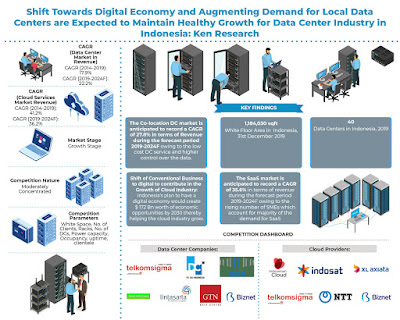

- The number of data centers is expected to increase in the future thereby, growing at a positive CAGR of 14.9%, due to a surge in the demand for the local data centers.

- Jakarta is anticipated to become the data center hub of Indonesia with the entry of data center companies in the next few years.

- The co-location data centers are anticipated to grow at a CAGR of 27.8% and the Managed Data Center at a CAGR of 17.8% during the forecast period 2019-2024F.

AI, IoT, and Big Data to Drive Data Center Growth: Data centers in Indonesia are adopting solutions such as AI, IoT, and Big data to drive up efficiency and cut down the cost. Companies such as Bizenet are achieving success in Indonesia post rolling out Big Data analytics solutions for its customers. An increasing amount of data in the country is leading to the traditional data centers to operate at a slower pace and also resulting in an inefficient output. Big data has a huge opportunity in Indonesia and is anticipated to reach USD 30 Billion by the year 2022 in Indonesia. Global cloud providers anticipated to enter the Indonesian market are planning to provide big data solutions to customers to tap a larger market of the country.

Digital Economy Plan of Indonesia: The Government's digital economy plan to contribute to the growth of the data center industry in Indonesia. Companies are opening up digital hubs to foster innovation and develop new business activities despite skill-set gaps in Indonesia. The Government of Indonesia and enterprises are eyeing to increase data center adoption to promote digital transformation across industry sectors through effective strategic partnerships with global as well as local data center vendors.

The emergence of Hyper-scale Data Centers: The country is anticipating to witness a huge number of cloud providers enter the Indonesia market with which the country would also witness the hyper-scale data center by the companies to come up to store the customer's data. The Government of Indonesia is focusing on improving the readiness of the country to support hyper-scale data centers by enhancing telecommunications and network infrastructure. Presently, the BFSI sector is the primary driver of the demand for data center services, followed by Over-the-top (OTT)/Content Service Provider (CSP) participants in Indonesia.

Analysts at Ken Research in their latest publication "Indonesia Data Center and Cloud Services Market Outlook to 2024- Implementation of Data Localization Law Leading to Surge in Localized Data Center Revenue" believe that the data center industry in Indonesia has been growing and is expected that it will expand further owing to the rising number of data centers, the surge in demand for local data centers, the entrance of global data center companies in the country, additional services provided by the companies such as cloud services, data recovery, security services, cross-connect, and others. The market is expected to register a positive CAGR of 22.2% in terms of revenue during the forecast period 2019-2024F.

Key Segments Covered: -

By Type of Data Centers:

Co-location Data Center

Retail Co-location

Wholesale Co-location

Managed Data Center

By Region:

Jakarta

Surabaya

Bandung

Bogor

Batam

Others (Medan, Makassar, Palembang, Bekasi, Bali, Kalimantan and rest)

By Tier Level:

Tier I & II

Tier III

Tier IV

By End Users:

BFSI

IT/ITes

Government

SME's

Others (Education, Retail, Manufacturing, Logistics and rest)

By Clients:

Domestic Clients

Global Clients

Key Segments Covered of Cloud Market

By Cloud Services:

SaaS

IaaS

PaaS

Others

By End Users:

Manufacturing

Telco/IT

BFSI

Government

Education

Others

By Clients:

Domestic Clients

Global Clients

By SaaS:

By Large Enterprise

SME

By IaaS:

By Large Enterprise

SME

By PaaS:

By Large Enterprise

SME

Key Target Audience

Data Center companies

Cloud providers (Domestic and Global)

Managed data center companies

Co-location data center companies

Private Equity and Venture Capitalist

Industry Associations

Data Center Constructors

Technology providers

Time Period Captured in the Report:

Historical Period - 2014-2019

Forecast Period - 2020-2024

Companies Covered:

Data Center Companies:

Telkom Sigma

PT DCI

Nex Data Center

Faasri Utama Sakthi

Aplikanusa Lintasarta

Biznet

GTN Data Center

Cloud Providers:

Indonesia Cloud

Indosat

XL Axiata

Key Topics Covered in the Report: -

Indonesia Cloud Services Market Forecast

Growth of Cloud Computing in Indonesia

data center Indonesia

list of data center in Indonesia

daftar data center di Indonesia

jumlah data center di Indonesia

Data Center companies in Indonesia

Cloud Services providers in Indonesia

Retail and Wholesale Colocation Data Center

SaaS Cloud Industry in Indonesia

Cloud Services Providers in Bandung

Bogor Cloud Services Market Analysis

Indonesia NTT Cloud Providers Market Growth

For More Information, Click on the Link Below: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249