What Is the Competition Scenario In The Indonesia Data Center Market?

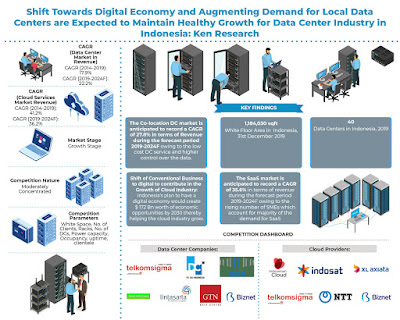

Competition within the Indonesia data center market was observed to be moderately concentrated along with the presence of both local and global data centers. Indonesia recorded a total of 40 data centers in Indonesia in the year 2019. The major companies in the data center industry in Indonesia includes Telkom sigma, Biznet, XL Axiata, Nexcenter, Faasri Utama sakthi, Aplikasi Lintasarta, Neuviz DC, GTN Data Center, PT CBN Nusantara (Nex Data Center) and others.

Major competing parameters include a number of data centers, services provided, white space, number of racks, Tier level, power capacity, uptime, occupancy rate, clientele. End users served and geographical presence.

How Is The Indonesia Cloud Industry Positioned?

The Cloud Services Market in Indonesia is at a nascent stage and was observed to grow at a double-digit growth rate during the review period 2014-2019. The Indonesian cloud services market in terms of Revenue has increased at a positive CAGR of ~% during the review period 2014-2019. Growing mobile consumption and increasing demand for disaster recovery services driving the cloud market in Indonesia. Global cloud providers are developing their own data centers in Indonesia as the end-users are insecure due to the protection of govt. regulations. Indonesia has a huge potential for the cloud industry owing to which the global cloud players are entering and investing in Indonesia to tap the market.

Indonesia’s “Making Indonesia 4.0” Initiative to contribute to the growth of the cloud computing industry in Indonesia Software as a Service (SaaS) dominated the data center industry in Indonesia owing to rising adoption and cloud services and the surge in the number of SMEs who are the major contributor to the SaaS market.

Indonesia Data Center Market Segmentation

By Type of Services (SaaS, IaaS, PaaS and others): Software as a Service (SaaS) was observed to be dominating the Indonesian cloud market in terms of revenue. SaaS constituted a market share of ~% in terms of revenue in the year 2019. The SaaS market is leading in Indonesia owing to the higher cost benefits and rising demand from SMEs in Indonesia.

By End Users (Manufacturing, Telcos/IT, BFSI, Government, Education and others): The Manufacturing industry dominated the cloud market with a market share of ~% in terms of revenue in the year 2019. Manufacturing industry in Indonesia was observed to dominate the cloud industry as manufacturing industry is the heavyweight of Indonesia’s economy.

By Clients (Domestic and Global Clients): Domestic clients dominated the Indonesia cloud market with a market share of ~%, followed by Global clients in the year 2019. Domestic clients in Indonesia dominated the cloud industry owing to the government’s data localization law which has made the domestic clients store their data in locally.

By SaaS (Large Enterprise and SMEs): Large enterprises dominated the SaaS industry in Indonesia with a market share of ~% owing to the higher usage of SaaS service by the end-users. It is anticipated that by next few years SME would be the dominator of the Saas market in Indonesia.

What Is The Competition Scenario In The Indonesia Cloud Service Market?

The competition in Indonesia cloud service market has been observed to be concentrated with a few pure cloud’s providers. DC companies are providing private cloud to customer as a value-added service to the customers. The major companies in the cloud service industry in Indonesia include Indonesia cloud, Indosat, XL Axiata, Alibaba, Biznet and others.

Major competing parameters include services provided, clientele. End users served, service partners, cost and geographical presence.

Indonesia Data Center Market Future Outlook and Projections

Over the forecast period 2019-2024F, the Indonesia Data Center Revenue is further anticipated to increase to USD ~ Million by the year 2024F, thus showcasing a CAGR of ~%. The number of data centers in Indonesia are forecasted to expand from ~ units of data centers 2019 to ~ units of a data center in 2024F, growing at a Compound Annual Growth Rate (CAGR) of ~%. Government initiatives, awareness of DC services, growth in e-commerce transactions, and development of e-govt. services are contributing to the growth of the data center industry in Indonesia.

The country is also expected to witness growth in the cloud services market in the next few years by a CAGR of ~% during the period 2019 to 2024F. Governments plan to turn large cities such as Jakarta into smart cities that would contribute to the growth of the cloud industry in the next few years. The upcoming data startups in Indonesia and the surge in demand for the cloud services is anticipated to contribute in the growth of the cloud industry in the next few years.

Key Segments Covered: -

By Type of Data Centers:

Co-location Data Center

Retail Co-location

Wholesale Co-location

Managed Data Center

By Region:

Jakarta

Surabaya

Bandung

Bogor

Batam

Others (Medan, Makassar, Palembang, Bekasi, Bali, Kalimantan and rest)

By Tier Level:

Tier I & II

Tier III

Tier IV

By End Users:

BFSI

IT/ITes

Government

SME’s

Others (Education, Retail, Manufacturing, Logistics and rest)

By Clients:

Domestic Clients

Global Clients

Key Segments Covered of Cloud Market

By Cloud Services:

SaaS

IaaS

PaaS

Others

By End Users:

Manufacturing

Telco/IT

BFSI

Government

Education

Others

By Clients:

Domestic Clients

Global Clients

By SaaS:

By Large Enterprise

SME

By IaaS:

By Large Enterprise

SME

By PaaS:

By Large Enterprise

SME

Key Target Audience

Data Center companies

Cloud providers (Domestic and Global)

Managed data center companies

Co-location data center companies

Private Equity and Venture Capitalist

Industry Associations

Data Center Constructors

Technology providers

Time Period Captured in the Report:

Historical Period – 2014-2019

Forecast Period – 2020-2024

Companies Covered:

Data Center Companies:

Telkom Sigma

PT DCI

Nex Data Center

Faasri Utama Sakthi

Aplikanusa Lintasarta

Biznet

GTN Data Center

Cloud Providers:

Indonesia Cloud

Indosat

XL Axiata

Key Topics Covered in the Report: -

daftar data center di Indonesia

jumlah data center di Indonesia

Data Centre Global Clients in Indonesia

Data Center companies in Indonesia

Cloud Services providers in Indonesia

Data Centre Technology providers in Indonesia

No of data centers in Indonesia

Retail and Wholesale Colocation Data Center

SaaS Cloud Industry in Indonesia

cloud service players in Indonesia

Cloud Services Providers in Bandung

Bogor Cloud Services Market Analysis

PT DCI Indonesia Data Center Market Revenue

For More Information on the Research Report, Click on the Link Below: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

No comments:

Post a Comment