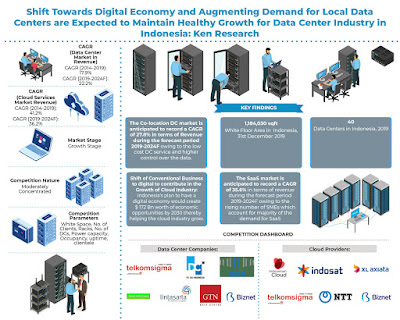

1. During 2021, the presence of 65 data center facilities in Indonesia generated revenue in excess of $1 billion

To learn more about this report Download A Free Sample

Because more people are using cloud-based services, especially in Indonesia, there is a significant need for data centers. Businesses are also beginning to embrace data-intensive technologies like IOT, data analytics, and AI. In addition, the Indonesian government has plans to build national data centers (Pusat Data Nasional) in four distinct locations. Apart from that, the building of data center facilities has started both locally and internationally by operators and developers. STT GDC, Digital Edge, and LOGOS have all made the decision to partner with Pure Data Centers in order to develop their data centers in Indonesia.

2. Increasing investments, new data center facilities, better connectivity, and rising internet penetration are some of the major factors driving the Indonesian data center market.

The sector for data centers in Indonesia is seeing an increase in investments from both domestic and local companies. Global DC operator Pure DC has worked with Logos, despite Princeton Digital Group in Singapore having announced a $150 million investment for a new DC facility. Additionally, Facebook and Google are constructing two new undersea cables that will improve connectivity between Singapore, Indonesia, and North America. Operators of data centers in Indonesia are also creating hyper-scalable buildings with a wide range of service possibilities. Not to mention, in 2021, 73% of the 276 million people on the planet will have daily access to the internet, up from 54% in 2017. Ranking seventh internationally is a result of rising daily internet usage and rising data consumption per user.

3. Less fibre optic capabilities and power supply, cyber-attacks, and the environment are all major challenges in the Indonesian data center market.

Visit this Link Request for a custom report

Only 36% of Indonesia has fiber-optic coverage, with fibre connections improving in major areas but still lacking in distant and rural areas. Additionally, the DCs face difficulties due to Indonesia's erratic power supply. The main source of electricity for DCs in Indonesia is the state-owned PLN. The risks associated with earthquakes and urban floods in Indonesia are both considered significant. It is crucial and difficult to do a location evaluation to establish the best location for data centers. Finally, when it comes to cyber security risks, Indonesia is currently the third most targeted nation. Indonesian data center customers are expressing concerns over the country’s increasing number of cyberattacks, and this could have a bad effect on the sector.

4. Indonesia data center market is expected to generate $ more than 2.5 Bn in revenue owing to 106 DC facilities during the year 2026F

The need for data services and infrastructure in Indonesia is anticipated to rise rapidly with the expansion of the internet economy. Additionally, new entrants will significantly accelerate market growth between 2022 and 2026, serving the wholesale requirements of regional cloud service providers and local businesses. Surge, a subsidiary of PT Solusi Sinergi Digital Tbk, is also getting ready to construct edge data centers in train stations and KUD warehouses across Java Island.