How is the fitness services market positioned in Australia?

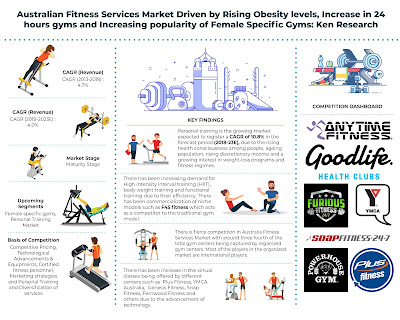

Australia fitness service market revenue has grown from AUD ~ million in 2013 to AUD ~ million in 2018, registering a CAGR of ~%, due to the increasing obesity levels, rising health consciousness among Australians, increasing female-specific gyms, the emergence of 24 hours gyms and regional expansion by various fitness centers in Australia fitness service market. A major contributing factor to the boost in revenue had been the addition of integrated fitness services such as Yoga, Pilates, and Swimming; provided less than one roof. Additionally, an increase in the demand for personal training and increasing disposable income and various other factors have supplemented tremendous growth.

In terms of membership, the market observed a growth rate of ~% year on year from 2013-2018. The number of subscribers in the fitness service market increased from ~ million in 2013 to ~ million in 2018 because of the higher demand for fitness services as people have become more health-conscious over the years. The fitness service market in Australia has been witnessing an upward trend and has registered a positive CAGR of ~% during 2013-2018 in terms of a number of fitness centers. The number of fitness centers in Australia has increased from ~ in 2013 to ~ in 2018 because of the expansion in the number of organized gyms, an increase in the number of female-specific fitness centers.

How Competition Scenario Works In Australia Fitness Services Market?

The Australia Fitness Service market has fierce competition, i.e., the players have been highly competitive and experimental while offering a gamut of services, packages and follow business strategies to expand their reach across Australia. Existence of international brands in the market has made it already competitive.

The market is fragmented in terms of revenue generated, with around ~ organized gym centers and ~ unorganized gym centers. This includes all the branches of organized and unorganized sector. Going by the number of outlets, the market is dominated by the organized sector which accounts for ~% of the total number of fitness centers in Australia. Major players of the organized sector with respect to membership include Anytime Fitness, YMCA Australia, Good Life Health Clubs, Cross Fit, Plus Fitness, Snap Fitness, Jetts Fitness, and others.

What Are Future Estimations About The Australia Fitness Services Market And Its Segments?

The Australia fitness service market revenue has been anticipated to grow to AUD ~ million by the end of 2023E from AUD ~ million in 2018 registering a CAGR of ~% during 2018 to 2023E. The growth will be supported by the increase in the number of members which is expected to grow from around ~ million in 2018 to around ~ million in 2023, at a CAGR of around ~% during the same. Surging unhealthy eating habits, growing demand for personal training, expanding the geographical presence of major fitness centers and diversifying services portfolio will act as a tailwind reason for market growth in the future. Increase in health awareness would act as a prime driver in the market. These would have a combined effect and increase the number of fitness centers from ~ in 2018 to approximately ~ in 2023E registering a CAGR of ~% during 2018-2023E. The revenue share of gym memberships is expected to decrease from ~% in 2018 to ~% in 2023E since there will be an increase in the demand of personal training due to daily monitoring of progress, extra attention and customized exercises are given to the customers.

Key Segments Covered:-

By Revenue Streams

Membership Fee

Personal Training Fee

By Subscription period

1 month

3 months

6 months

1 year

By Region

New South Wales

Victoria

Queensland

Western Australia

Southern Australia

Australian Capital Territory

Tasmania

Northern Territory

By Type of Market

Organized Market

Unorganized Market

By Number of Gyms by Subscription Fee

Up to 850 AUD

Between 850- 1200 AUD

Above 1200 AUD

By Gender –Gym Members

Males

Females

Key Target Audience

Fitness Centers in Australia

Fitness Equipment companies

Private Equity firms

Ministry of Health

Time Period Captured in the Report

Historical Period: 2013-2018

Forecast Period: 2019-2023E

Major Fitness Centers Covered:-

Anytime Fitness

YMCA Australia

Good life Health Clubs

CrossFit

Plus Fitness

Snap Fitness

Jetts Fitness

F45 Aus Hold Co Pty Ltd

World Gym

Fernwood Fitness

Virgin active

Genesis Fitness

Fit N Fast

Zap Fitness

Fitness First Australia Pty Ltd

Powerhouse Gyms

Furious Fitness 24/7

Stepz Gym

Derimut Gym

Keywords:-

Australia Gym Industry

Australia Fitness Centre Market

Australia Fitness Centre Industry

Australia Fitness Market

Australia Fitness Industry

Australia Gym and Fitness Centre Service Market

Men Gym Market Australia

Gym Membership Fee Australia

Australia Fitness Personal Training Market

Australia Personal Training Revenue

Fitness Revenue Good Life Health Clubs

Fitness Centers Cross Fit Australia

Fitness Club Membership Australia

Yoga Studio Market Australia

Australia Anytime Fitness Members

For More Information, Refer To Below Link:-

Related Reports:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Sales@kenresearch.com

+91-9015378249

Amazing post.......................Hornsby Gym

ReplyDelete