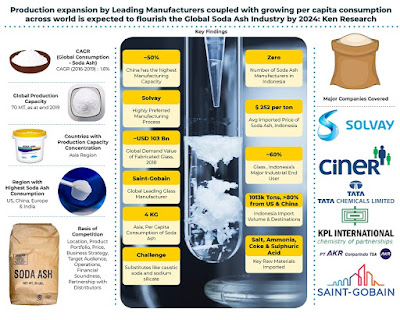

Soda Ash is considered to be among one of the top 5 major inorganic chemicals at the global level wherein the major production happens through the Synthetic process. Due to the high concentration of Natural Soda Ash Reserves in the US, the production process has been shifting from Synthetic to Natural. Even though the pattern is shifting, 75% of production is done through synthetic mode worldwide with the high scope of revenue from down-stream industries.

Environmental Challenge

Mining of Soda Ash from Natural resources implied exhaustion and depletion of Trona ores, resulting in low volume and high soda ash prices. Emission of ~60 Mt (Source: Ken Research Analysis) of CO2 gas during the soda ash production process and sulfur oxides during its transportation through vessels have raised alarms for serious Environmental concerns across the world and therefore called for stringent regulations and restricted processes.

Impact of Stringent Regulations

Such emission norms caused a significant decline in supplies from countries majorly Europe and China (with the highest concentration of manufacturing capacity) due to high production costs. Environmental checks to improve industrial waste caused supply-demand difference and resulted in price fluctuations across the globe. Moreover, with the new regulations, manufacturers in the industry are required to either upgrade their existing machinery or replace the old factories with new ones to meet new environmental standards.

Is there a room for Growth?

Reduced production and process up-gradation costs pave way for enlarged opportunities for countries like Turkey, to augment their products in the future so as to meet the worldwide steady soda ash demand. A noteworthy growth rate of 6%-7% has been witnessed in the Synthetic soda ash production process segment due to its rising availability as a raw material to the global glass (largest application sector) manufacturing industry.

Opportunity for South Asian Countries

With infrastructural support to Middle-east and Asian Pacific countries (China, Thailand, Vietnam, Indonesia) development of domestic and commercial buildings, Household Detergents and Water Treatment industry in such Countries will upsurge their soda ash consumption Indonesia, being the 3rd largest importer of soda ash now has the opportunity to set up their first manufacturing plant in the country to meet this rising demand domestically and from neighbouring nations.

Key Target Audience: -

Soda Ash Manufacturers

Soda Ash Distributors

Chemicals Industry

Glass Industry

Soaps and Detergents Industry

Industry Associations

Government Associations

Government Agencies

Private Equity and Venture Capitalist Firms

Time Period Captured in the Report:

Historical Period: 2012 – 2019(P)

Forecast Period: 2019 – 2024F

Companies Covered:

Manufacturers

Solvay

Nirma

Ciner

TATA Chemicals

Genesisalkali

CIECH Group

Distributors

ANSAC

PT Lautan Luas

PT AKR Corporindo

Key Topics Covered in the Report: -

Global Soda Ash Market

Global Soda Ash Industry

Asia Soda Ash Market

Soda Ash Indonesia

Household Cleaners Global Market Size

Indonesia Glass Industry Revenue

Growth Rate of Indonesia Glass Industry

Global Players Soda Ash Market

Global Soda Ash Consumption Market

Soda Ash Factory Indonesia

Global Soda Ash Market Research Report

Global Soda Ash Industry Research Report

Production Costs of Soda Ash Indonesia

For More Information on the research report, refer to below link: -

Related Report by Ken Research: -

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

No comments:

Post a Comment