How Nigeria Freight Forwarding Market Evolved?

Logistics is vital for the economic performance of any economy. Nigeria, like other African countries, has structural issues such as logistics infrastructure and cumbersome customs procedures at the seaports.

Freight forwarders specialize in arranging to ship merchandise on behalf of its shippers. They usually provide a full range of services such as tracking inland transportation, negotiating freight charges, freight consolidation, cargo insurance, and filing of insurance.

The Lagos Port Complex and Tin can Port in Lagos is the largest commercial ports in Nigeria. MMIA is the major commercial airport in Nigeria, situated in the capital city of Lagos. Therefore, Lagos is the commercial and trading hub of Nigeria.

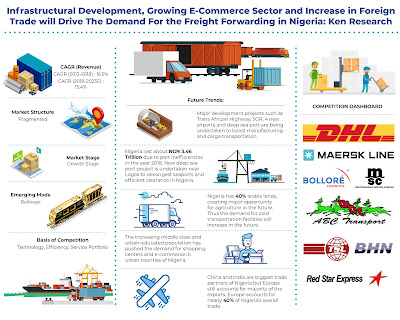

Nigeria Freight forwarding industry was evaluated to grow from USD ~ million in 2013 to USD ~ million in the year 2018 at a compounded annual growth rate (CAGR) of ~% during the period. In 2016, Nigeria was hit by a very bad recession where it had a setback because oil prices fell down from ~ a barrel in 2014 to below ~ in 2016. This affected the country’s logistics sector and fall to a growth rate of almost ~% in 2016-2017 but finally came out of recession in 2018.

In 2018, Nigeria has achieved rank 145 in the Ease of Doing Business Index and rank 112 in the Logistic Performance Index.

The increasing middle class and urban-educated population have pushed the demand for shopping centers and e-commerce in Lagos and urban counties of Nigeria. This is increasing the demand for logistics from such platforms.

Nigeria Freight Forwarding Market Segmentation

By Mode of Freight

Sea Transport dominates the freight forwarding market as all the imports and exports are done by sea. Road transport is important for last-mile delivery in e-commerce and transporting goods to other neighboring African countries but suffered from the poor condition of roads. Air transport is not very popular in cargo transportation and used mostly for passengers. Rail Transport is expected to grow with the introduction of SGR in Nigeria.

By Type of Freight

International freight forwarding accounted for larger revenues share in overall Nigeria Freight Forwarding Market, accounting for a share of ~% in the year 2018.

By Flow Corridors

Over the past decade, Europe has replaced Asia as the major trading partner of Nigeria with a share in overall share of ~% in international freight. ~%. Asian countries such as China and India are major trading partners with Nigeria.

By End Users

The major end-users of freight forwarding services in Nigeria include the Food and Beverage, Industrial and Retail sectors with a share of ~% and ~% respectively. The F&B sector also creates a demand for cold transportation for perishable items. Increasing Nigerian local food products and shipping structures manufacturing in the country have triggered the demand for logistics and warehousing services.

By Contract and Integrated:

Third-Party Logistics in Nigeria has been thriving in the Nigeria Freight Forwarding Market with a share of ~% in overall market revenue.

Competitive Scenario in Nigeria Freight Forwarding Market

- The Nigeria Freight Forwarding the market is highly scattered with over ~ freight local forwarding companies registered under the Council for Freight Forwarders in Nigeria. The market is scattered and constitutes of a number of multi-service logistics firms, specialized freight forwarders, and local transporters/truckers. While multi-service firms are mostly international, almost all transporters/truckers are local and regional.

- The industry is at a growth stage in terms of parameters in terms of adoption of technology, efficient utilization, diversification of its service but the logistics cost charged is very high due to the dearth of proper infrastructure in the country. The cost of transporting 40 ft containers and 20 ft containers to warehouses has increased ~ % in the past few years.

Companies Cited in the Report:-

DHL

BHN Logistics

Bollore Logistics

ABC Transport

UPS (United Postal Services)

Redstar Logistics

Maersk Line

MSC (Mediterranean Shipping Company)

TSL Logistics

Nigeria Freight Forwarding Future Outlook and Projections

Nigeria's freight forwarding market is projected to grow at a CAGR of ~% during the forecast period 2018-2023 owing to the country’s plans to turn itself into the trading and manufacturing hub of Africa.

The revenue from the freight forwarding market in the country is anticipated to grow from USD ~ million in 2018 to USD ~ million by the year ending 2023.

The key growth drivers for the market include the rising demand for products through online purchases which has augmented the E-commerce market. The increasing international trade volumes and domestic manufacturing are expected to increase the demand for freight forwarding services.

The increasing year on year investment by the government of Nigeria on infrastructural and development projects such as the Trans African Highway, Lagos-Kano SGR, Lekki Deep Sea Port and improving the air transport network is also witnessed to positively impact the market. Due to such reasons, new firms continue to enter the market despite any tariff or trade barriers.

Key Segments Covered:-

Nigeria Freight Forwarding Market

By Mode of Freight

Road Freight

Rail Freight (Volume and Revenue)

Air Freight (Airfreight in Nigeria (Volume- Imports and Exports of Cargo and Mail By Airports)

Sea Freight (Volume By Import –Export And Cargo Type, Logistic cost, Container Freight Rates, CARGO duty, General Cargo Delivery Charges, And Ship Dues)

By Type of Freight

International Freight Revenue

Domestic Freight Revenue

By Flow Corridors

Asian Countries

European Countries

Middle East

America

African Countries

By Contract and Integrated

Contract Logistics Revenue

Integrated Logistics Revenue

By End-User

Food and Beverages

Industrial and Retail

Automotive

Others (Chemical products, fertilizers, pharmaceutical products, perfumes, etc)

Companies Covered:-

DHL

BHN Logistics

Bollore Logistics

ABC Transport

UPS (United Postal Services)

Redstar Logistics

Maersk Line

MSC (Mediterranean Shipping Company)

TSL Logistics

Key Target Audience

Freight Forwarding Companies

E-Commerce Logistics Companies

3PL Companies

Consultancy Companies

Express Delivery Logistics Companies

Time Period Captured in the Report:-

Historical Period – 2013-2018

Forecast Period – 2019-2023

Key Topics Covered in the Report:-

Nigeria Transportation Major Companies

Inland Container Depot Niagara

Road Freight Industry Nigeria

E-Commerce Logistics Companies in Nigeria

Third-Party Logistics in Nigeria

International Freight Companies in Nigeria

Nigeria Freight Forwarders

Nigeria exports Revenue

Nigeria logistics and warehousing services

International trade of Nigeria

Nigeria ECOWAS Agreement

Nigeria Container Freight Rates

Cargo Shipping Cost to Nigeria

For More Information, Refer To Below Link:-

Related Reports by Ken Research:-

+91-9015378249

No comments:

Post a Comment