The Movie Theater market saw large investments, from international, regional and local movie theater companies, in the period 2018-2019 with 7 companies receiving operating licenses from GCAM, of which 3 companies set up more than 110 screens across 11 locations at the end of 2019.

Financial Assistance: Saudi Entertainment Ventures, SEVEN, has been promoting investment in Saudi Arabia through private sector participation in ventures such as movie theaters, entertainment destinations, amusement parks among others. AMC Theaters opened KSA’s first movie theater with a 10% equity contribution. The investment arm of the Public Investment Fund, SEVEN had been mandated with USD 10 Billion for investment in the leisure and entertainment sector. The organization has confirmed setting up 20 entertainment destinations, 50 movie theaters and 2 amusement parks across Saudi Arabia.

Growth in Inbound Tourism: Although primarily driven by religious tourism, the number of tourists grew from 18.3 million in 2014 to nearly 26 million by 2019. The government has also begun the first phase of issuing tourist visa or visas on arrivals from 49 countries. The government has issued 400,000 tourist visas as of March 2020. The first phase of tourist visas issuance is concentrating on tourism around beaches, deserts, mountains and heritage sites. The second phase of visa issuance will concentrate on tourism around Giga projects.

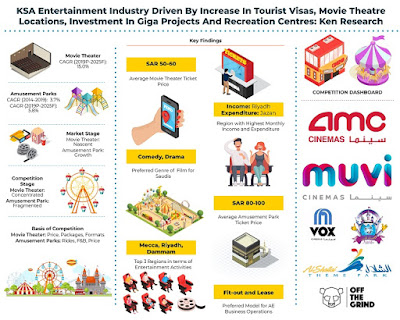

Key Investment Locations: For movie theaters and amusement parks, major top cities such as Riyadh, Dammam, and Jeddah were observed to be hotspots due to their large size, higher comparative monthly income and expenditure, and high retail occupancy rates among others. Al-Khobar, an eastern city, saw the opening of various alternate entertainment investments such as bowling alleys, VR gaming as well as trampoline parks as the region had high tourism with nearly 60% occupancy in hotels in 2019.

The shift in Socio-economic Norms: Since the relaxation of rules regarding women, many entertainment destinations have welcomed this shift with the introduction of women’s only nights, such as in bowling alleys, amusement parks and trampoline parks among others. Al Hokair Time was the kingdom’s first women’s only amusement park, which began operations in 2019. The entry of women has led to innovation in products and offerings such as driving lessons on Virtual Reality equipment, mock driving lessons in amusement parks and trampoline parks introducing women’s fitness programs.

The report titled “Saudi Arabia Leisure and Entertainment Market Outlook to 2025 – Movie Theater Market by Revenue (Ticket Admissions, Food, and Beverage Sales, Advertisements and Sponsorships), Amusement Park Industry (Ticket Admissions, Food and Beverage, Merchandise, Games, and Others(Parking, Sponsorships and Royalty)) and Alternate Entertainment Avenues (VR Gaming, Bowling Alley and Trampoline Parks)” by Ken Research suggested that investment in Leisure and Entertainment sector in Saudi Arabia has been growing since the unveiling of VISION 2030 in 2017. The government’s aim is to increase GDP from non-oil sources have led to revoking the ban on movie theaters, increased investment in amusement parks and FECs, and favorable investment climate for foreign investors. The movie theater industry and the amusement park industry are projected to grow at a CAGR of 15% and 5.3% respectively.

Key Segments Covered: -

Movie Theater Market

Ticket Admissions

Food and Beverages

Advertisements and Sponsorships

Amusement Park Market

Ticket Admissions

Food and Beverages

Merchandise

Games

Others (Parking, Royalty and Sponsorships)

Alternate Entertainment Investment

VR Gaming Center

Bowling Alley

Trampoline Parks

Key Target Audience

Movie Theater Companies

Film Distribution Companies

Screen Format Companies (IMAX, 4D, 4DX)

Government Entities

Amusement Park Operators and Chains

Real Estate Developers

Mall Operators and Groups

Time Period Captured in the Report:

Historical Period – 2014-2019

Forecast Period – 2019-2025

Companies Covered in Report:

AMC Theaters

VOX Cinemas

MUVI Cinemas

Al Hokair Group

Al Shallal Theme Park

Off the Grind

Emirates Bowling Alley

BOUNCE Trampoline Park, Jeddah

Key Topics Covered in the Report: -

Saudi Arabia Entertainment Industry

KSA Leisure and Entertainment Industry Research Report

Saudi Arabia Leisure Industry

KSA Entertainment Market

KSA Entertainment Industry

Saudi Arabia Movie Theater Market Growth

spending on entertainment in Saudi Arabia

Saudi Arabia Movie Theatre Market Growth

Film Distribution Companies in Saudi Arabia

Saudi Arabia Entertainment Market Growth Rate

Movie Theater Companies in Saudi Arabia

Saudi entertainment Major companies

KSA Amusement Park Operators and Chains Analysis

Saudi Arabia Screen Format Companies Growth

Saudi Arabia VR Gaming Revenue

For More Information on the research report, refer to below link: -

Related Reports by Ken Research: -

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

No comments:

Post a Comment