro-Electric, Diesel-Electric, etc.)

- By Transmission Type

- Auto

- Manual

- Others (Semi-Auto, CVT)

Companies Covered

- Authorized Dealers

- Benz Hansung

- BMW Deutsch Motor

- BMW Bavarian Motors

- KCC Auto

- C2B/C2B2C/B2C

- K-Cars

- Aj SellCar

- Autohands

- Hey Dealer

- U-Car

- Autoplus

- Online Portals – Online Auto Classified Platforms

- Encar

- Kb Cha Cha Cha

- Auction Players

- Hyundai Glovis

- Lotte Rental – Auction

- Aj SellCar Auction

- K Car Auction

Time Period Captured in the Report:-

- Historical Period – 2015-2021P

- Forecast Period – 2021P-2026F

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- South Korea Used Car Market Overview

- South Korea Used Car Market Size, 2015-2021P

- South Korea Used Car Market Segmentation, 2021P

- Growth Drivers in South Korea Used Car Market

- Issues and Challenges in South Korea Used Car Market

- Government Regulations

- Ecosystem and Value Chain of Used Car Industry in South Korea

- Customers Purchase Decision Making Parameters

- Cross Comparison between Major Authorized Dealers and Multi-brand Dealers

- Snapshot on Online used car market

- Future Market Size and Segmentations, 2021P - 2026F

- Covid-19 Impact on the Industry & the way forward

- Analysts’ Recommendations

For more information on the research report, refer to below link:

South Korea Used Car Market Outlook To 2026

Related Reports

Philippines Used Car Market Outlook to 2026 (Third Edition)

Egypt Used Car Market Outlook to 2026

Follow Us

LinkedIn | Facebook | Twitter | YouTube

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249