How Indonesia Car Finance Market Is Positioned?

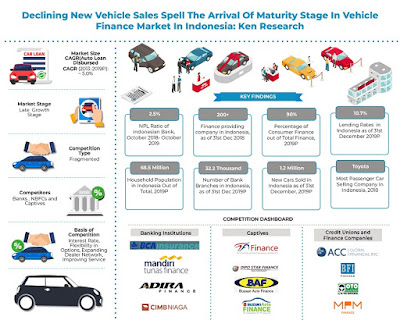

Indonesia Car finance market has been identified as in its late growth stage. During the last 5 years, the Car finance market has risen as demand and supply for automotive grew at a decent rate year on year. Lenders institutions in this period have evolved to provide a range of innovative products and services to further improve attraction and penetration of the market. Car finance gained dominance as people started accepting loans as a way of buying their cars majorly because of interest rates were following a declining trend; innovative finance products by Fintech institutions and ease of terms for a loan were prevalent. The majority of the expansion in auto finance sales in these years came from financial institutes such as banks and Multi Finance Institutions. Online entities such as Lead Generation Companies and Aggregators have also started gaining prominence.

The Car finance market has increased to approximately USD ~ billion in 2019P from USD ~ billion in 2013 registering a CAGR of ~% during the same period. The credit disbursed in the Indonesia Car Finance market has increased from USD ~ billion in 2013 to USD ~ billion in 2019P. The number of vehicles financed increased from ~ in 2013 to ~ in 2019P. There have been various factors responsible for the growth. One of the major factors has been the growing level of sales of used vehicles in Indonesia along with a vast array of financing options being offered by lenders. Moreover, convenience in lending is being improved as online lending ecosystems contribute to the rising total addressable market in vehicle finance and lenders offer highly customized products catered to the borrower’s needs. The Issuance of digitally Advanced Products, being offered by various Fintech Institutions, also acts as a Catalyst to the Growth of Industry.

Indonesia Car Finance Market Segmentation

By New and Used Vehicle: In Indonesia, the Car loan is disbursed for both new and used vehicles. Credit Disbursed for New Car finance was observed to dominate the market during 2019P. New Vehicle Finance enjoys a majority share in the market owing to the advantages that come handy with the new vehicles that include higher resale value and better financing schemes. Used vehicles capture a comparatively lower share in the market. However, in terms of Units Financed, they have a bigger share.

By Tenure of Loan (New Car and Used Cars) : The loan tenure selected by the customer depends on factors such as the price of the car, income level of the customer, flexible scheme options and other social factors such as family size and lifestyle of the individual. The 4 Year Tenure of Loan is dominant in the Market for new Cars, while the 3 Year tenure comes in second place. Used car Finance customers, generally tend to go for the 1-year loan as the value of financing required is not really high and that helps them to repay the loan quickly.

By Banks, NBFCs and Captives (New Car and used Cars): Commercial banks have accounted for a Major Share in the Overall Car Finance Market of Indonesia on the basis of new Cars Financed. The second position in the market was captured by NBFCs and Multifinance Companies, who operate in the market, the nonfinancial institutions' Captive finance companies have contributed the remaining part of the credit disbursed for new car financing in 2019P.

Competitive Landscape in the Indonesia Car Finance Market

Competition in the Indonesia finance market is extremely fragmented. The Major lending institution types in the market are Banks, Captives, and Multi Finance Companies. Banks hold a majority share in the lending space for New Cars, and NBFCs tries to majorly provide services to the Used Cars segment. Some of the leading banking institutions include Bank of Central Asia (BCA Finance), Mandiri Bank (Mandiri Tunas Finance), Danamon Bank (Adira Dinamika Finance), CIMB Niaga. Stiff competition was observed in the case of Captives including Toyota Astra Finance (Toyota and Daihatsu), Dipo Star Finance (Mitsubishi), Bussan Car Finance (Yamaha), and Suzuki Car Finance (Suzuki). Some NBFC institutions such as Adira Dinamika have been seen to register double-digit growth, representing the trend of the rapid growth of credit unions. Parameters on the basis of which companies compete in the market include interest rate, digitalization, and ease of transaction, distribution network, service portfolio, repayment methods available and others.

Indonesia Car Finance Market Future Outlook and Projections

Over the forecast period, Indonesia The car Finance market is expected to be positive if there is a continuous need for Car among the population. Multiple fin-tech startups have also come up in the country’s financial sector which poses a threat to conventional finance companies and banks. These startups have developed products to augment the digitalization of the banking sector. This includes digital payments, online lending, online aggregation, and remote banking facilities which made the customer lending process uncomplicated and simple further facilitating the car finance market in the country. Banks and Captives are expected to continue their leading position in the market due to their vast networks and range of products. In addition to that, the Indonesia market is likely to witness a decline in Car sales which threatens the growth of a number of loans issued in the future.

Key Segments Covered:-

By New and Used Cars

New cars

Used cars

By Lender Institutions

Banks

Captives

Multi Finance Companies (NBFCs)

By Loan Tenure between New and Used Cars

Two Years

Three Years

Four Years

Five Years

One year

Five Years or more

Key Target Audience

Existing Car Finance Companies

Banks

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Carmobile Associations

Carmobile OEMs

Time Period Captured in the Report:-

Historical Period: 2013-2019P

Forecast Period: 2019P-2024

Key Companies Covered:-

Banks

Bank of Central Asia (BCA Finance)

Mandiri Bank (Mandiri Tunas Finance)

Danamon Bank (Adira Dinamika Finance)

CIMB Niaga

Bank Rakyat Indonesia

Bank Negara Indonesia

Megabank (WOM)

NBFCs

ACC Finance

BFI Finance

Oto Multiartha

MPM Finance

Batavia Prosperindo

Radana Bhaskara

Indomobil Multi Jasa

Mandala Multifinance

Tifa Finance

Adira Quantum Multifinance

Clemont Finance Indonesia

Captives

Toyota Astra Finance (Toyota and Daihatsu)

Dipo Star Finance (Mitsubishi)

Bussan Auto Finance (Yamaha)

Suzuki Auto Finance (Suzuki)

Key Topics Covered in the Report:-

Dipo Star Finance Market Revenue Indonesia

NBFCs share Indonesia Credit Disbursed in USD Million

Number of Used and New Cars Sold in Indonesia

Pasar Keuangan Mobil Indonesia

Industri Keuangan Mobil Indonesia

Pasar Keuangan Mobil Indonesia

Industri Keuangan Mobil Indonesia

Laporan Penelitian Pasar Keuangan Mobil Indonesia

Laporan Penelitian Industri Pembiayaan Mobil Indonesia

Suzuki Indonesia Auto Finance Market Revenue

BFI Indonesia Car Finance Market Report

Radana Bhaskara Auto Finance Market Revenue

Indonesia Car Finance Market

For More Information On The Research Report, Refer To Below Link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249

No comments:

Post a Comment