Increasing Internet Penetration: There were 52 million internet users in Thailand in January 2020 Internet penetration in Thailand was 75% during the same period. As the smart phone and internet penetration in Thailand is increasing, the used car dealers have been able to increase their footfall. They are using digitalization to make market offerings attractive. Digital platform provide online services such as photos and videos and instant finance which are drawing more customers into buying used cars.

The Concerns about Health from

Using Public Transportation:

Due to the onset of corona virus, public transport and ride sharing are

no longer considered to be a safe option. Nowadays, more people are concerned

about health and risk for severe illness from the virus, and as a result, used

car is an alternative for prevent getting and spreading COVID-19 to keep social

distance. In addition to the same, with the decrease in purchasing power, new

vehicles are not considered to be economical option which makes used car a

perfect choice for customers with limited budget.

Supply Gut Leads to Higher Prices

of Used Cars: Due to the moratorium period provided by the Government of

Thailand during the pandemic, banks cannot repossess car from loan defaulters.

This has led to a supply disruption in the used car market. Also, since rental

companies are facing a downward trend, they are unwilling to sell their cars at

a lower price. The combined effect of both has led to an increased price of

used car which may hamper the sales in the future.

Impact on Used Car Sales due to

Covid-19: The demand for used cars decreased during the corona virus

pandemic. This was due to low supply and also due to closure of OEM dealerships

and Local Tents during lockdown. This was further fuelled by decrease in

purchasing power which led to postponing of new and used car purchases. Also,

Thailand has recently recovered from a political and economical instability

which has led to a decline in supply. Apart from sales issues, used car

companies experienced cash flow difficulties due to the fact that most of the

banks were not repossessing cars. The demand for used cars in the country

remained low at the starting of 2020, however there was increase in demand in

the second half of the year post ease in confinement. The manufacturers are

expected to shift focus towards digital medium in order to drive sales and

increase customer footfall.

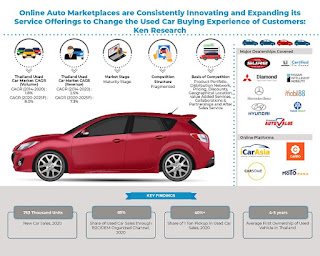

Analysts at Ken Research in their latest publication “Thailand Used Car Market Outlook To 2025 – Growth of

Online Used Car Platforms and Easy Availability of Credit Escalating Industry's

Growth” observed that Thailand is a growing used car market in

South East Asia and is slowly recovering from the economic crisis after

pandemic. The increasing credit availability in the country along exemption in

taxes is driving the growth of the industry. Increasing focus on promotional and

marketing activities, new product launches, partnerships & collaborations

are expected to drive the industry in the future. The Thailand Used Car Market

is expected to grow at a CAGR of 7.3% on the basis of GTV over the forecast

period 2020-2025.

Key Segments Covered

By Market Type

C2C

B2C/OEM organized

Multi Brand Organized Dealer

Multi Brand Unorganized Dealer

OEM Organized

Auction

By Car Segment

Hatchback

1 ton pickup

Sedan

MPV, HPV/Mini MPV

SUV

By Region

Bangkok

North East

North

South

East

West

By Kilometers Driven

Less than 20,000

20,000-50,000

50,000-80,000

80,000-120,000

Above 120,000

By Age of Vehicle

Less than 1 year

1-3 years

3-5 years

5-8 years

More than 8 years

By Age of Buyers

20-30 Years

30-50 Years

Above 50 Years

By Source of Lead

Online (Social Media/Car Portals/Official Website)

Offline (Dealership Walk-in)

Companies Covered (OEM Dealerships)

Toyota Sure Thailand

Honda Used Certified Thailand

Mitsubishi Diamond Used Car

Nissan Intelligence

Mercedes Certified

Volvo

Companies Covered (Online Portals)

ICar Asia (One2Car, Thaicar, Autospinn)

Carsome Thailand

Carro Thailand

Key Target Audience

Used Car Companies

OEMs

Online Used Car Portals

Used Car Financing Companies

Government Bodies

Investors & Venture Capital Firms

Used Car Dealerships

Used Car Distributors Auction Houses

Used Car Associations

Time Period Captured in the

Report:-

Historical Period –

2014-2020

Forecast Period –

2021-2025

Key Topics Covered in the Report

Executive Summary

Research Methodology

Thailand Used Car Market Overview

Thailand Used Car Market Size, 2014-2020

Thailand Used Car Market Segmentation, 2020

Growth Drivers in Thailand Used Car Market

Issues and Challenges in Thailand Used Car Market

Regulatory Framework

Snapshots on Used Car Financing

Snapshot on Auction Market

Snapshot on Used Bike Market

Ecosystem and Value Chain of Used Car Industry in Thailand

Customers Purchase Decision Making Parameters

Cross Comparison between Major OEMs and Multibrand Dealers and Company

Profiles & Product Portfolios

Future Market Size and Segmentations, 2021-2025F

Covid-19 Impact on the Industry & the Way Forward

Analysts’ Recommendations

For More Information on the

Research Report, refer to below links:-

Related Reports by Ken Research

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

No comments:

Post a Comment