How Turkey Logistics Market Is Is Positioned?

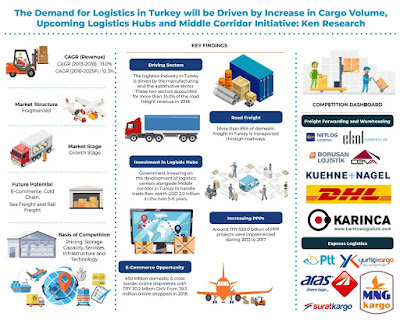

Overview: Turkey Logistics Market comprises of both organized and unorganized players which provide both logistics and warehousing services in the country. The logistics operations are majorly centered in the Western and the Southern side of Turkey. The country is now among the world's leading producers of agricultural products; textiles; motor vehicles, transportation equipment, and others.

Due to high growth in the manufacturing and automotive sector, players have begun turning to 3PL (Third Party Logistics). They have also been witnessed to adopt new technology. In 2012, Turkey bagged the overall rank of 27 on the LPI index but plunged to 47th position in 2018 due to a significant decline in timeliness and international shipment rankings.

Market: The market has been continuously growing. In recent years, the market share of third-party logistics has been growing at a significant rate in the country. Turkey logistics industry has shown remarkable growth over the last five years recording a CAGR of ~% owing to the investments in the logistics infrastructure and logistics centers. A key driver behind the recent growth in the market is the strategic location of Turkey as a bridge between Asia and Europe. The freight forwarding sector is the leading segment towards the revenues of the logistics industry, followed by courier & parcel activities and warehousing. The other sectors include value-added services, e-commerce deliveries, and the 3PL market.

Turkey Logistics and Warehousing Market

By Service Mix: Freight forwarding segment has dominated the logistics industry of Turkey and has grown at a five-year CAGR of ~% during the period 2013-2018. The market was witnessed to grow from TRY ~ billion in 2013 to TRY ~ billion in 2018. This is primarily due to an increase in bilateral trade with different countries and rising demand for transportation of goods from one place to another. Increasing export and import value have positively impacted the freight forwarding industry of the country. Courier and parcel market is the second-largest contributor in the logistics industry of Turkey and reached TRY ~ billion in 2018 owing to an increasing number of online shopping. The warehousing market acquired a revenue share of TRY ~ billion in the year 2018 which was an increment from 2013. The industry is still growing with the increasing investment in the logistics centers by the government.

Turkey Freight Forwarding Market Segmentation

By Mode of Service: Turkey freight forwarding market was dominated by road freight owing to the high transportation of cargo through roads. Sea freight and air freight acquired the second and third largest share respectively in 2018. Rail freight acquired the least share of ~% in 2018.

By Mode of Freight: This includes domestic and international freight. In terms of revenue, international freight forwarding contributed the majority share of ~% in 2018. The remaining share of ~% was occupied by domestic freight in 2018.

By Flow Corridors: European Countries flow corridor is the largest contributor in terms of revenue in the freight forwarding market owing to the trade agreement between the EU and Turkey.

Revenue by End Users: The major end-users of freight forwarding services in Turkey include the Manufacturing and Automotive sector.

By 3PL and Integrated Logistics: Third-Party Logistics dominated the freight forwarding market of Turkey in 2018 as most companies preferred to undertake third party logistics for providing freight forwarding solutions to their clients.

Turkey Warehousing Market Segmentation

By Type of Warehouses: The market share of closed warehouses in the country was evaluated to be approximate ~%. Open yards warehouses captured the market share of ~% in 2018. Cold storage warehouses captured the remaining market share of ~% in 2018.

By Business Model: The industrial and retail warehouses dominated the overall Turkey warehousing market with a revenue share of ~% in 2018. This is primarily due to increasing investment done by automotive, manufacturing and others in the country in the past few years.

By 3PL and Integrated Logistics: 3PL warehousing is gaining popularity in Turkey owing to fewer investment requirements.

By Regions: Istanbul and Izmir are the two prime locations in Turkey in terms of trade and logistics. Therefore, the warehousing space in Turkey has been clustered around these two regions.

Revenue by End Users: The major end-users of warehousing services in Turkey include F&B, Automotive, Manufacturing, Consumer Retail, and Others.

Key Segments Covered:-

Logistics and Warehousing:

By Service Mix (Freight Forwarding, Warehousing, Courier Express, and Parcel Activities and Value Added Services)

Freight Forwarding:

By Mode of Service (Road Freight and via Pipelines, Sea Freight, Air Freight, and Rail Freight)

Volume Data for Sea, Air, and Rail in Thousand Tonnes

By Mode of Freight (Domestic and International Freight Forwarding)

By Flow Corridors (European Countries, Asian Countries, American Countries, and Others)

By End Users (Manufacturing, Automotive, Food and Beverages, Consumer Retail and Others)

By Third-Party Logistics (3PL) and Integrated Logistics

Warehousing:

By Business Model (Industrial/Retail, Container Freight/Inland Container Depot, and Cold Storage)

By Type of Warehouses (Closed Warehouses, Open Yards, and Cold Storage)

By Region (Istanbul, Izmir, Ankara, Bursa, and Others)

By Third-Party Logistics (3PL) and Integrated Logistics

End Users (Food and Beverages, Automotive, Manufacturing, and Consumer Retail & Others)

Third-Party Logistics:

By Phases of Delivery (Hub-Hub, Hub-Spoke, and Spoke-Door)

By Service Mix (Freight Forwarding and Warehousing)

Snapshot on Turkey Courier, Express and Parcel Market

Competition Scenario in Turkey Courier and Parcel Market

Snapshot on Turkey E-Commerce Logistics Market

Competition Scenario in Turkey E-Commerce Logistics Market

Key Target Audience

Logistics Companies

Warehousing Companies

Cold Chain Companies

Courier and Parcel Companies

Express Logistics Companies

E-Commerce Logistics Companies

Logistics Association

Government Association

Investors and Private Equity Companies

Time Period Captured in the Report:-

Historical Period: 2013-2018

Forecast Period: 2019-2025

Key Companies Covered:

Freight Forwarding and Warehousing Market:

Ekol Logistics

Netlog Logistics

Mars Logistics

DHL

Kuehne + Nagel

Borusan Logistics

Yusen Inci Logistics

Hellmann Worldwide Logistics

Omsan Logistics

CEVA Logistics

Karinca Logistics

KITA Logistics

DB Schenker

Agility Logistics

Barsan Global Logistics

Courier and Parcel Market:

PTT

Yurtici Cargo

Aras Kargo

MNG Kargo

Surat Kargo

Key Topics Covered in the Report:-

Turkey E-Commerce Logistics Market

Warehousing Services in Turkey

Major Players Express Delivery Turkey

Warehousing Type Turkey

Freight Forwarding Market Turkey

Third-Party Logistics Market Turkey

Free Trade Agreements of Turkey

Shipping Fleet Major Turkey Seaports

Cargo Throughput Turkey Seaports

Cargo Shipment Turkey Airports

Turkey Pipeline Transport Market

Turkey Logistics Master Plan 2023

Growth Express Delivery Services Turkey

Turkey Cross Border Transportation Market

Turkey Sea Freight Forwarding Market

Turkey Air Freight Forwarding Market

Turkey Road Freight Forwarding Market

Turkey International Freight Forwarding Market

Turkey Inland Container Depot Market

Turkey Ekol Logistics Market Share

DHL Turkey Logistics Market Revenue

CEVA Logistics Turkey Warehousing Space Share

DB Schenker Warehousing Space Turkey

Kuehne + Nagel Logistics Market Growth

Turkey Hellmann Worldwide Logistics Market

For More Information On The Research Report, Refer To Below Link:-

Related Reports by Ken Research:-

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

No comments:

Post a Comment