The report provides a comprehensive analysis of the Indonesia Car finance market including market evolution, market overview, market genesis, and market size and market segmentation. Extensive focus has been placed in quantifying the credit disbursed and a number of vehicles financed, both new and used. The report covers aspects such as market segmentation (by loan tenure, new and used C and type of Lending Institution), customer perspective in the market and snapshot on online Aggregating ecosystem in Indonesia.

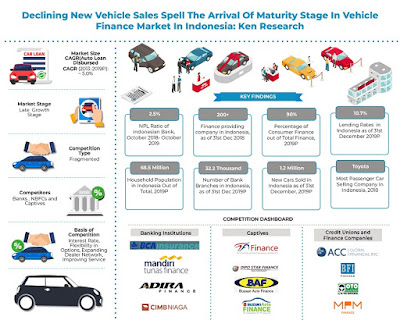

Competitive landscape of major lenders Bank of Central Asia (BCA Finance), Mandiri Bank (Mandiri Tunas Finance), Danamon Bank (Adira Dinamika Finance), CIMB Niaga , Bank Rakyat Indonesia, Bank Negara Indonesia, Megabank (WOM), ACC Finance, BFI Finance, Oto Multiartha, MPM Finance, Rabana Investindo, Toyota Astra Finance (Toyota and Daihatsu), Dipo Star Finance (Mitsubishi), Bussan Car Finance (Yamaha), Suzuki Car Finance (Suzuki).

The report also covers the future industry analysis (by credit disbursed and new and used Car Finance), future market segmentation, growth opportunities, up-coming business models, government regulations and analyst recommendations.

- Strong credit demand from businesses and consumers allowed for significant net interest rate margins, helping commercial lenders generate handsome earnings on their loan business.

- Indonesia's financial services authority (OJK) has removed down payment requirements for vehicle loans extended by some multi-finance companies in a bid to boost economic growth.

- It is also expected that the spread of online lending, models will continue in the future. Lead Generation, Online Lending, Loan Aggregation and Technology trends such as Blockchain, Artificial Intelligence, and Fin-tech are expected to impact and disrupt the traditional indirect lending model in the market.

Harnessing Fintech to achieve financial inclusion: FinTech has an ability to solve Indonesia’s financial inclusion challenges, which include being an archipelago country with limited infrastructure and a lack of credit information on corporates and individuals. Due to advances in technology and the emergence of Fin-tech startups, which are leveraging their resources to improve the lending experience for the consumer, the market has become more efficient and competitive. Developments in financial technology have allowed for various improvements such as quick retrieval of documents, quicker transactions and customized services based on the customer’s preferences. Car vehicle financing has become seamless, fast and transparent leading to improved operations. However, a key challenge is the lack of credit scoring data. Fintech companies are seeking to overcome this through credit-assessment built on alternative data, including airtime usage.

Changing Nature of ownership: Consumers in Indonesia are increasingly moving forward to accommodate newer models of mobility and prefer partial ownership of vehicles instead of full ownership. Leasing and Car Rental were foreign concepts in Indonesia a couple of years ago, however, they are now some of the growing operating models in the automobile industry in Indonesia. This perception shift is forcing lenders to adopt new models and incorporate newer products in their portfolio offerings to consumers.

Analysts at Ken Research in their latest publication “Indonesia Car Finance Market Outlook to 2024: Growing Prominence of Captive Finance Companies Backed by Surging Car Sales to Drive Market Growth”, believe that the Indonesia Car Finance market demand is likely to follow a stable trend in the near future due to a forthcoming Increase in used Cars sales and a shift towards newer models of mobility such as car-sharing and leasing, which will, in turn, help the economy grow as well. Some positive factors expected to impact the market is the influx of digitization-based lending models (Introduction of Fintech Products), the spread of customized loan products and a further rise in the penetration rate of C finance. The market is anticipated to register a positive CAGR of ~5.3% in terms of Credit Disbursed during the forecasted period 2019P-2024.

Key Segments Covered: -

By New and Used Cars

New cars

Used cars

By Lender Institutions

Banks

Captives

Multi Finance Companies (NBFCs)

By Loan Tenure between New and Used Cars

Two Years

Three Years

Four Years

Five Years

One year

Five Years or more

Key Target Audience

Existing Car Finance Companies

Banks

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Carmobile Associations

Carmobile OEMs

Time Period Captured in the Report: -

Historical Period: 2013-2019P

Forecast Period: 2019P-2024

Key Companies Covered: -

Banks

Bank of Central Asia (BCA Finance)

Mandiri Bank (Mandiri Tunas Finance)

Danamon Bank (Adira Dinamika Finance)

CIMB Niaga

Bank Rakyat Indonesia

Bank Negara Indonesia

Megabank (WOM)

NBFCs

ACC Finance

BFI Finance

Oto Multiartha

MPM Finance

Batavia Prosperindo

Radana Bhaskara

Indomobil Multi Jasa

Mandala Multifinance

Tifa Finance

Adira Quantum Multifinance

Clemont Finance Indonesia

Captives

Toyota Astra Finance (Toyota and Daihatsu)

Dipo Star Finance (Mitsubishi)

Bussan Auto Finance (Yamaha)

Suzuki Auto Finance (Suzuki)

Key Topics Covered in the Report: -

NBFCs share Indonesia Credit Disbursed in USD Million

Minimum Down Payment for Car Finance Indonesia

Number of Used and New Cars Sold in Indonesia

Lending Interest Rate in Indonesia

Digitization of Car Finance Indonesia

Indonesia Online Car Lending Ecosystem

Indonesia Car Finance Credit Disbursed

Indonesia Car Loan Outstanding

Indonesia Major Captive Finance Institutions

Indonesia Car Finance Interest Rate

Non-Bank Institutes Indonesia

For More Information On The Research Report, Refer To Below Link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249