Key Findings

One negative for used cars is the 7% VAT that’s added to the bill if the

customer buys from a showroom or used car dealer, or use a loan to finance the

purchase.

Consumers are shifting away from traditional methods & increasing

using online platforms for their used car buying/selling journey. Many

start-ups and auto portals present in Southeast Asia are entering the Thailand

market or expanding their presence through mergers & acquisitions, seeing

the industry’s potential.

One Ton Pickups have gained a significant share in the used cars market

in the last five years as they are better aligned with the expectations of Thai

consumers. This is mainly due to the reason that they can be used as passenger

and commercial vehicle for transportation. Moreover, theses vehicle enjoy a tax

rebate if registered as commercial vehicles.

Growth of Digital Platforms: Increasing

internet and smart phone penetration in the country has resulted in large

number of consumers preferring to buy and sell cars through online auto

classifieds and social media. Auction Houses are also increasing their spending

on online advertising and generating leads through these platforms. Data from

Google Trends also indicates that the market has gained more attention.

Searching for major second-hand car brands on the Internet increased in the

past two years.

Unorganised dealers dominate the

Sales Volume in the Market: Independent dealers (Car Tents) dominate the market

due to large presence across the country. These dealers are also increasing

their online presence by listing their inventory on their own website/Facebook

account or platforms resulting in market growth. The players in the unorganized

sector give strong preference to less-aged cars and popular brands with good

resale value. Consequently, buyers have limited range of vehicle options to

choose from.

Sluggish Growth Rate Due to First

Car Buyer Program: From 2011 to 2012, the Thai government implemented

the First-Time Buyer Program to encourage automobile consumption, which led to

a rapid growth in automobile production and sales. However, by the end of 2017

the market was flooded with second hand cars after the end of program. This

caused a decrease of 20%-25% in the price of used car thereby affecting the

industry revenue.

Declining Used Car Sales Demand due

to Covid-19: The demand for used cars decreased during the corona virus

pandemic. This was due to low supply and also due to closure of OEM dealerships

and Local Tents during lockdown. This was further fuelled by decrease in

purchasing power which led to postponing of new and used car purchases. Also,

Thailand has recently recovered from a political and economical instability

which has led to a decline in supply. Apart from sales issues, used car

companies experienced cash flow difficulties due to the fact that most of the

banks were not repossessing cars. The demand for used cars in the country

remained low at the starting of 2020, however there was increase in demand in

the second half of the year post ease in confinement. Slow recovery is expected

in 2021. The manufacturers are expected to shift focus towards digital medium

in order to drive sales and increase customer footfall.

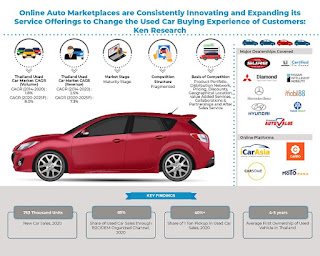

Analysts at Ken Research in their latest publication “Thailand

Used Car Market Outlook To 2025 – Growth of Online Used Car Platforms and Easy

Availability of Credit Escalating Industry's Growth” observed that Thailand

is a growing used car market in South East Asia and is slowly recovering from

the economic crisis after pandemic. The increasing credit availability in the

country along exemption in taxes is driving the growth of the industry.

Increasing focus on promotional and marketing activities, new product launches,

partnerships & collaborations are expected to drive the industry in the

future. The Thailand Used Car Market is expected to grow at a CAGR of 7.3% on

the basis of GTV over the forecast period 2020-2025.

Key Segments Covered

By Market Type

C2C

B2C/OEM organized

Multi Brand Organized Dealer

Multi Brand Unorganized Dealer

OEM Organized

Auction

By Car Segment

Hatchback

1 ton pickup

Sedan

MPV, HPV/Mini MPV

SUV

By Region

Bangkok

North East

North

South

East

West

By Kilometers Driven

Less than 20,000

20,000-50,000

50,000-80,000

80,000-120,000

Above 120,000

By Age of Vehicle

Less than 1 year

1-3 years

3-5 years

5-8 years

More than 8 years

By Age of Buyers

20-30 Years

30-50 Years

Above 50 Years

By Source of Lead

Online (Social Media/Car Portals/Official Website)

Offline (Dealership Walk-in)

Companies Covered (OEM Dealerships)

Toyota Sure Thailand

Honda Used Certified Thailand

Mitsubishi Diamond Used Car

Nissan Intelligence

Mercedes Certified

Volvo

Companies Covered (Online Portals)

ICar Asia (One2Car, Thaicar, Autospinn)

Carsome Thailand

Carro Thailand

Key Target Audience

Used Car Companies

OEMs

Online Used Car Portals

Used Car Financing Companies

Government Bodies

Investors & Venture Capital Firms

Used Car Dealerships

Used Car Distributors Auction Houses

Used Car Associations

Time Period Captured in the

Report:-

Historical Period –

2014-2020

Forecast Period –

2021-2025

Key Topics Covered in the Report

Executive Summary

Research Methodology

Thailand Used Car Market Overview

Thailand Used Car Market Size, 2014-2020

Thailand Used Car Market Segmentation, 2020

Growth Drivers in Thailand Used Car Market

Issues and Challenges in Thailand Used Car Market

Regulatory Framework

Snapshots on Used Car Financing

Snapshot on Auction Market

Snapshot on Used Bike Market

Ecosystem and Value Chain of Used Car Industry in Thailand

Customers Purchase Decision Making Parameters

Cross Comparison between Major OEMs and Multibrand Dealers and Company

Profiles & Product Portfolios

Future Market Size and Segmentations, 2021-2025F

Covid-19 Impact on the Industry & the Way Forward

Analysts’ Recommendations

For More Information on the

Research Report, refer to below links:-

Related Reports by Ken Research

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications